Crop Protection Market Development: U.S. and EU

Scroll Down to Read

By Derek Oliphant

This article will outline the development of the crop protection market in the U.S. and EU, examining the current situation as well as the key future trends expected to influence market development over the next year.

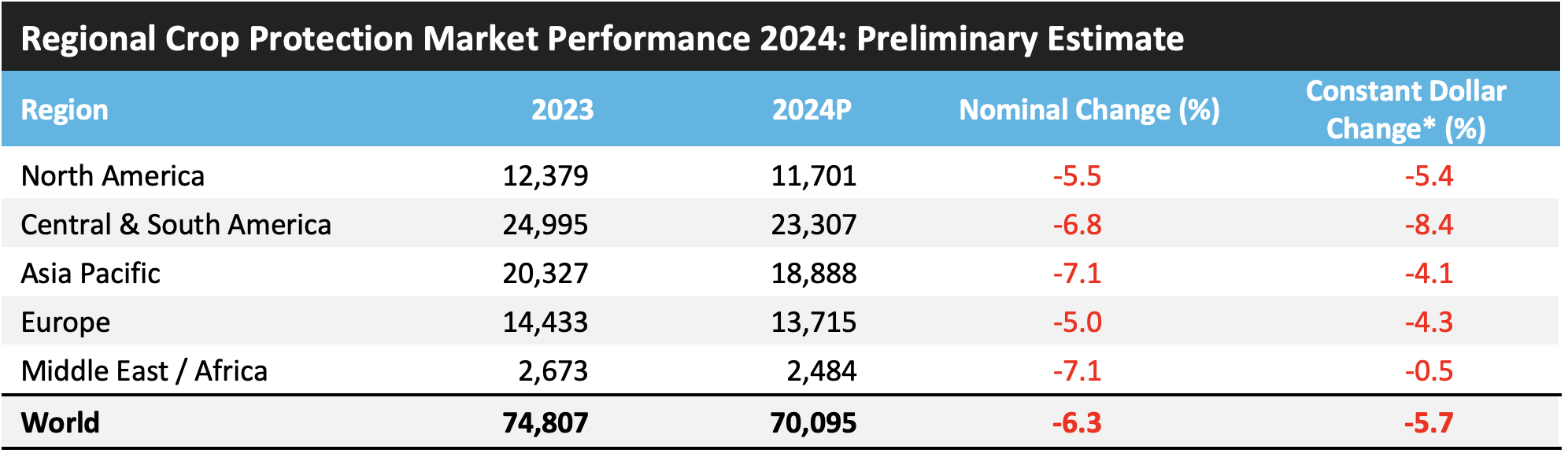

Market values are Agbiolnvestor’s estimates of the value of crop protection products used on the ground in the agricultural year, expressed in U.S. dollar terms at the ex-manufacturer level. For northern hemisphere countries, the agricultural year is approximately October to September, for example ‘2023’ refers to the value of products used on the ground between October 2023 and September 2024.

The most recent full data year available is 2023, with preliminary estimates provided for 2024, as well as a longer-term outlook.

*2023 baseline

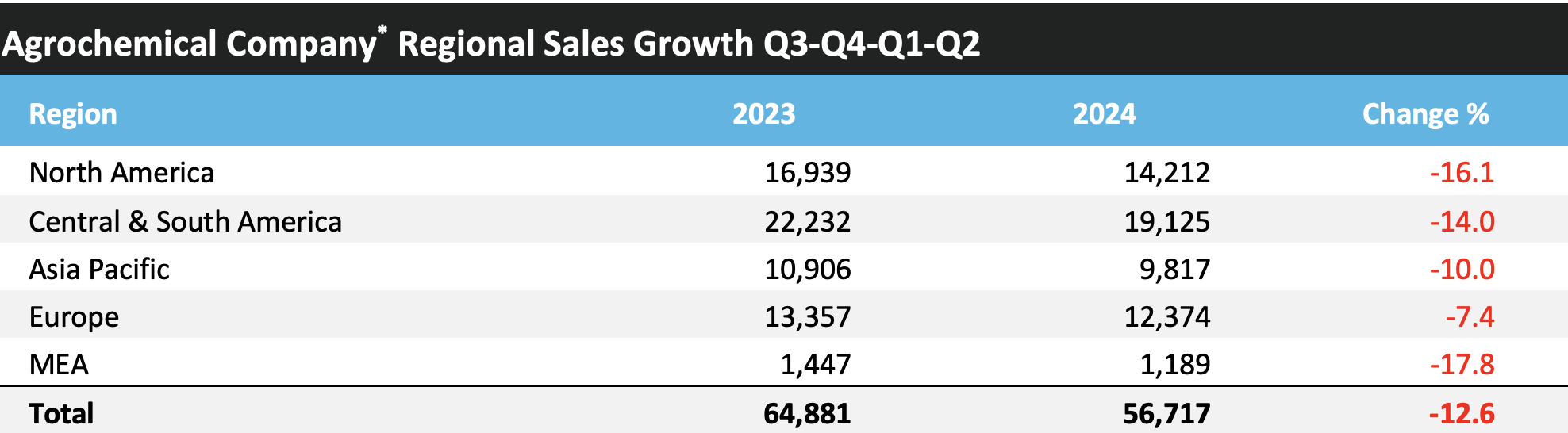

The table below outlines the sales performance of the leading agrochemical companies in each region in the 12-month period between July 2023 and June 2024

-

-

BASF, Bayer, Corteva, FMC, Sumitomo Chemical, Syngenta, ADAMA, UPL

Source: AgbioInvestor Quarterly Briefing

-

The key factors noted by the companies in regional performance were noted as below:

North America: Inventory destocking, low prices. Declining commodity prices.

Central & South America: Delayed purchasing at distributor level. Unfavorable weather in key markets, notably Brazil, impacting volume use. Declining commodity prices.

Asia Pacific: Prices remain under pressure, and volumes impacted by unfavourable weather. Low pest pressure in key markets, notably India, where high inventories also remained an issue.

Europe: Unfavorable weather conditions, including heavy rains in Western Europe. Product withdrawals. Pricing remains robust.

North America Review

Key Factors |

- In the U.S., lower maize and wheat areas, but increase for soybean.

- Falling agrochemical prices.

- Low commodity prices holding back grower purchasing power.

- Dry conditions prevailing across large parts of the U.S., with more than 210 million acres reported to be experiencing drought conditions.

- More favorable weather conditions for U.S. soybean; however, strong production could further hamper soybean price improvement.

- Agricultural trade deficit in the U.S. projected to total $30.5 billion in the 2024 fiscal year (Oct – Sep), $1.5 billion lower than the May forecast, but $13.4 billion more than the deficit recorded in the previous year.

- For fiscal year 2025, the U.S. agricultural trade deficit is forecast to increase further, amounting to a record $42.5 billion.

- Dry conditions in Canada easing, with only 52% of the total crop area categorized as being under drought conditions, down from almost 60% in the prior quarter.

- Canada crop areas variable in 2024:

- Wheat area down slightly, with increased durum area not offsetting decline for other wheat.

- Canola area expected to decline, but soybean up.

- Pules and special crop area to increase, with production also up strongly.

However, prices for most key crops in Canada expected to be down compared to prior year.

US Market Progress 2024 |

One of the biggest issues facing U.S. growers in recent months has been declining commodity prices, which are depressing farm incomes and offsetting any positive effects from lower input prices. In addition, reduced levels of government support are also having an impact on farm incomes. For 2024, the USDA expects farm income to be down by 4.4% to $140.0 billion, driven by a reduction in farm cash receipts. Within this, total crop receipts are forecast to fall by 10.0% in 2024, led by declines for maize (-20.0%) and soybeans (-14.6%) which are being impacted by lower prices offsetting higher sold quantities. Net farm income in 2024 is also expected to be impacted by lower direct government payments, which are forecast to fall by 15.1% from 2023. In contrast to previous estimations, total production expenses are projected to decline by 1.1% in 2024. Expenditure on pesticides is currently forecast to fall by 10.4%, with seed purchases projected to decline by 0.4%. Expenditure on fertilizers, lime and soil conditioners is expected to decrease by 9.7%.

In Canada, total crop production in 2024/25 is projected to increase by 1.8% to 93.856 million tonnes. Grains and oilseeds production is estimated to rise by 0.2% to 87.015 million tonnes, while pulses and special crops production is expected to grow by 29.5% to 6.841 million tonnes. The outlook for crop prices is generally negative, with declines forecast in 2024/25 for durum wheat (-23.5%), barley

(-9.2%), maize (-2.8%), oats (-9.6%), canola (-11.2%) and soybeans (-12.6%), while prices for non-durum wheat (+4.4%) are expected to increase.

In 2023, the value of the crop protection market in North America declined by 2.4% in nominal terms to $12,379 million, impacted by low agrochemical pricing, with glyphosate prices estimated approximately 25% lower than the prior year in some situations. In addition, lower soybean and cotton areas also had a negative impact. This was somewhat offset by volumes increasing slightly, with improved weather conditions in the west and high insect pest pressure, although dryness was an issue in the Corn Belt. In Canada, dry weather also held back market development. For 2024, the negative effects of lower commodity prices, lower areas for certain key crops, notably maize in the U.S. and canola in Canada, and expectations for continued dry weather conditions suggest this negative momentum may continue over this current agricultural year.

Based on preliminary estimations, the value of the crop protection market in North America is expected to decline by 5.5% in nominal terms in 2024 to $11,701 million.

Looking ahead, there are recent developments which can be expected to affect the crop protection marker in the U.S., in 2025 and beyond. These legal decisions can be expected to have significant ramifications on the distribution chain and product availability in the country.

Antidumping and Countervailing Duty Investigation: This investigation revolves around concerns over antidumping and countervailing of 2,4-D into the U.S. from China and India. While still ongoing, with final determinations from the International Trade Commission (ITC) expected on 9 January 2025, a preliminary determination has recommended the imposing of countervailing rates on imports of

2,4-D. The case is based on Corteva’s petition that imports of 2,4-D from certain companies in these countries were being offered at subsidised and heavily discounted rates. These countervailing rates would lead to significant tariffs being placed on imports of 2,4-D from these destinations, with expectations that this would greatly reduce the competitive environment and resultant price pressure on domestic material, with the tariffs being such that imports could effectively be priced out of the market. While this can be expected to protect against price erosion caused by a glut of low-priced imported material as has been the case in recent years, this coupled with the current low commodity price environment can be expected to exert further pressure on grower incomes in the country.

Crop Inputs Antitrust Litigation Case Dismissed: This case involved litigation by several plaintiffs involved in the direct and indirect purchasing of crop inputs (specifically seeds and crop protection chemicals) citing an ‘alleged conspiracy to restrain trade across three distribution levels for all crop inputs sold in the country’. If successful, this action had the potential to cause significant disruption to the established crop input distribution chain in the U.S., leading to the cessation of loyalty programs and potentially opening up the market to alternative suppliers, notably e-retailer platforms. This then had the potential to lead to increased competition and subsequent price erosion for both seeds and crop protection chemicals in the U.S. market. However, the dismissal of the case can be expected to lead to the resumption of the established distribution chain in the U.S.

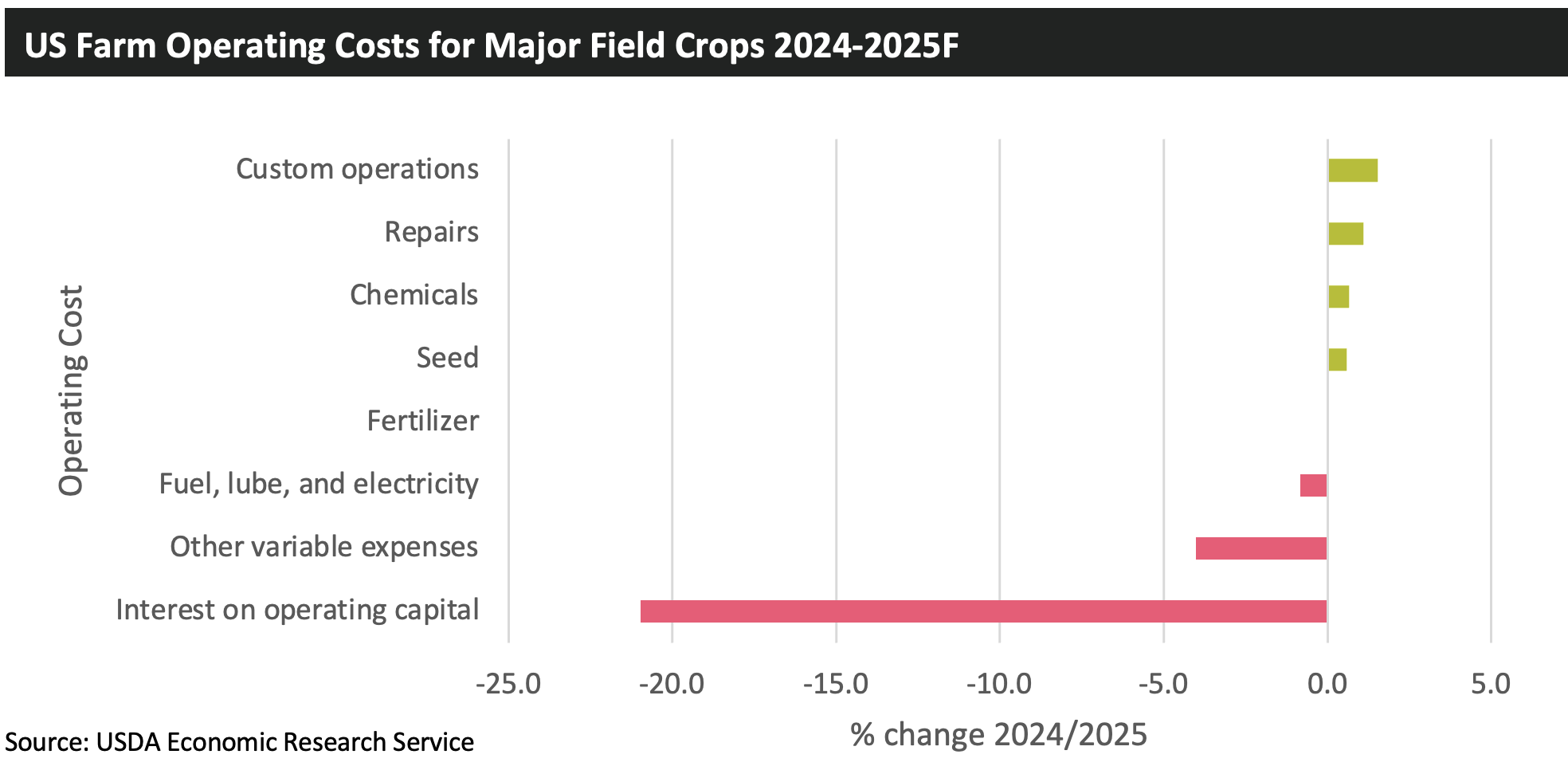

The figure below shows the expected difference for farm operating costs in the U.S. between 2024 and 2025, based on projections from the USDA’s Economic Research Services. As can be seen, operating costs for fuel and interest are expected to decline in 2025, but higher spending is expected on chemicals and seed.

According to the USDA, the agricultural trade deficit in the country is projected at $30.5 billion in the 2024 fiscal year (Oct – Sep). Although this is $1.5 billion lower than the May forecast, this reflects a widening of $13.4 billion compared the deficit recorded in the previous year. For FY 2025, the U.S. agricultural trade deficit is forecast to increase further, amounting to a record $42.5 billion.

In terms of crop areas, it can be expected that the maize area will rebound at the expense of soybean in the U.S., primarily driven by high production and low usage of soybean stocks in the country leading to high supply levels and subsequent price deflation. Expectations for cotton also suggest a decline, based on high increases in the last two years. For Canada, the wheat area is expected to rise, rebounding from low areas in 2024, while canola can also be expected to increase to meet high crushing demand.

Europe Review

| Key Factors |

- EU-27 crop areas variable, although production severely impacted by weather:

- Soft wheat area estimated to be down by 5.5%, but maize up by 5.0%; however, production expected to be hampered by unfavorable weather conditions.

- Oilseed area expected to fall by 2.7% in 2024, with an 8.8% decline for oilseed rape.

- Sunflower area expected up by 2.2%, but production down by more than 6%.

- While conditions have favored pest development, field access has been a significant issue for growers in many parts of western Europe.

- Grain production in Germany expected to be at lowest level since drought-afflicted 2018 harvest.

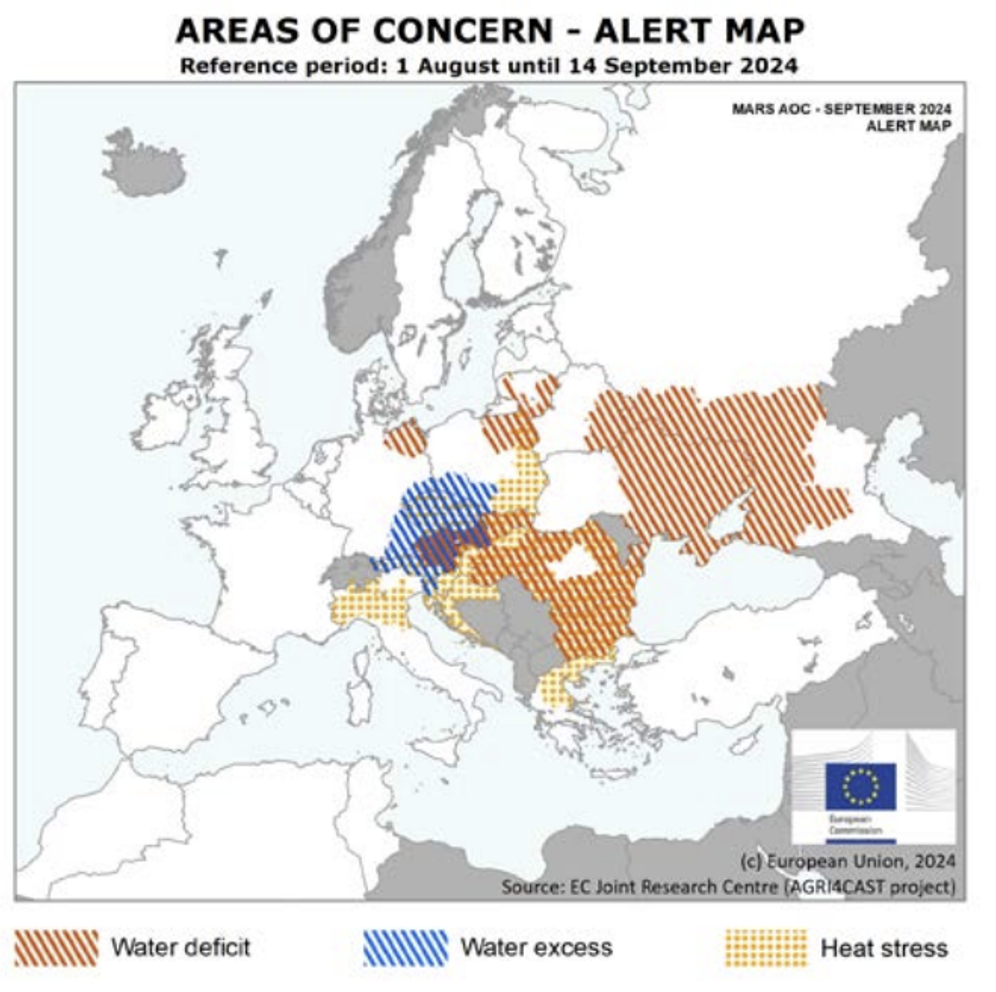

- Weather conditions continue to present a challenge to European growers:

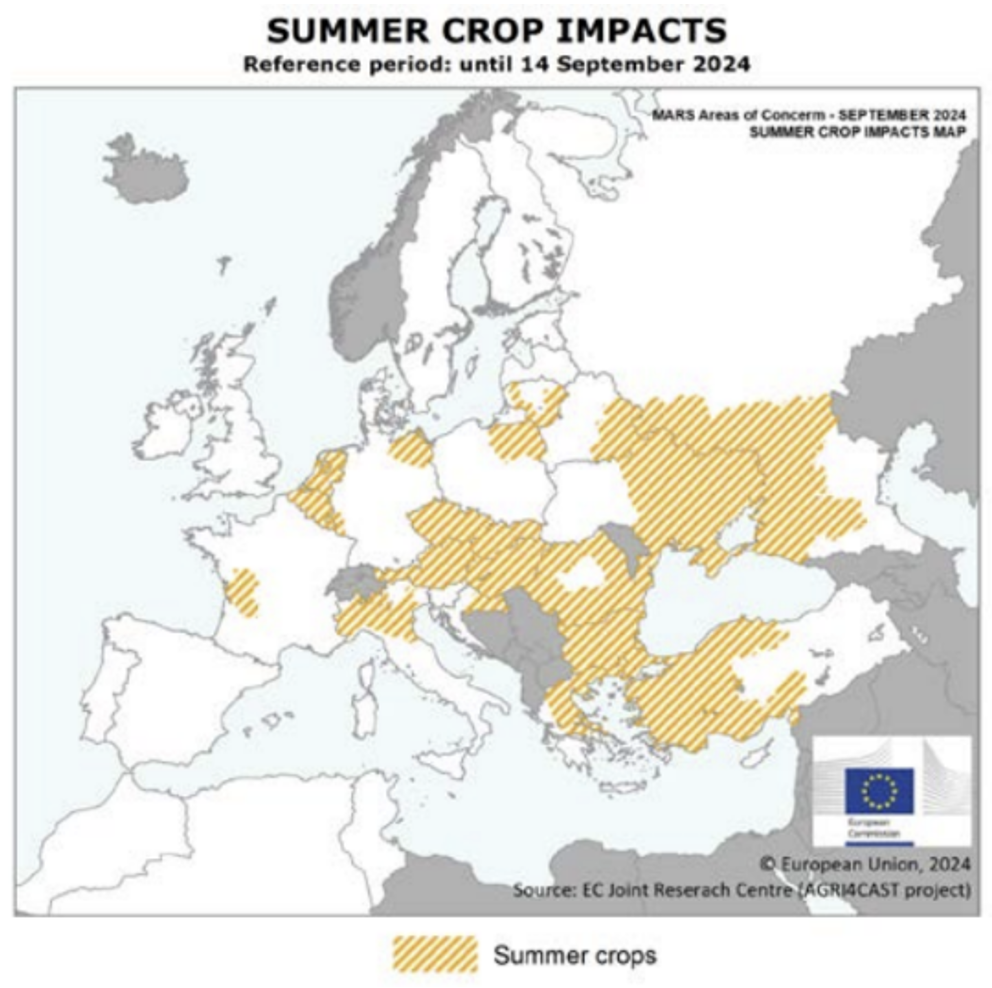

- Very hot summer in southern and eastern Europe, impacting summer crops such as maize and sunflower.

- Very wet conditions in western and northern Europe, leading to widespread lodging and lower grain quality.

- More recently, extreme rainfall and flooding across central and eastern Europe, impacting harvest and leading to crop damage.

- Severe weather in Russia impacting large areas of both winter and spring wheat.

- Five regions have declared a state of emergency in response to extreme weather. Recent heavy rains have resulted in waterlogging and crop damage.

- Many southern regions are being negatively impacted by drought.

Grain harvest forecast at 132 million tonnes, which would represent a 10% decline compared to the previous year.

| Market Progress Q3 2024 |

The winter wheat harvest in northern Europe is being completed under mixed conditions, with weather expected to heavily impact yields in several countries, notably the UK, France, Belgium, and Italy; however, conditions are more favorable, and yields are expected to more positive in other countries, including Spain, Romania, and Bulgaria. Conversely, hot and dry weather is currently impacting maize crops in parts of eastern and southern Europe, particularly in Romania, Hungary, Bulgaria, and Greece, Bulgaria.

In France, the straw cereal harvest is estimated at 38.7 million tonnes, one of the lowest harvests in 40 years, with yields falling sharply from last year. For Germany, the total wheat area in 2024 is estimated to have declined by 9.4%, but production is expected to be down by approximately 13%.

In Ukraine, western regions have experienced positive conditions and as a result yields are expected to by strong; however, eastern and southern parts of the country have been impacted by dry weather conditions and the ongoing conflict with Russia. For Russia, harsh frosts have impacted winter wheat yields, however the spring wheat crop is currently under more favorable conditions.

The hot and dry weather conditions prevalent in southern and eastern Europe in recent months are also expected to affect other crops, with many vineyards in these regions experience lower-than-normal disease pressure: key wine producing regions in Italy for example recorded almost a complete absence of notable diseases such as powdery and downy mildew and botrytis. Clearly this is of benefit to yield and crop quality but limits the potential for fungicide applications and is considered an overall negative for the development of the crop protection market in these countries.

While issues around product inventory have been a significant issue for supplies of crop protection products in many regions in the previous 12-18 months, anecdotal evidence suggests the situation is easing significantly in Europe. Purchasing patterns are switching to a more just-in-time approach, moving away from the high levels of pre-buying which became more commonplace post-pandemic, arising from uncertainty over product supply.

The crop protection market in Europe increased by 5.3% in nominal terms in 2023, characterized by favorable weather conditions in key markets, and recovery from a poor 2022. In 2024 the crop protection market in Europe is estimated to be down by 5.0% in nominal terms to $13,715 million, equating to a decline of 4.3% in constant currency terms, impacted primarily by unfavorable conditions in several regions, notably affecting winter cereals, a key crop in most northern and western countries. As discussed above, wet conditions hampered crop planting and development, and hindered field access for both planting and for crop input applications. Conditions are more varied on southern regions, where less of a focus is placed on winter crops such as cereals and oilseed rape. However, many southern countries strongly outperformed the overall market in 2023 based on recovery from a poor 2022, leading to slight growth from a more normal base in 2024.

For 2025, positivity can be expected in the European market based on a return to more normal, positive weather conditions. The weather-impacted production of 2024 can be expected to limit crop availability and should provide some solidity to crop commodity prices moving forward. Although crop availability from Black Sea destinations drove prices high initially, the worst inflationary effects of this are now over as supplies and crop commodity movement have reached a new equilibrium. While agrochemical pricing is a negative, the impacts in Europe are less than in many other regions, with Europe not as reliant on Chinese material. Costs in Europe have been affected by a myriad of factors, although energy costs have been a key factor in prices being sustained above most other regional markets. In addition, further value can continue to be derived from new product introductions, with active ingredients such as bixlozone and cinmethylin being introduced in markets where regulation and resistance have restricted product choice in recent years. •

Photo Credit: Derek Oliphant, AgBioInvestor