Doing Business in Latin America

Scroll Down to Read

by Javier Chavarro

by Javier Chavarro

Contributing Writer

The agricultural industry in Latin America has been fundamental for the economic growth of the region. Over the past two decades of rapidly expanding agricultural production, the sector’s contribution to the region’s economy has almost doubled, evidencing the improvement of the livelihoods of significant percentages of the rural population as well as greater food security in Latin American countries and the rest of the world, according to Responsible Business Conduct in the Agriculture Sector in Latin America and the Caribbean.

In talking about agriculture in Latin America, the conversation leads to professional producers, high-quality standards, highly-diversified agriculture, intensive and extensive agriculture, exportation, and local consumption.

Over the past 20 years, countries such as Brazil, Argentina, Mexico, Colombia, Chile, Costa Rica, and Peru have become some of the world’s leading exporters of agricultural products, including cereals, oilseeds, fruits, vegetables, and coffee. This industry continues to drive socioeconomic development whereas agriculture remains an important source of employment throughout the region and represents approximately 14% of its workforce. However, if the 20 Latin American countries are considered as a whole, the average rises to 18.42%. This growth has allowed many countries to establish themselves as both key and influential players in the international trade of agricultural products.

Agriculture as we traditionally know it has changed radically. This transformation goes from being only a consumer of crop protection products and fertilizers, toward the requiring of personalized solutions for each of the producing farms. This allows farmers to plant, cultivate, and protect their plots and crops using a smaller production area, water, and energy to achieve its objectives.

Nowadays the needs and demands of farmers are different from those that were traditionally managed, since today these requirements involve a series of well-thought-out solutions for agriculture, which includes four groups of requirements that must be adjusted to their needs:

| 1. Crop protection: comprises chemical management of weeds, pests, and diseases. |

| 2. Biological products: embraces innovative nature-based agricultural technologies that can serve as an important part of many integrated crop management systems, often in the form of biocontrollers and biostimulants. |

| 3. Improved seeds: involves seed varieties that combine genetics and particular characteristics and quality. |

| 4. Digital agriculture solutions: data collected and used for further decision-making processes. |

It is important to highlight that in the South American agricultural industry there is a wide range of new technologies that promise to impact significantly in production models, acknowledging new trends in the collection, storage, management, transfer, and analysis of large volumes of data. A study made by the Inter-American Development Bank, identified nine areas of technological innovation that have greater potential to unleash the productivity of the agricultural sector in a sustainable way:

- New production systems,

- Mechanization and automation of work,

- Genetics and protection of crops and animals,

- Big data and precision agriculture,

- Management software and information services for decision making,

- Innovative buying and selling platforms,

- Outsourced services and financing,

- Technologies in the logistics and food distribution chain, and

- Innovative food products and services.

A point of reference in Latin America is the value of the agrochemical market, which in 2023 was recognized as the year of price adjustment, where the purchase of products was reduced between 10% to 30% with a drop in prices due to high-priced stocks that came from 2022.

According to CropLife, Brazil, as of today, stands as the most significant market in the region. It also estimates a drop of 10% to 15% of last year’s value in the value of agricultural chemicals applied in the country, whose lobby Sindiveg sector set at $21.7 billion in 2022 according to Successful Farming magazine, on January 11, 2024.

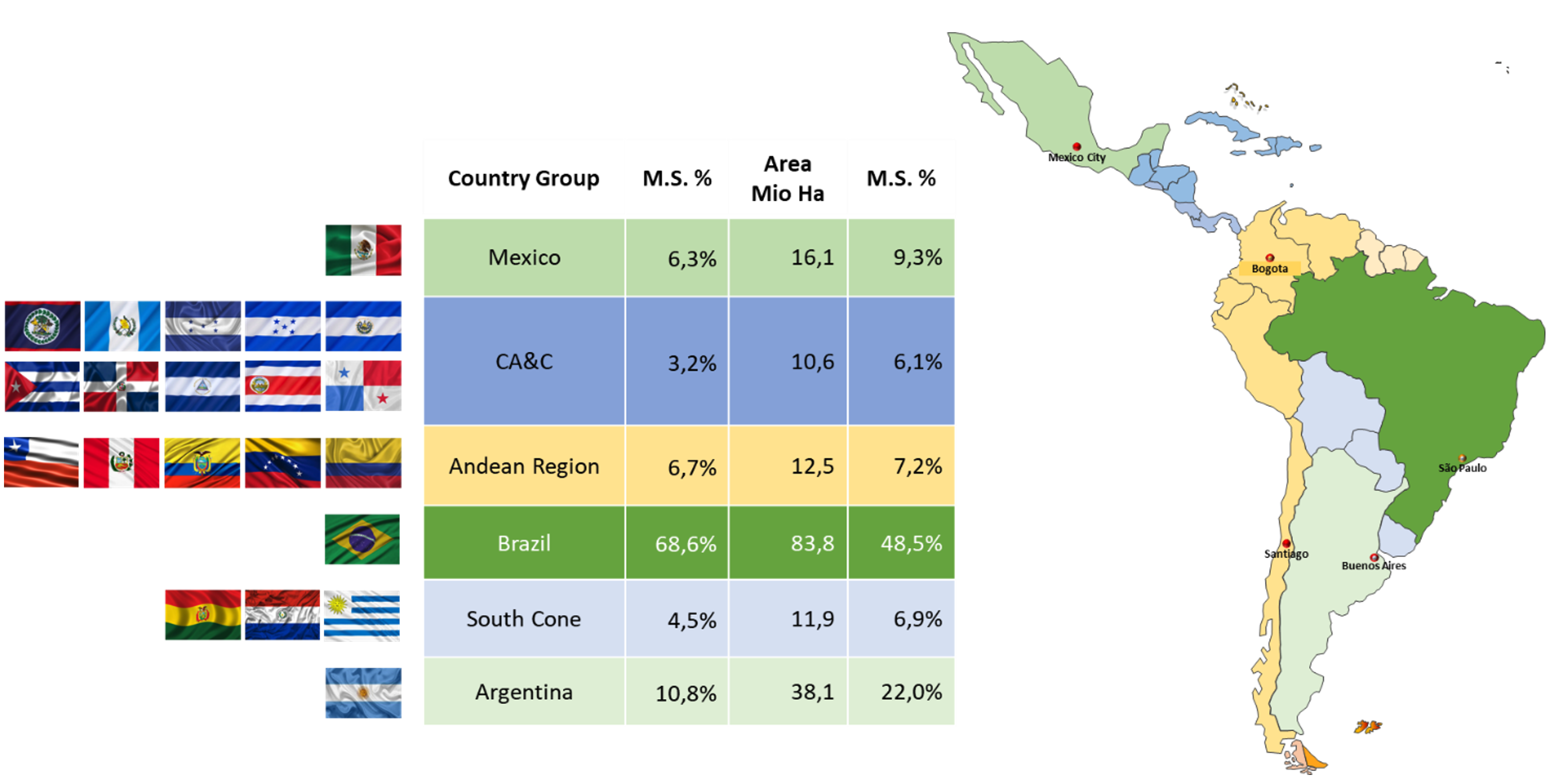

The largest markets in Latin America are Brazil with 69% of the total, followed by Argentina with 11%, Mexico with 6.3%, and the Andean region with 6.7% representing the country groups with the strongest markets of the region, bringing together almost 93% of the total business in these four clusters.

LATAM Agrochemical Market in 2023 (Percentage (℮)

But how are all these products, tools, and solutions marketed in the field? How can farmers obtain these elements to apply them on their farms?

In Latin America, there are several work models regarding the distribution of agrochemicals. The first level is made up of R&D companies, where the six largest companies in the world are well established throughout Latin America. At the second level are the post-patent companies, some of which are also found in almost all countries in the region. Finally, the third level are the local companies, the ones that deal with the distribution of products of R&D companies and those of post-patent companies in addition to formulating private brands of different products.

(R&D companies, post-patent and local companies acting in Latin America)

These companies work to bring farmers products to use in their fields and control the many problems and issues of their crops. This point is important because many of them are merging or acquiring in different countries to achieve a greater participation in local businesses.

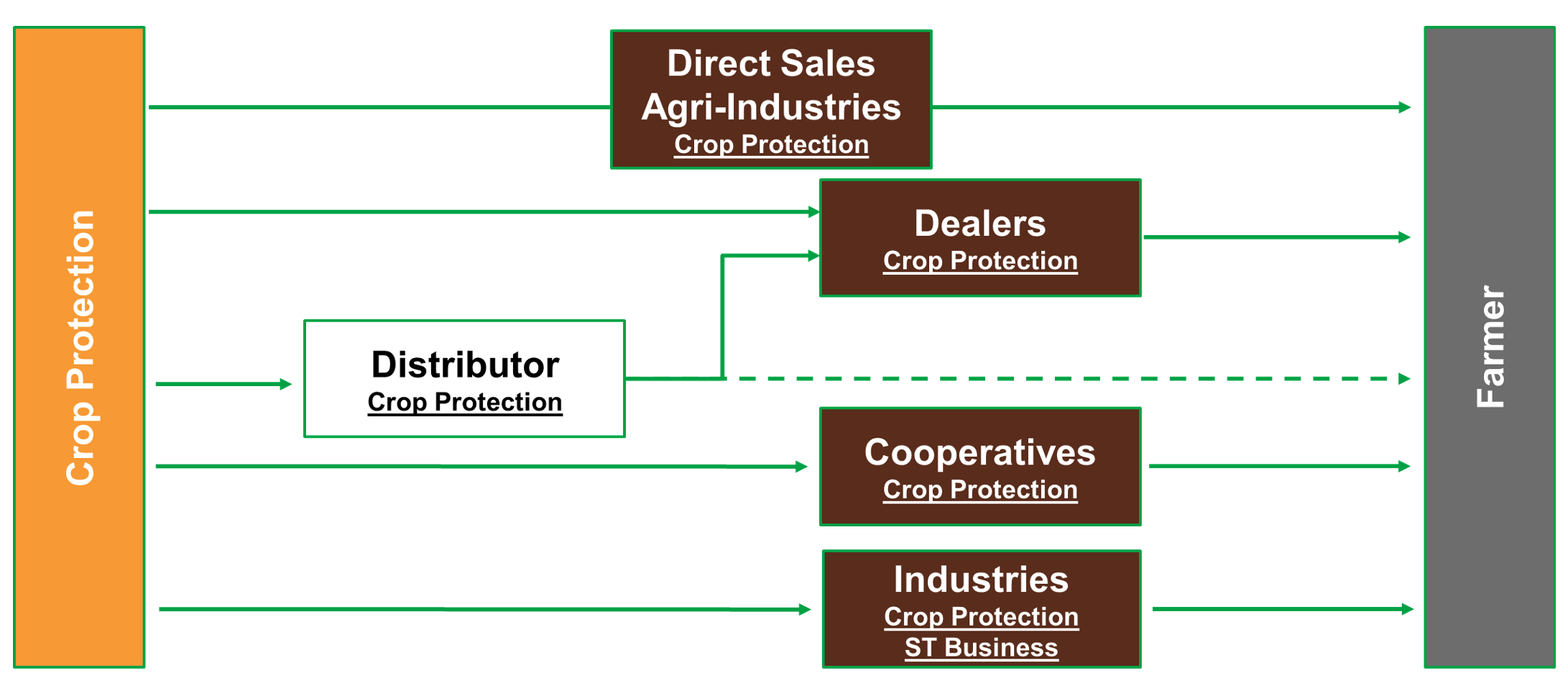

In general, for most Latin American countries, the strategy of reaching farmers goes through the following channels to reach end users.

Normally, agrochemical companies do not reach the user directly, although there is a small percentage. Most of it goes through chains of distribution where the distributors or wholesalers and in some cases the super-distributors are located. Then comes the level of the dealers, which in many countries are of significant importance because they are the ones that make it possible to reach a lower level, which are stores and retailers in the areas where the farmers are located. Other elements of the marketing chain are cooperatives, which unfortunately in the rest of Latin America are not as relevant as in Brazil. Another important level is the direct sales that are made to industries that, depending on the country, can be, for example, agro-industries or seed treatment, as shown in the model in the following graph.

(LATAM Market Access model – From Crop Protection companies to farmer)

The marketing of agrochemical products in the region is based on the retail strategy, also known as retail sales or retail trade, especially due to land tenure where the vast majority of farmers are smallholders.

In the case of the Andean region and Central America, many farmers have less than three hectares on average, with cases in some countries where 32% of farmers have less than half a hectare. In the same way, the stores registered for the commercialization of products vary according to each country and the number of farmers it has. For the specific case of the Andean region, there are around ~30,000 agro-input stores in the region. Colombia with more than ~12,000 stores to serve the 2.7 million farmers and in the case of Peru more than 7,000 stores to serve more than the 2.6 million farmers, and Ecuador with more than 5,000 stores in the country for the 2.0 million farmers.

The Brazilian case offers another scenario. The main companies with active operations in Brazil that market agrochemicals are Syngenta, Bayer, BASF, Corteva, FMC, UPL, ADAMA, Sumitomo Chemical, Iharabras, Nortox, Albaugh, Ouro Fino, Helm, Sipcam, Nichino, Tecnomyl, Rotam, CCAB, Cropchem, Alta, Sinon, Stockton, Tide, Avgust, Dinagro, Unibras, etc.

These companies are divided into two organizations:

One is SINDIVEG, which is the National Union of the Phytosanitary Products Industry, which is the union entity that has represented the phytosanitary products industry in Brazil for more than 80 years. This group of companies corresponds to approximately 40% of the market for crop protection products in Brazil and partnered with 27 companies in both the research and development and post-patent areas, which are distributed in the different states of the country.

The other organization is AENDA, which is the National Association of Phytosanitary Product Companies. This is the main entity that acted at the origin of the registration of pesticides by equivalence. Over the years, it has demonstrated solidity in the involvement of the most diverse topics, such as such as: federal regulation, state regulation, application and use of products, federal and state taxes and fees, patent system, import procedures and much more.

In addition to these two organizations:

There is the ANDAV association, which is the National Association of Distributors of Agricultural and Veterinary Agri-Inputs. All the commercial organizations have been grouped here for more than 33 years. There are more than 3,000 associates responsible for bringing good agricultural practices to the field, and above all, ensuring the proper functioning of the distribution chain by spreading knowledge, products, services and technology.

|

|

|

Brazil is one of the largest agricultural input markets. In general terms, this market has a great influence on the retail trade of agricultural inputs, which is one of the most dynamic sectors of this economy. According to the consulting firm ZMP, this market is estimated at R$ 360 billion (USD 288 Bi) (2022/2021). The participation of the distribution chain and platforms has 39% of the market. Direct sales represent 30% of the market. Cooperatives represent 27% of the sector and multipliers with 4% participation.

(AgroInputs Market Access in Brazil)

Source: ZMP Consultoria based on Sindiveg, Abisolo, MAPA, Mercado Referencia Defensivos, CADE, SPARK 2022/202

Brazilian agricultural cooperatives are a fundamental axis in the distribution of agrochemicals and much of this success is due to growing investment in innovation. According to the Yearbook of Brazilian Cooperatives 2023, the country had 1,185 cooperatives in the agricultural sector, with more than 1 million members and 250 thousand direct employees.

Main Cooperatives in Brazil (Forbes Agro 100 & Valor Económico)

Distribution in Brazil finds itself into a process of consolidation where the retail trade of agricultural inputs is undergoing a profound transformation. Less than a decade ago, thousands of small and medium-sized Brazilian rural producers were served by thousands of other small and medium-sized agricultural input traders spread throughout the country, generally former salespeople for large multinationals, who opened local stores to sell agrochemicals and seeds, fertilizers, and other specialties as mentioned by Brasilagro in October 2023. Today, there is a great tendency toward concentration, which is the trend of the world market and in the agricultural distributors of the world it is advancing very strongly to consolidate its power.

(Consolidation of distribution systems in Brazil due to M&A )

(Consolidation of distribution systems in Brazil due to M&A )

Source: ZMP Consultoria

As time goes by, the market is experiencing a decelerating pace when compared to previous years. Nonetheless, it is becoming more strategic on the part of the large groups as the coming years will be challenging for the distribution chain, especially for those that do not manage the risk by considering the prices of key products such as soybeans and corn. Among the companies leading the consolidation process, there is a perception that smaller regional retailers offer a great market opportunity, since they have a customer base and know the particularities of the territory in which they operate.

One of the key points will be the margins that tend to reduce, also with some key production areas with a great saturation of distributors in some regions.

As indicated by colleague Renato Cesar Seraphim, CEO of Ciarama Maquinas John Deere in Sao Paulo, Brazil, “In addition to the consolidation of the distribution system, the advance of cooperatives in the Cerrado sector, the increase in digital sales, the entry of new suppliers of chemicals, seeds and specialties, currently a number of ag techs are also seeking to access this super competitive market to offer services before, inside and after the farm-door, remembering that the market for services for agricultural properties is at least three times larger than that for agro-inputs, a market that needs to be occupied and retaken by these retailers.” •

Join us at AgriBusiness GlobtalSM LATAM Conference on 14-15 May in Panama City, Panama, to explore new business opportunities and establish relationships with key players in the LATAM region. Register early to save and set the groundwork for generating new business and partnerships in Latin America! ABGLATAM.com