From Made-in-China to Created-in-China

Scroll Down to Read

By David Li, VP of SPM Biosciences

The height of a society’s scientific and technological development does not depend on the breadth of its scientific and technological development, but on the depth to which the society adopts it.

Huimin Li (left), a student from China Agricultural University, introduces Apple CEO Tim Cook (right) to the Agriscience Yard program at the organic farm in Shunyi District, Beijing, China. Source: Apple Inc.

On the morning of October 22, 2024, Apple CEO Tim Cook, COO Jeff Williams, and Greater China Managing Director Yue Ge were at an organic farm in Beijing’s Shunyi, also known as the Agriscience Yard.

The Agriscience Yard is an innovative organizational model for the development of modern agriculture in China, linking the innovative resources of universities, China’s top agricultural talents, and the most valuable resource for the Chinese people, arable land. Although China’s agriscience programs may not have dazzling terms or use the APP interface to obtain agronomic solutions, in China, agricultural scientists along with farmers are using mobile terminals out in the fields.

Shi Liu, General Manager of Da Bei Nong Biotechnology Company (DBN), mentioned on his social media, “Commercial decision-making in agricultural and business activities is a multivariate, quantitative, and complex decision-making in a specific environment.”

Therefore, science and technology innovations in agriculture-related fields need to fulfill two conditions at the same time:

- The decision maker’s intuitive judgment about a specific environment, and

- The decision maker having enough tools in hand to meet the requirements of complex decision making.

In such decision-making systems, experienced young Chinese scientists are utilizing high-performance technology platforms to simplify and enhance the collection of all the data needed for agricultural actions. This may be the innovation meaning for Huimin Li, a student at the China Agricultural University as well.

If we define China’s Agriscience Yard as the frontend of innovation, then tool innovation for field management is the backend. However, innovation in crop protection tools is far more challenging.

Because of the intense competition in China’s generic pesticide market, Chinese pesticide companies have only one path to take, and that is to deliver their generic products to market as quickly as possible and scale them up soon to achieve as much profit as possible as first mover.

Jack Chen, Deputy General Manager and Chief Marketing Strategy Officer, China/APAC

However, when almost every company has the financial strength as well as sufficient production experience, the window of time for Chinese pesticide companies to obtain a higher ROI (return of investment) becomes very narrow. Fierce competition has led to significant overlap in product lines among individual companies. This seems to have turned into an insoluble problem for China’s pesticide industry. While the Chinese government is expected to begin actively reorienting its policies to downsize poor-quality assets and capacity by 2025, the process will probably be lengthy.

Jack Chen, Deputy General Manager and Chief Marketing Strategy Officer, China/APAC of KingAgroot says, “At the beginning of KingAgroot venture, the generic crop protection market in China was already heavily saturated, and the ROI for the company would not have been ideal if it had entered the field at that time.”

This is one example of a larger trend for the Chinese pesticide industry, which has become very cautious in the field of capacity investment.

“We noticed that, after 2000, China is transforming from a labor dividend to engineer dividend, and R&D is the future competitiveness of China,” Chen says. “If it is a patented innovative product as a breakthrough, we can focus on launching R&D projects in limited specific segment with relatively low investment, and gradually increase investment in more strategic segments as the company grows to advance innovative patent products from the lab to the field. The growth of the market segments can push the company to further develop, and then as a return to increase R&D investment, which is a positive business development cycle.”

The most important thing is for Chinese companies to find a positive feedback loop from the market demand. Correspondingly, in the future, they must abandon the model of concentrating production capacity and then adopt penetration price to gain market share, thus being forced to obtain meager profits through economies of scale.

KingAgroot is leveraging digital technology in China to provide its service to growers more efficiently and build closer engagement with professional growers. It has been practicing its platform of farmer service called “Field Check, for Field Solution” for several years. It’s taking this feedback back to R&D.

Andy Liu, Marketing Director, APAC Region at KingAgroot

“Promoting simplification, resistance management, and crop quality and yield improvement is a key focus of R&D,” says Andy Liu, Marketing Director, APAC region at KingAgroot.

“Resistance development is a constant challenge in crop protection. Unfortunately, the R&D input of leading multinational companies has slowed over the past few years, and growers have no choice but to use higher doses or tank mix with many products, which not only increases costs and environmental risks, but also fails to address the underlying problem,” says Liu, “We believe that only through innovation can we enhance the value of the industry and shift the industry from price competition to value competition.”

According to KingAgroot, they plan to have three to four patented compounds enter the registration process every year. Flusulfinam (FSM, a post-emergence herbicide for rice) and flufenoximacil (FFO, a quick-acting burndown herbicide) have already been launched into China market in 2024. Fluchloraminopyr-tefuryl (FCA), a systemic long-lasting herbicide to target resistant weeds, will be marketed in the near future. These are all active ingredients for resistance problems.

The essence of innovation may be very simple: it is the creative fulfilment of latent needs that are prevalent in the marketplace. In the past two decades, Chinese pesticide companies have been more interested in meeting defined customer needs, i.e., producing and supplying raw materials for generic compounds as well as formulation products proposed by customers.

In the next two decades, Chinese companies are promoting product innovation to stimulate end-user demand. With professional talents, Chinese companies are transitioning from basic raw material manufacturing to creating solutions.

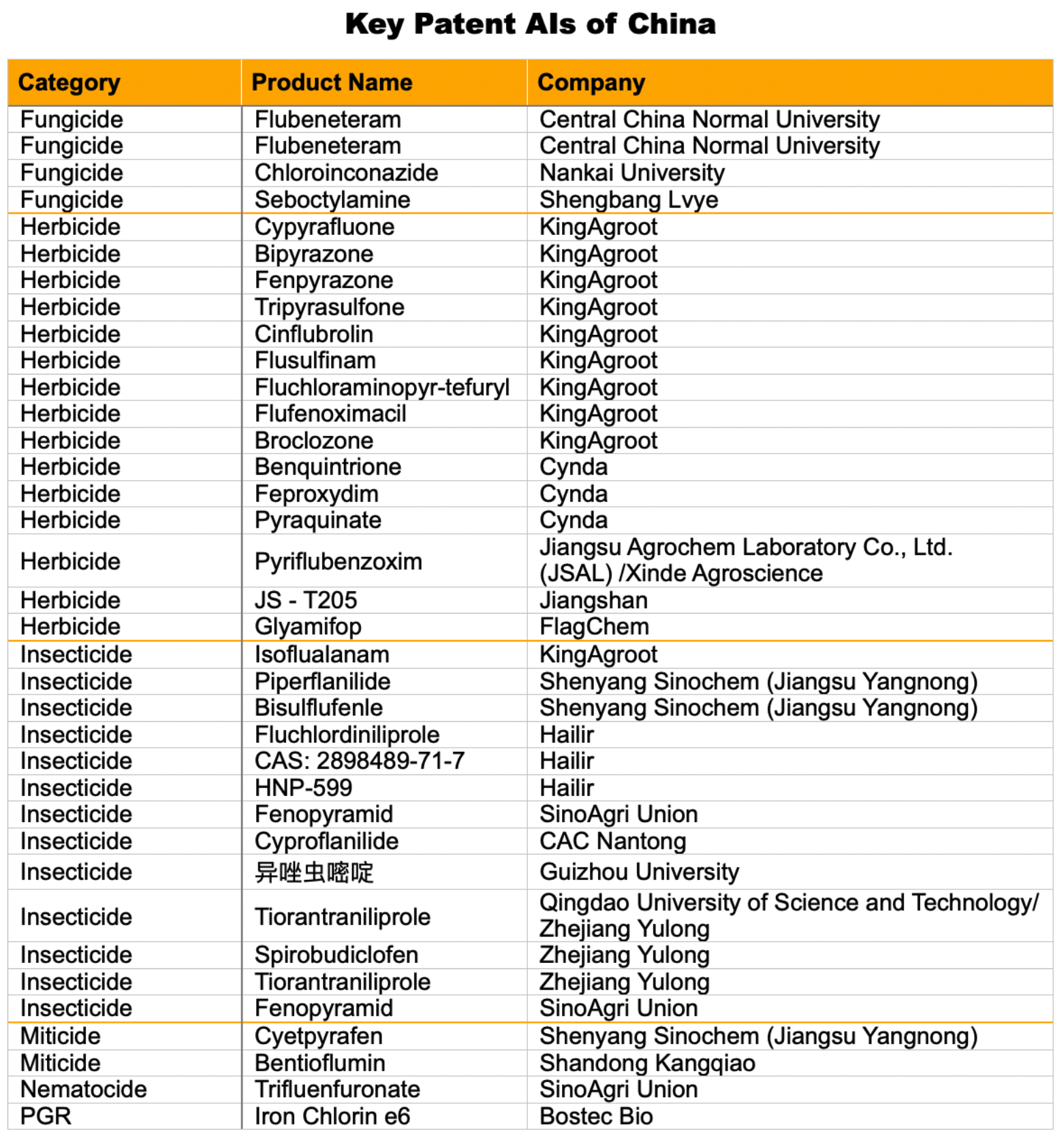

Currently the majority of patented compounds in the Chinese pesticide supply market come from universities, institutions, and companies with a vision to create patent active ingredients (see table below). While most Chinese pesticide companies are more focused on the production of generic compounds, as Chinese companies increase their investment in active ingredient discovery, the future of active ingredient discovery in China could be a growth spurt.

Similar to the dilemma encountered by Chinese generic agrochemical companies going overseas, there are only two options for Chinese producers of patented AIs if they want to promote globally.

One is to partner with a multinational company; CAC Nantong’s cyproflanilide has a domestic market presence in China with Syngenta Group China. Overseas, CAC Nantong has just recently reached a cooperation agreement with UPL for global promotion. In terms of pest resistance management, CAC Nantong is ambitious in marketing cyproflanilide.

For a company that focuses on product supply, linking farmers through a multinational company’s portfolio and channels can optimize its asset allocation. Innovative companies are open to any business model that can deliver product value to growers professionally, for example, partnering with multinational companies through patent licensing or product distribution. Chinese agrochemical companies are taking a proactive approach in welcoming like-minded partners to build relationships and achieve win-win cooperation.

The cost of registering and educating farmers about the global rollout of patented compounds is high. The introduction of patented compounds into MNCs’ product lines may be the most cost-effective way of cooperation. Filling in the gaps in the MNC’s resistance management product line is a more realistic option. In order to protect their own product equity, multinationals can of course also build global brand equity to ensure that the collaboration is mutually beneficial and sustainable.

Obviously, the product agency model is more favorable for Chinese patent AI companies. Through market penetration, Chinese firms can build awareness of the product among farmers in the target market. However, a strategy with long-term strategic significance for Chinese patent AI firms may be difficult to be easily accepted by MNC executives. If we learn from the development experience of patent companies in Japan and other countries, it is more pragmatic that both the innovator and its partner can launch their own branded products in the target markets. Direct competition can be avoided between the two parties through different brand strategies and synergy.

Another way is to “enter through the narrow door and take the difficult path.” Chinese patent companies need to deeply participate in the promotion of the global crop protection market and effectively establish links with farmers.

Frustratingly, Chinese pesticide companies always misunderstand the definition of branding. Branding is not the same as advertising, and it is not just about making a striking logo or open a splendid conference. From the enterprise’s point of view, the essence of the brand is to synergize the customer relationship. It is only on the basis of relationship building that a company’s value can be fully delivered to its customers and profits can be made.

Only that the time for such global customer relationship building and the energy it takes is hard to predict. If Chinese AI companies want to build their own brands and grow their businesses beyond being suppliers of patent AI, they need to be like the young scientists in China’s science and technology academies who spend years in the fields overseas, working with farmers around the world and in the environments of their target markets, so that they can influence the complex purchasing decisions that farmers make about agricultural inputs.

Starting in 2025, the global agricultural market will enter an era of chaos. Geopolitics and trade barriers may force global agricultural commodity prices to continue to fall by about 10%. Global agricultural growers are facing greater profitability challenges.

The impact of market conditions on the upstream agricultural input industry will follow suit. Perhaps the most significant feature is the shift from “product-centric” to “farmer- and agriculture-centric.” Multinationals are confirming this trend by digitizing the feedback they receive from farmers. Understanding farmers and having access to first-hand data is more important than ever. In the Chinese market, Chinese companies have realized this direction as well. It’s just that it will still take time for the upcoming Chinese patent companies to cultivate market acceptance of Chinese proprietary molecules and its portfolios.

As we discovered in the achievements of the 2024 Nobel Prize winners in Chemistry, David Baker, Demis Hassabis, and John Jumper, modern science has been able to completely break through the problem that has been plaguing scientists for 50 years, which is the use of AI models to predict the complex structures of proteins.

At the recently concluded NVIDIA 2025 product launch event, NVIDIA CEO Jessen Huang introduced that the next generation of AI will be the era of “Physical AI.” In the future, scientists will be able to utilize supercomputing power to build AI models to predict and manufacture small molecules of active ingredients that can accurately act on targets in the plant. This new approach to R&D has the potential to revolutionize the future of the crop protection industry.

Technological breakthroughs are changing the world at an incredible pace. Through supply chain disengagement and alternative products, the future global crop protection market may be completely removed from the current Chinese generic active ingredient supply chain. But China’s creation brings an unknown variable to the Chinese crop protection industry. Perhaps when the experience of Chinese scientists in the field is combined with the creativity of Chinese patent active ingredients, China may improve the efficiency of the world’s agricultural production in a way that has never been done before, which will be something to look forward to. •