Outlook for M&A Activity in Central America and Mexico

Scroll Down to Read

By Lawrence Middler

Senior Analyst

AgbioInvestor

The crop protection market has witnessed a considerable level of consolidation in recent years following the spate of mega-mergers that saw Bayer acquire Monsanto; Dow and DuPont merge to form Corteva; UPL acquiring Arysta; and Syngenta becoming part of Chem China. Following this, the mergers and acquisition landscape within conventional crop protection has been relatively more subdued. We have, however, seen a considerable increase in the level of M&A activity in the biopesticide and biostimulants segments, which has ultimately been driven by the strong growth in the end-market for those technologies.

AgbioInvestor forecasts that the global crop protection market will be relatively static over the next five years in real terms when using 2021 baseline pricing to account for the dramatic spike in active ingredient pricing that ultimately drove the dramatic growth of the market in 2022. As a result, many stakeholders in the industry will already be thinking about where the next opportunity may arise for investment in a challenging market.

Mergers and acquisitions traditionally follow a number of well-established patterns:

- In challenging market conditions, companies seek to combine to out-scale major competitors, building a leaner new entity with greater market share/access, lower cost base, broader technology/product portfolio and stronger brand identity.

- Disruptive and innovative technologies may also lead to a wave of investment activity that translates into a high level of deals being made.

- Emerging country markets, where prior technology adoption is lower attracts foreign investment. M&A activity is often used to foster market access through distribution capability, and local knowledge.

In the case of Central and South America, there is the case to be made that the region falls under the latter two categories both down to the overall development of agricultural economies, particularly in Mexico, but also from the perspective of the biologicals market and other emerging technologies such as precision ag, drone application, irrigation technologies, and new conventional chemistries.

Mexico

In 2022, the market for crop protection products in Mexico increased by 17.4% to $1,155 million. At this level, the country is ranked as the 13th most valuable in terms of crop protection sales in 2022. Between 2017 and 2022, the crop protection market in Mexico has increased steadily at an annual average of 5.9%, marginally ahead of the industry average.

The agriculture sector in Mexico has advanced at a rate ahead of the country overall, with growth in agricultural GDP outstripping total GDP. Between 2017 and 2022, total GDP has grown from $1.15 trillion in 2017 to $1.41 trillion in 2022 in current U.S. dollar terms. At this level, GDP of Agriculture and Forestry has increased from $39 billion to $59 billion over the same period.

The growth in both the crop protection market as well as agricultural GDP has made Mexico an increasingly attractive target for investment. The country has placed a focus in recent years on creating and maintaining a position as a key exporter of agricultural produce, primarily fruit and vegetables. This has benefitted the adoption of new technologies both within conventional crop protection as well as the biologicals market.

Notable recent activity in the country has included the 2022 acquisition of SIFATEC by Grupo Duwest, a Guatemalan company with activities in crop protection, animal health, seeds, and agricultural machinery. This marked DuWest’s first entry into Mexico and is perhaps indicative of the view many companies have of the Mexican market.

Other distribution agreements include the Spanish manufacturer of biopesticides and biostimulants, Futureco Bioscience, establishing a partnership with Innovak Global for the exclusive distribution of the plant-extract based biofungicide Bestcure (Citrus reticulata and Citrus aurantium extracts).

Guatemala

In 2022, the market for crop protection products in Guatemala increased by 15.6% to $185 million. Between 2017 and 2022, the crop protection market in Guatemala has increased steadily at an annual average of 11.6%, considerably ahead of the industry average.

There is limited basic manufacture of active ingredients in Guatemala, notably by DuWest and Foragro. However, there are significant formulation capabilities, notably by Quilubrisa (a subsidiary of Disagro), Agrocentro/Cindeco, and Inquisa, amongst others.

There are many importers and distributors of agrochemicals in Guatemala, including GBM (based in Mexico and now part of Arysta/UPL), Hendrix, Tikal Agros, Agrofortress, Anasac, La Quinsa, and Cosmocel. In addition, there are a number of chemical companies, formulators, and trading houses based in Central America that service the market.

The major factors that will impact investment in Guatemala and ultimately M&A activity will be the growth in the fruit and vegetable market for export and the plantation market such as palm oil. This is likely to drive growth in the adoption of new technologies such as biologicals, new conventional products as well as formulation technologies. Consolidation in distributors and formulators may take place, but it may be more likely that external partnerships between multinationals and local companies will occur. This will assist in market access for innovative technologies and with the development of novel formulations to tackle increasingly challenging climatic patterns, such as biostimulant products that offer abiotic stress tolerance. These factors could ultimately favor more investment in local distributors and formulators with knowledge of the local market and established relationships with growers.

Nicaragua

Agriculture remains a key part of the Nicaraguan economy, employing around a third of the workforce despite accounting for only 16.8% of GDP. Agrochemical usage on a per hectare basis is high compared to other developing markets, although similar to that in the other Latin American countries of Bolivia, Guatemala, and Ecuador. Nicaragua has only limited agrochemical formulation capability, indicated by only 1% of imports from the U.S., China, and India being of technical material. The most significant product sources are China, the U.S., the EU, and India. The low levels of formulation capability means that any M&A activity in the country is likely to come in the form of distributors seeking to build scale in importing finished products from elsewhere in Central America and beyond. As with other markets in Central America, weather patterns can be erratic and a greater adoption of biostimulants products for abiotic stress and a greater level of biologicals usage can be expected, although uptake is expected to be slower compared to more established markets such as Mexico with large F&V export markets. Uptake of row crop usage in Nicaragua for biologicals is likely to be lower than for Mexico initially as grower awareness and acceptance is lower.

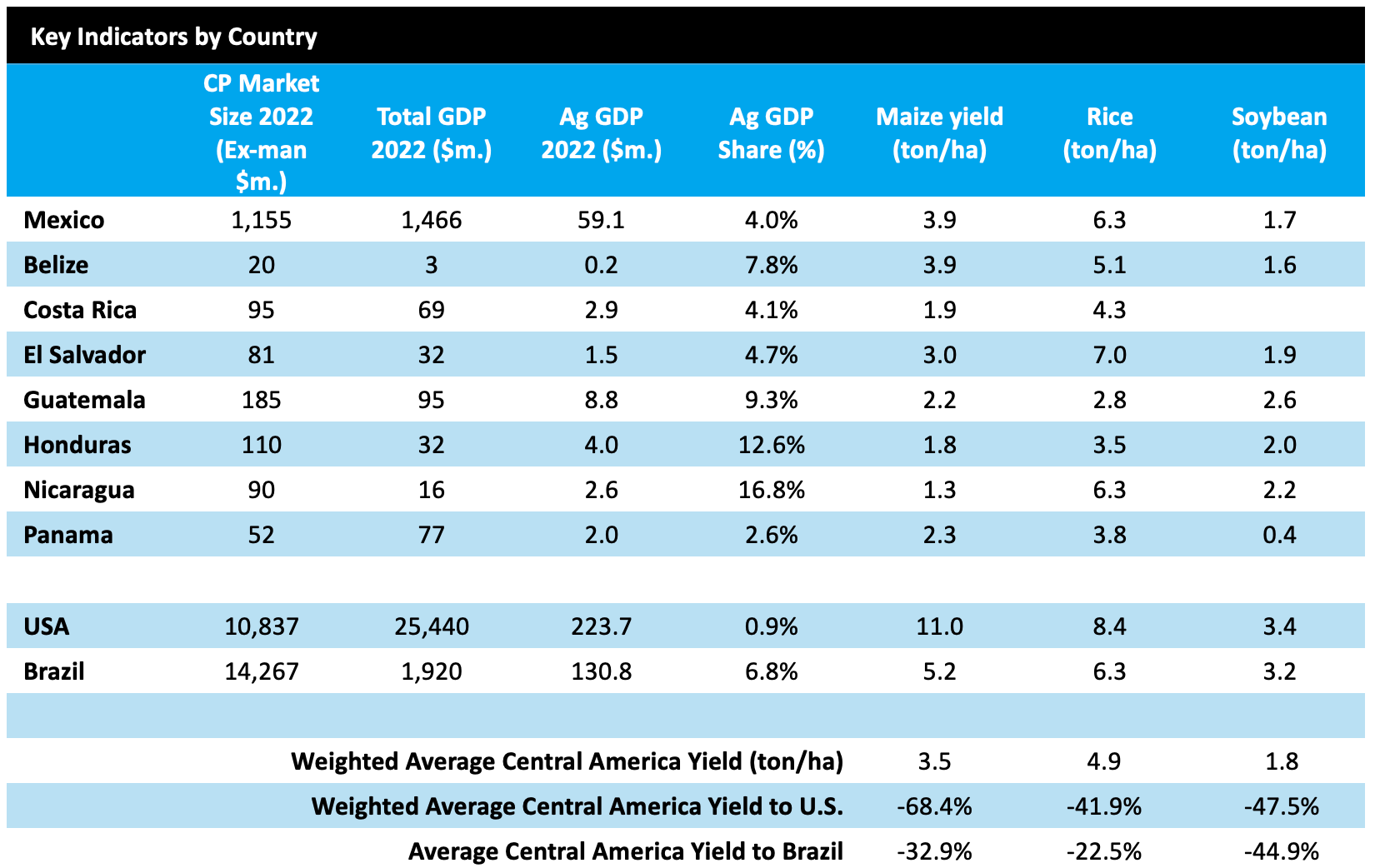

Crop protection yields remain lower in Central America compared to more developed markets.

GDP data sourced from World Bank. Yield data calculated from average of FAO STAT 2016-2022 data.

GDP data sourced from World Bank. Yield data calculated from average of FAO STAT 2016-2022 data.

When looking across the Central American region it is evident that for key row crops cultivation is undertaken on a less intensive basis when compared to more developed agricultural economies such as the U.S. and Brazil. Average yields for maize are typically 68% lower than the U.S. and 33% lower than Brazil. The picture is much the same when comparing average yields for rice which were 42% lower than the U.S. and 23% lower than Brazil, and for soybean 48% and 45% lower than the U.S. and Brazil respectively.

The lower yields achieved in the region poses the question – is Central American poised for further intensification and could this act as a driver of M&A activity? While it is true that consolidation within the region could help companies achieve a lower cost base and achieve a greater distribution footprint, the regional market is ultimately influenced by farm economics.

Within Mexico approximately 70% of the total farm number can be attributed to smallholder farmers, likewise in the rest of the Central American region the figure is high, with about 80% in Guatemala and 90% in Nicaragua and Panama.

Subsidies in Central America are also lower than developed agriculture economies. In Mexico, for example, producer support estimate (PSE – an indicator of the annual monetary value of gross transfers from consumers and the state to agricultural producers) for 2019-21 equated to around 9% of gross farm receipts, which is around half of the Organization for Economic Development (OECD) average. In Costa Rica, agricultural policies generated average support for producers of 6.3% of gross farm receipts in 2018-20, further still below the OECD average. The majority of the subsidies typically take the form of market price support (MPS). MPS artificially boost prices received by farmers through a mixture of tariffs and minimum reference prices.

The bottom line is that at a fundamental level the farming ecosystem in Central America remains less developed financially and more fragmented both geographically and at a socioeconomic level. Coupled with varying degrees of political instability, challenges with liquidity/access to credit, high interest rates and rural crime, this makes the region less attractive from the perspective of foreign investment. One notable exception to this is Mexico, which exported around three quarters of its fruit and vegetable production to the U.S. in 2022. There has also been a rise in the organic farming acreage in the country driven by increasing demand for such produce in the U.S., and to a smaller extent a growing middle-class in Mexico.

Taking these factors into consideration the outlook for M&A activity is likely to be a tale of two halves: Mexico will likely continue to see a moderate level of M&A activity and wider investment in the crop protection industry as the government seeks to boost farm investment and food security post-pandemic, while in the rest of Central America, the M&A activity will be more modest, with smaller strategic acquisitions being made by international players seeking improved market access in certain specialty crop groups in need of increased levels of technification. Good examples of this include banana producers seeking to tackle black sigatoka, or the ever-challenging fall armyworm, which is resistant to many commonly used generic insecticides.

“Mergers and acquisitions are just one lever in the corporate toolkit when a company is seeking to build market share and competitiveness in a given market.”

We also should not overlook the fact that mergers and acquisitions are just one lever in the corporate toolkit when a company is seeking to build market share and competitiveness in a given market. Distribution deals such as the one signed by AgBiome in early 2023 whereby Summit Agro Mexico gained exclusive distribution rights to Howler fungicide, are indicative of one such approach outside of full-company acquisition. While this approach may be less risky, the downside to such an approach is that there will likely be lower profit margins, and the IP rights holder may be subject to acquisition themselves. The product rights may also be acquired by others. Robust contract negotiations from the outset can alleviate some of these concerns.

Companies may also take the route of establishing joint ventures or opening local subsidiaries, employing local experts with the knowledge of regional processes, market conditions and customer base. For example, in 2022 Nihon Nohyaku subsidiary Nichino America, Inc. formed a new subsidiary, Nichino Mexico de S. de R.L. de C.V., with the aim of developing its crop protection business in Mexico.

Biologicals

The high-volume F&V exports to the U.S. from Mexico is likely to also contribute to consolidation in distributors, and distribution agreements in the biopesticide and biostimulants space. AgbioInvestor’s new AgBiological multi-client report powered by AgBioInsight (ABI’s bio-market research data tools) has identified a relatively low number of locally-based biological companies in the Mexican market, compared to more developed biological markets, indicating that the M&A of bio companies both by external partners and within the country will be more limited. However, the role of distributors will likely be the driver of M&A and investment activity.

NB A detailed breakdown of market shares can be found in the granular data contained within AgBioInvestor’s Biologicals Market Research Study. Bio-aligned refers to products that are adjacent to ‘true-bio’ products -e.g. copper/sulfur, fermentation products.

In Mexico, the biologicals market research that ABI conducted has underlined the importance of building relationships between the grower and the agronomist/advisor, distributors, manufacturers’ representatives, and cooperatives, as these were all identified as key sources of information and recommendations. In row crops such as maize, other growers were the most significant sources of information followed by agronomists/advisors and distributors. The fact that word of mouth was important in building adoption of biological products highlights the potential importance of ensuring product efficacy is robust, but also in building a unified brand identity. This is one area where M&A may ultimately contribute to building on previously established corporate identities in the Central American region. International companies seeking market access can build on local brand awareness, distribution capabilities as well as the relationship between grower and agronomic advisor. In other crops surveyed such as tree fruit/nuts, vine, horticulture, and sugarcane the agronomist/advisor was the clear leader in influencing decision-making processes and ultimately product uptake. •