Latest Mergers and Acquisitions Impacting Latin America

Multinationals acquire biological companies with products and know-how to strengthen portfolios of integrated offerings to Latin American farmers.

Scroll Down to Read

LATIN AMERICA UPDATE |

By Javier Chavarro

By Javier Chavarro

Contributor

Global agrochemical companies, as well as regional companies, are acquiring businesses with a focus on biological products to complement their traditional crop protection portfolios, driven by the need to comply with regulations for countries and regions.

Current mergers and acquisitions (M&A) activity is fueled by consumers and marketing chains, where many agrochemical products are being relieved by biological products and biostimulants. For exporting food, Latin American farmers have strict guidance on products that can or cannot be applied in the field.

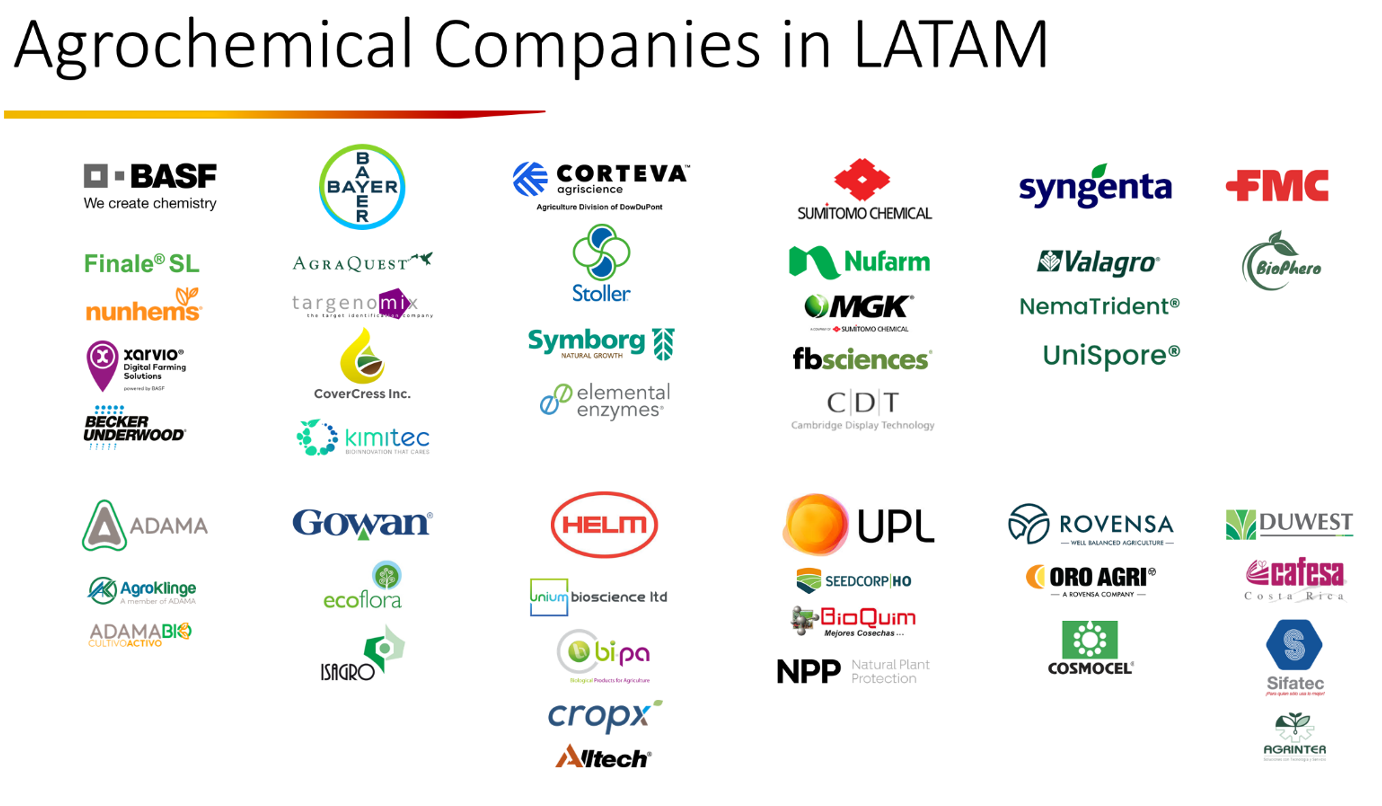

The image below shows the main companies that are not only buying businesses, but also products, and in many cases internally developing a division to promote the use of biologicals such as ADAMA with ADAMA-Bio and the UPL company with NPP — Natural Plant Protection.

The headquarters of global companies, mainly based in Europe, the United States, and Asia, are evaluating companies, products, and portfolios, especially for the Latin American region. Latin America is no stranger to all these processes, since this region has become the global pantry for grains such as soybeans, corn, and wheat that are produced with extensive agriculture and efficient use of resources in Brazil and in the countries like Argentina, Paraguay, Uruguay, and Bolivia. These countries are driven toward exporting to different global destinations.

For exported fruits and vegetables such as grapes, blueberries, avocados, bananas, pineapples, coffee, among many other products, these high value crops are produced with strict standards on small farms in countries such as Mexico, the Andean Region that includes Chile, Peru, Ecuador, and Colombia, and Central America with Costa Rica, Guatemala, Panama, Honduras, and Nicaragua.

The current focus for M&A is on companies offering biological and biostimulant products to create a portfolio for farmers who can use a joint application of these type of products with chemical crop protection for the benefits provided by each of them. It falls along the lines of the concept of “chemical load reduction,” which seeks to replace an application of a chemical by a biopesticide without reducing efficacy or yield.

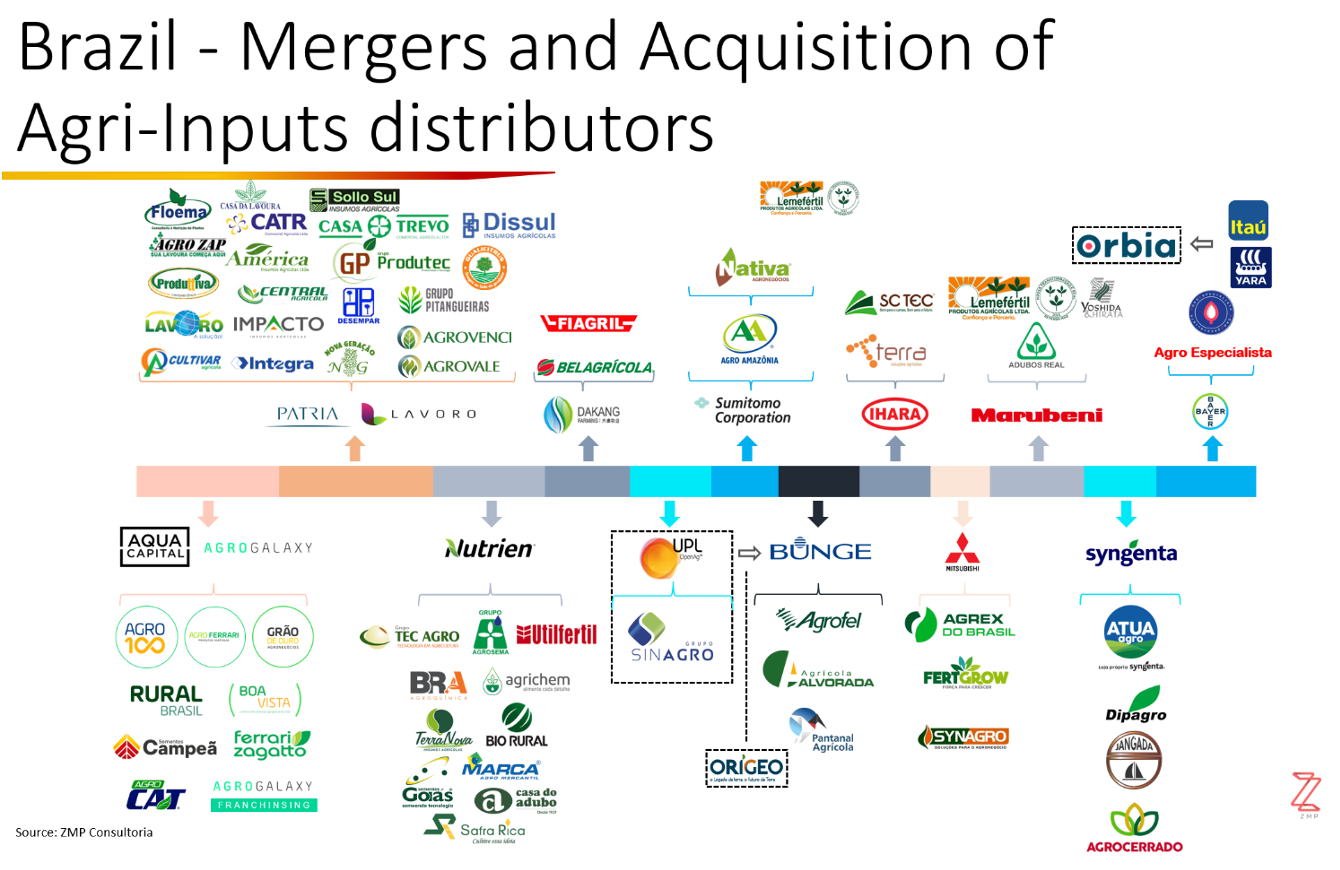

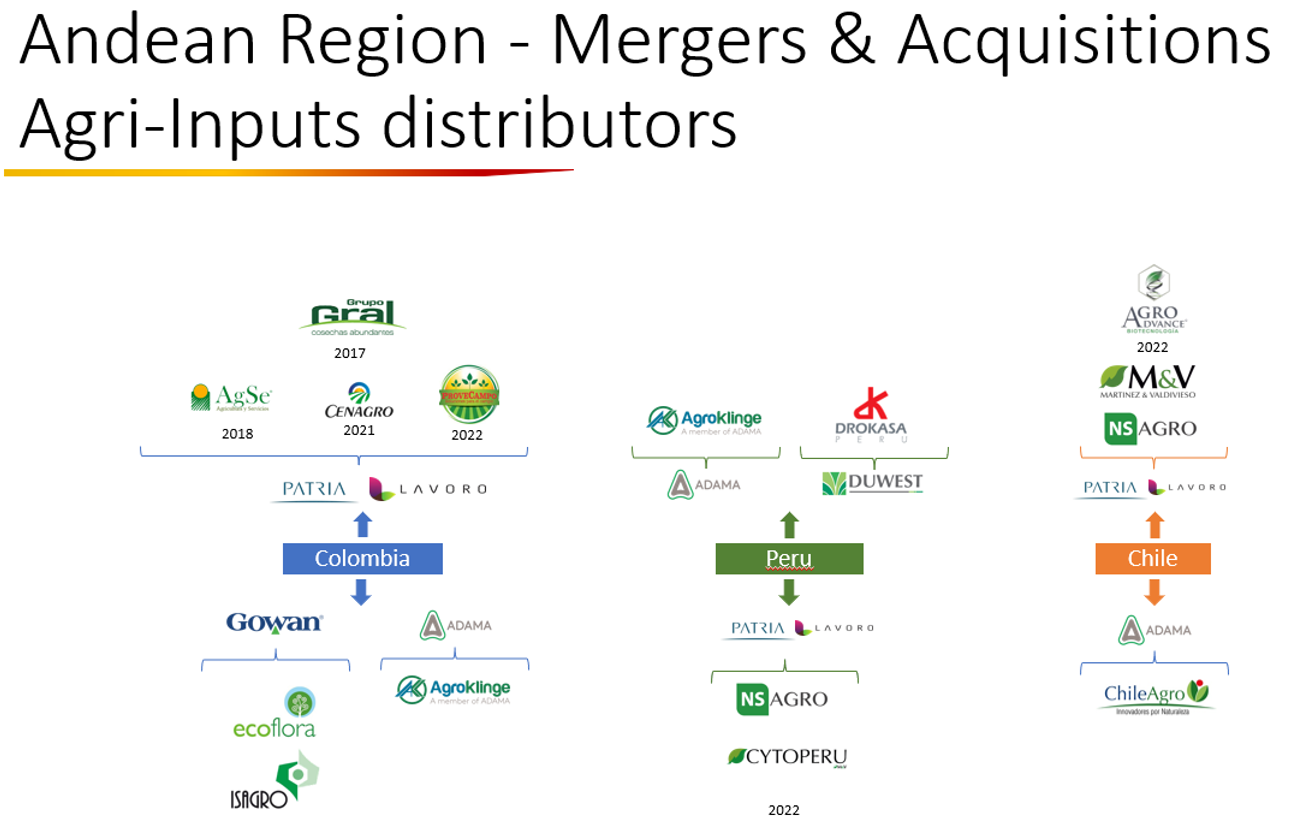

In the case of Latin America, M&A is generating a great impact for supplying farmers in two ways: The first, which is being generated mainly in Brazil, where M&A of distributors of agricultural inputs is occurring at an accelerated pace, as shown in the following image from ZMP Consultoria. The second is a focus on the Andean Region.

The Brazilian agro-inputs market began 2023 with many important changes by big players. With the acquisitions made, these companies should reach a revenue projection of around R$40 billion (USD$7.8 billion) with 700 stores and approximately 3,000 consultants.

This is the case of the groups of companies Lavoro and AgroGalaxy that have a preponderant position in this country, supported by investment funds such as Patria Investments and Aqua Capital, respectively.

According to Lavoroagro.com, “With more than 190 stores in Brazil and Colombia, the Lavoro Group stands out in agrobusiness as the largest distributor of agricultural inputs in Latin America. The company’s revenue in the 21/22 cycle reached the BRL 7.2 billion mark. The expectation for the 22/23 harvest is to reach R$10 billion (USD$1.99 billion), maintaining the current level of annual organic growth, which is around 25%. Lavoro was created from the merger and acquisition of more than 20 large and medium-sized distribution companies, under the control of the Pátria Investimentos Fund. In addition, the group has its own brands of agrochemicals, foliar, and biological fertilizers.”

For the rest of Latin America, and especially in South America, these groups made several acquisitions in these countries with the focus being mainly the Andean region, where there is high interest in companies in Colombia, Peru, and Chile that contribute heavily to the economic development of the region.

Today, the integration of portfolios toward biological products is dictating the rules of M&A in the agricultural sector. As indicated by Mike Frank, Chief Executive Officer of UPL, “the increasing introduction of biological agents in crop management aims to control the resistance of pests and diseases to certain chemical solutions, which lose effectiveness over time. In addition, they contribute to agriculture with fewer greenhouse gas emissions and to the recovery of soil health.”

The importance of biological products in the future of global agriculture is guaranteed and is supported by the large number of companies that are in the process of being acquired to complement the portfolios of different companies, which will lead them to comply with the medium-term objective set forth by Frank. “For this company (UPL), the goal is for biological products to be responsible for 50% of global sales by 2027.”

Mergers and Acquisitions TimelineSince the ’90s, the model of discovery, development, production, and global commercialization of agrochemicals has been changing rapidly. In the last 30 years, four important phases in M&A in different global markets have impacted Latin America. |

| 1. The first phase, which had its main period in the ’90s, has to do with the development of new active ingredients, which were specially developed in Japan (e.g. Nihon Nohyaku, Otsuka, Mitsui, Kumiai, Hokko, Nipon Soda, Agro Kanesho, Nissan), followed by the United States (e.g. Dow, Dupont, Valent, FMC, R&H, Merck, Abbott), and Europe (e.g. Bayer, Hoechst, Schering, Rhone Poulenc, Coba, Sandoz, Zeneca) where the companies involved in the investigation of new active principles that were marketed in one way or another by companies globally. |

| 2. The second phase, named Mega Mergers, which consolidated four large companies globally, took place at the end of the ’90s, when the M&A race began involving large, medium, and small companies in the agrochemical sector globally, seeking to strengthen their portfolios of all kinds of products to control different problems that affected farmers. |

| 3. The third phase was developed in parallel to the last big M&A activity, which sought to locally consolidate a strong position of the companies in the distribution and marketing chains in the different countries. It was supported by the most important investment funds that supported distribution chains not only locally, but also regionally. |

4. The fourth phase, the most recent one, relates to compliance with regulations of the different countries. That has to do with the requirements of consumers and marketing chains, where many agrochemical products are being replaced or complemented by biological products and biostimulants. Here, there is a very high consideration of the analysis of the market requirements, the new regulations of the industry about the products that can no longer be used, like glyphosate, and the demands of the final consumers in the follow-up strategy of products from production to table. •

Zoran Zeremski – stock.adobe.com |