Mergers and Acquisitions: The Prominence of Brazil

Scroll Down to Read

By André Dias

Executive Director LATAM, Kynetec

Latin America continues to be an important player for agribusiness merger and acquisitions (M&As). As one of the most important markets in Latin America, following Brazil’s M&A activity occurring in the last decade is crucial to understanding the region.

Ag Input Consolidation Process

Multinationals M&A activity, like Monsanto/Bayer, Adama/Syngenta, and Dow/Dupont, have impacted the Brazilian ag input industries. While the global focus was often more around portfolio expansion, local discussions focused on the distribution and sales organization as well as product positioning.

After the first global consolidation wave, mainly impacting the crop protection market, consolidation activity is happening in very fragmented markets such as liquid fertilizers and biologicals, such as Syngenta/Valagro, Corteva/Stoller and ICL/Fertilaqua/Compass Minerals. Unlike the crop protection chemical industry that has a higher consolidated market, there is still space for consolidation in the biologicals and liquid fertilizer markets. Considering that, after the current recession period that agribusiness is experiencing in Brazil, more M&As should be expected.

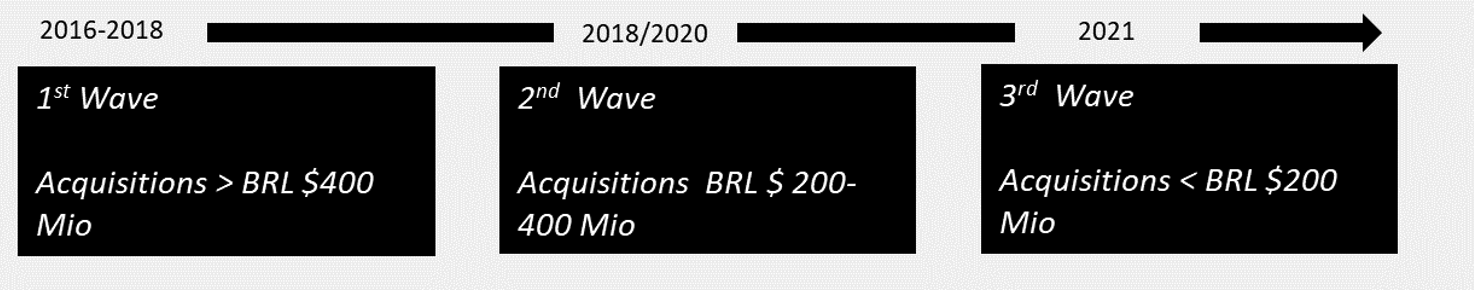

Distribution Chain M&As

The Brazilian M&A movement in the agribusiness sector started with consolidation of the value chain. As in the image below, since 2016, we had the first wave of consolidation of the retailer distribution business with the entry of important private equity funds. The first goal was companies that, by the time had an annual revenue bigger than BRL 400 Mio in ag input sales only and a total revenue more than a billion Brazilian reals (BRL) considering the grain trade business. From 2018-2020, we experienced the second wave of M&As with smaller targets, from BRL 200-400 Mio of ag input sales. Finally, the third consolidation wave of the private equity movement in the distribution business occurred in 2021-2022, in targets with revenue approximately BRL 150 Mio annually.

Generic Strategy Entry of Private Equity by acquisitions

Aginput annual sales

Nutrien

At the same time, from 2017, we have seen the entry of an important player in the ag retailer market in Brazil, the Canadian giant player, Nutrien. Nutrien has started a strong acquisition activity also consolidating the retailer market in Brazil, with a significant latest Brazilian retailer acquisition of Casa do Adubo Nutrien in 2022 for BRL 1,5 Bi.

Ag Input Industries as a Go-To-Market Strategy

The Brazilian retailer market also experienced the entry of ag input multinational companies acquiring retailers and vertically integrating their business into the value chain. Now the crop protection companies have their own retailer. For example, UPL and BUNGE invested in Sinagro, Ihara with its holding of Terra Agro, and Syngenta implementing greenfield proprietary stores and acquiring many retailers as Agro Jangada and Dipagro to build their SINAP platform.

Traders Movement in Search of Grain Origination

Another segment showing M&A activity in the Brazilian value chain included global traders. With the progress of the Chinese Trading Cofco, we have seen, for example, the prominence of Bunge acquiring barter retailer players as Agrofel, Alvorada, and Sinagro acting to guarantee the access to the grain origination.

What’s Next?

2023 has been a tough year for the ag retailer and ag input business in Brazil. For distribution, a market that has been working for the last decade with very reduced margins has felt the negative impact of high inventory levels and price negative oscillation, affecting their overall performance. The industry is impacted by the results on its distribution chain.

Is the M&A movement gone to become less expressive in the coming years? Even if the margins are reduced and the operational efficiency is improved, Brazilian distribution market is still a highly fragmented market. There is significant space for consolidation.

Far from being ended, the M&As in Brazilian ag space should continue to progress in the next years. Private equity purchases of smaller retailers will occur, but not as highly valued as in previous years. The companies are still searching for better results to gain scale and M&As are likely to be their preferred choice as greenfield operation requires significant more effort and expertise.

Parallel to that, after five to eight years of private entry in the distribution market, the whole market is expecting the exit thesis to be consolidated. As the economy gradually evolves, we should soon expect new M&As to happen. Possibly from an industry player (crop protection or trader) acquiring a Brazilian retailer platform previously invested by a private equity, or even a new strategic investor bringing in foreign capital to the Brazilian market.

A similar situation can be expected, considering biologicals, biostimulants, and liquid fertilizer markets, there is still space for new activity and consolidation. Also, the biological market is expected to benefit from the environmental, social, and corporate governance (EST) thesis that it carries. The crop protection chemical companies will be more attracted to this segment, also private equities with sustainable bias should also realize a few acquisitions.

With a more stable scenario regarding economics and politics, Brazilian agribusiness in 2024 should be a recovery year, with a slight progress in the M&As activity. •

Join us at AgriBusiness GlobtalSM LATAM Conference on 14-15 May in Panama City, Panama, to explore new business opportunities and establish relationships with key players in the LATAM region. Register early to save and set the groundwork for generating new business and partnerships in Latin America! ABGLATAM.com

aFotostock – stock.adobe.com

André Dias – Kynetec