European Union: Biostimulants Pose as Alternatives in Mature Market

Scroll Down to Read

By Kynetec

The European Union (EU) biostimulants market is benefitting from a supportive regulatory framework and increasing demand for sustainable solutions.

“Despite external pressures like the COVID-19 pandemic and the war in Ukraine, the adoption of biostimulants has been growing steadily in key markets.

Michal Gazdecki

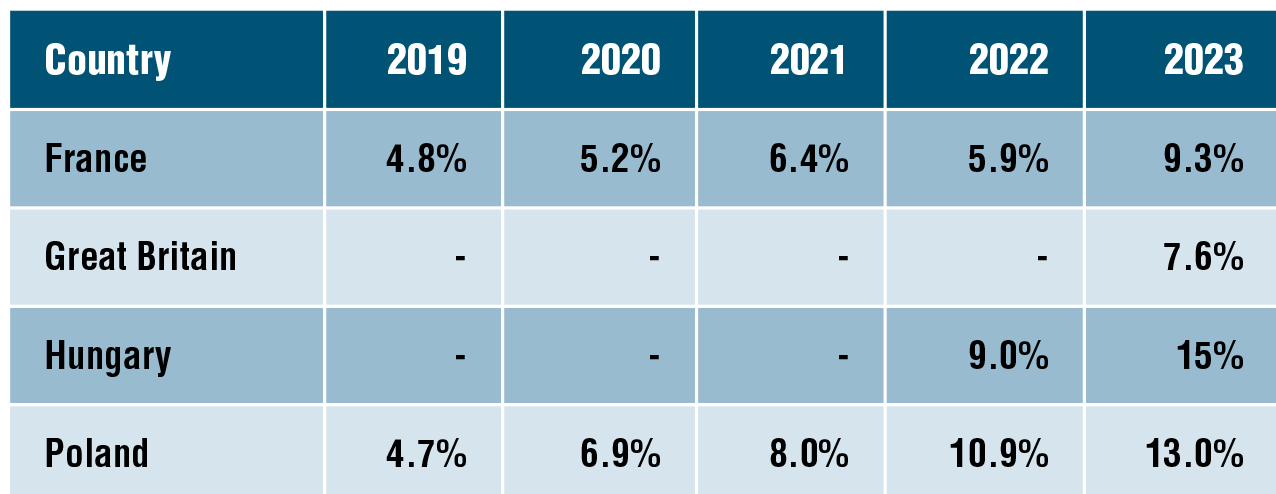

For instance, France saw a rise in adoption from 4.8% of cultivated area treated with biostimulants in 2019 to 9.3% in 2023, while Poland’s adoption rate jumped from 4.7% to 13.0% over the same period. These figures suggest a strong upward trend, particularly in countries with significant agricultural sectors,” says Michal Gazdecki, Director of Central Europe, Kynetec.

Describing the agricultural input market in Europe as mature, Gazdecki goes on to explain: “This means the utilization of conventional products has reached its maximum level, and the market value will be driven primarily by prices and/or innovations.”

Table 1. Adoption of Biostimulants – Percentage of Cultivated Area Treated with Biostimulants

Source: Kynetec, FarmTrak

*only cereals

In the EU, the biostimulants market has been shaped by the recent implementation of Regulation (EU) 2019/1009, which defines and regulates biostimulants under the category of fertilizers. This regulatory framework has provided clarity and enabled more streamlined product registration and fostered a consistent market across the EU.

Fragmented: Hindering User Adoption

Several factors are influencing biostimulant adoption in the EU. The withdrawal of conventional active ingredients has created opportunities for biostimulants as farmers seek alternatives. The EU’s Green Deal and Farm to Fork strategy also support biostimulants as part of a broader move toward sustainable farming practices. Alongside this, increasingly unpredictable weather patterns are pushing farmers to explore biostimulants as tools to enhance crop resilience.

The European biostimulants market is highly fragmented, with numerous small producers operating across different countries. Getting on the shelves of ag input suppliers as well as agronomists and other farm advisors is essential to uptake.

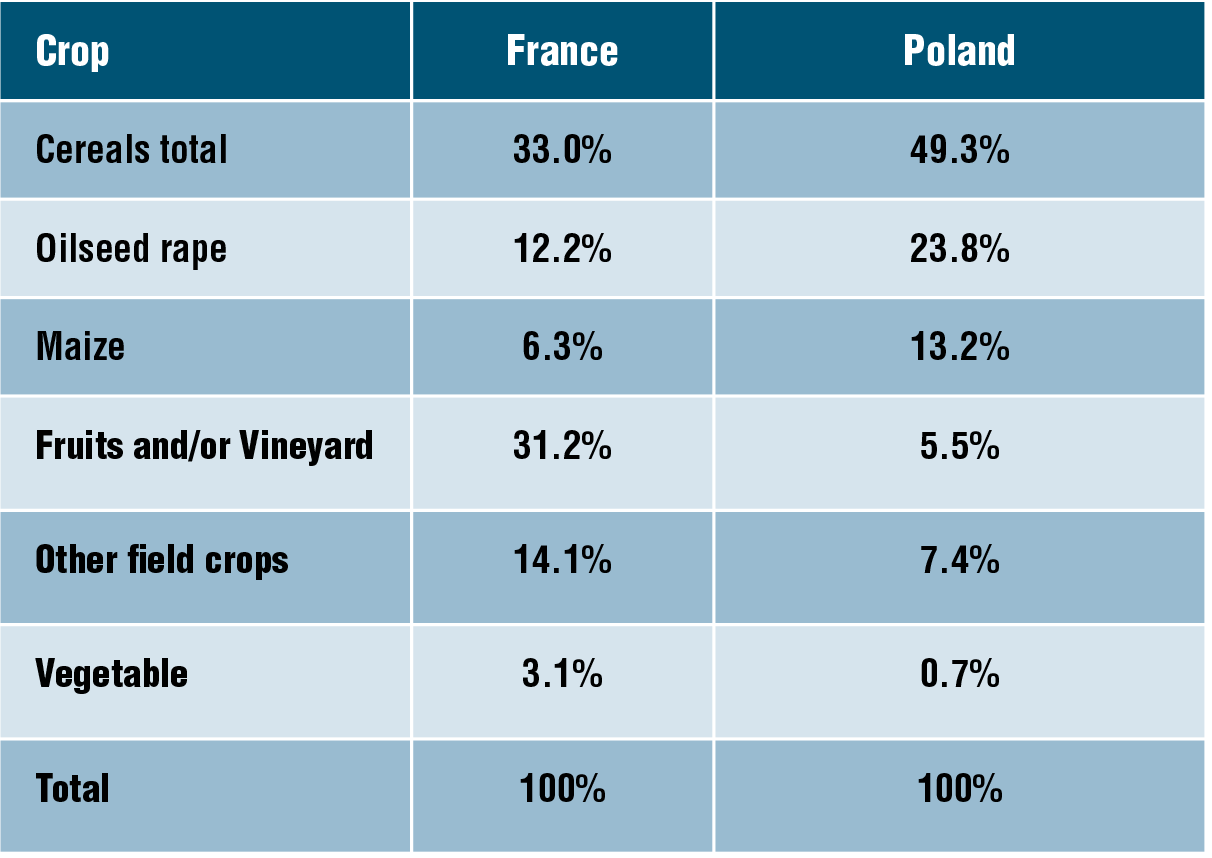

Specialty Versus Field Crops

In Europe, biostimulants are being adopted across a range of crops. The core of the market is built on field crops. Nevertheless, a few countries do hold specialty crops in significant importance. For example, in France, where fruits and vines represent ~31% of the biostimulant market. Cereals in France make up ~33% of the biostimulant-treated area, while in Poland, cereals account for ~49% of treated areas.

Table 2. Biostimulants market by crops in 2023 (percentage according to the total treated area)

EU New Entrants: Top Three Requirements

Gazdecki suggests the most important requirements for those looking to enter the biostimulant space is to counter the fragmented nature of the market and to get products into farmers hands by:

-

- Partnering with Strong Distributors

Given the fragmented nature of the EU market, finding reliable partners with extensive access to farmers is critical for success.

-

- Adapting to National Regulations

While the EU has standardized its approach to biostimulants, individual countries may have additional regulatory nuances. Target specific markets for compliance with national regulations.

-

- Leveraging the Sustainability Agenda

The EU’s push toward sustainability and the reduction of chemical inputs provides a significant opportunity for biostimulants, which align with these goals. Companies should emphasize the role of biostimulants in achieving sustainability targets.

What’s Next: Outlook in the EU

The EU biostimulant market is expected to grow as regulatory support continues and farmers adapt to climate challenges. However, adoption rates will likely vary across countries and crop types. Farmers will increasingly turn to biostimulants as part of their broader toolkit for managing input costs and improving crop resilience in the face of environmental and market pressures. •

Kynetec is a global provider of data, analytics and insights in agriculture, empowering agribusinesses companies to make data-driven decisions, from strategy to execution, through predictive analytics and advanced insights. www.kynetec.com

Photo Credit: Michal Gazdecki, Kynetec