Crop Protection Market Development in Latin America

Scroll Down to Read

By Derek Oliphant

LATIN AMERICA

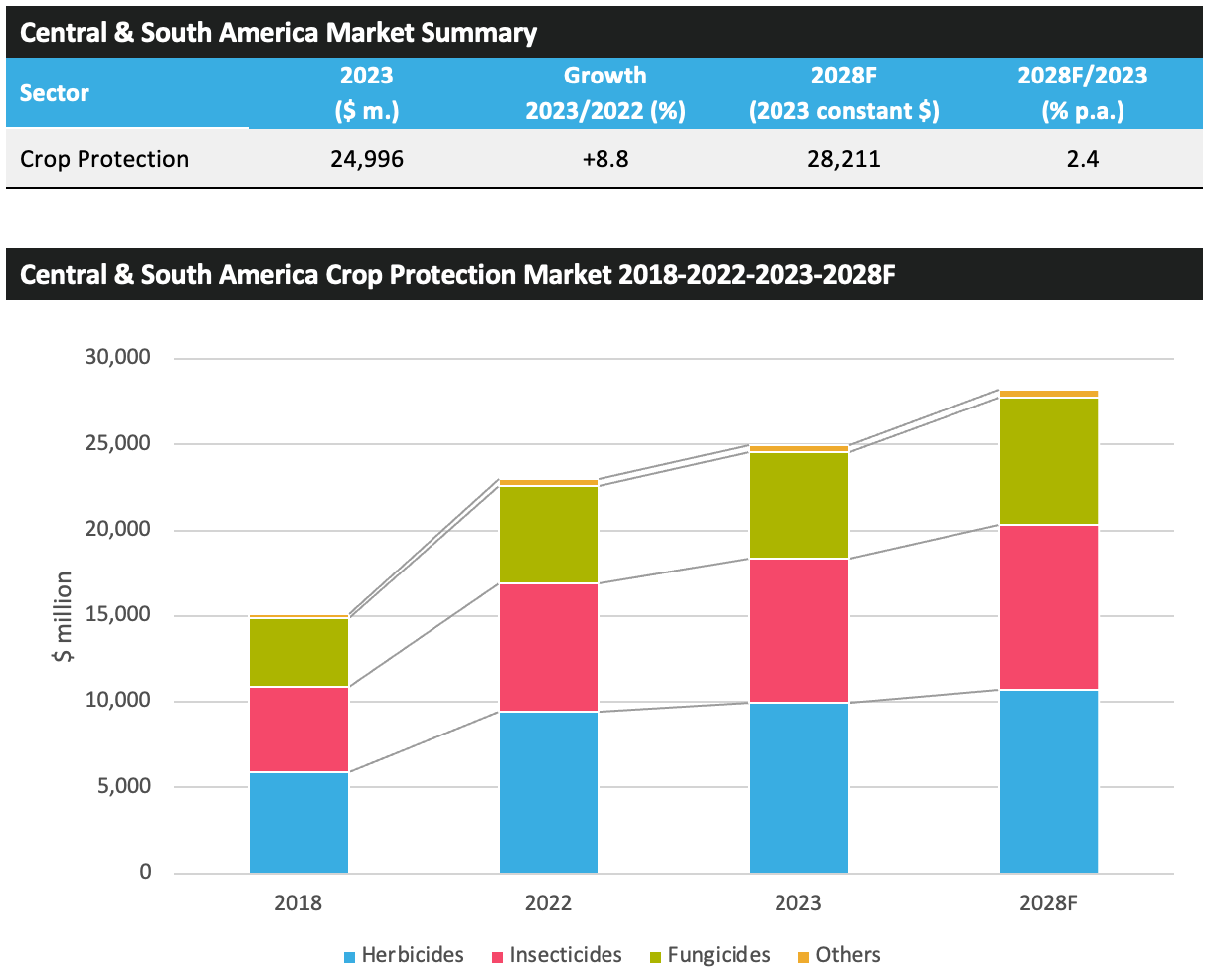

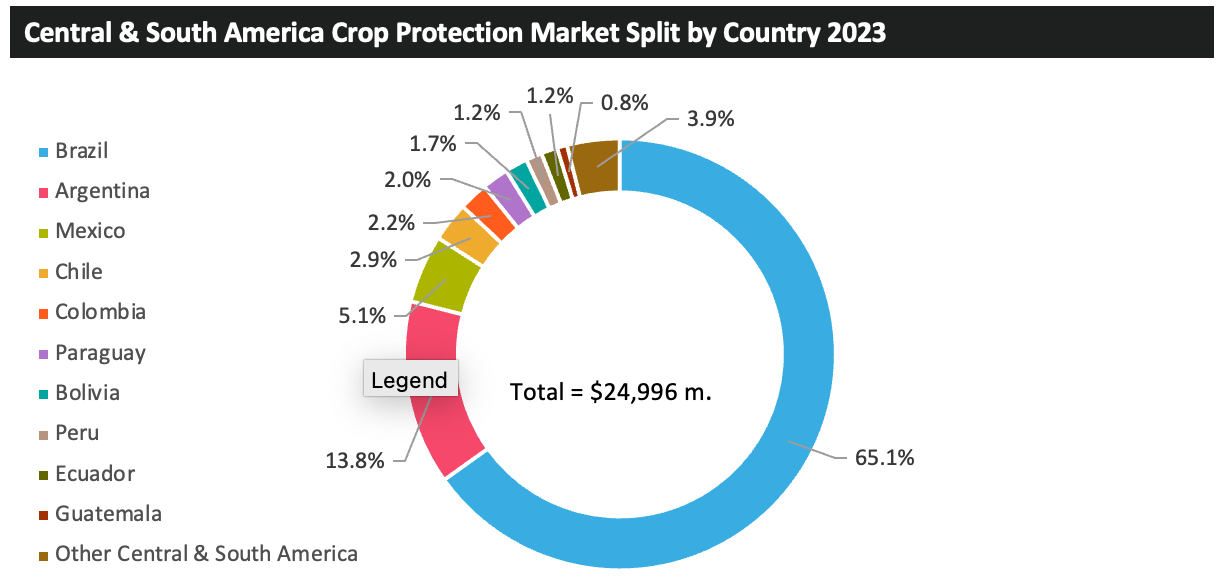

This article will outline the crop protection markets in certain countries in Central & South America, namely Argentina, Brazil, Colombia, Guatemala, and Mexico, examining the current situation as well as the key future trends expected to influence market development in the coming years.

Market values are Agbiolnvestor’s estimates of the value of crop protection products used on the ground in the agricultural year, expressed in US$ terms at the ex-manufacturer level. For southern hemisphere countries, the agricultural year is approximately July to June, for example ‘2024’ refers to the value of products used on the ground between July 2023 and June 2024).

The most recent full data year available is 2023, with preliminary estimates provided for 2024, as well as outlook for the 2025 season, which is currently underway.

ARGENTINA

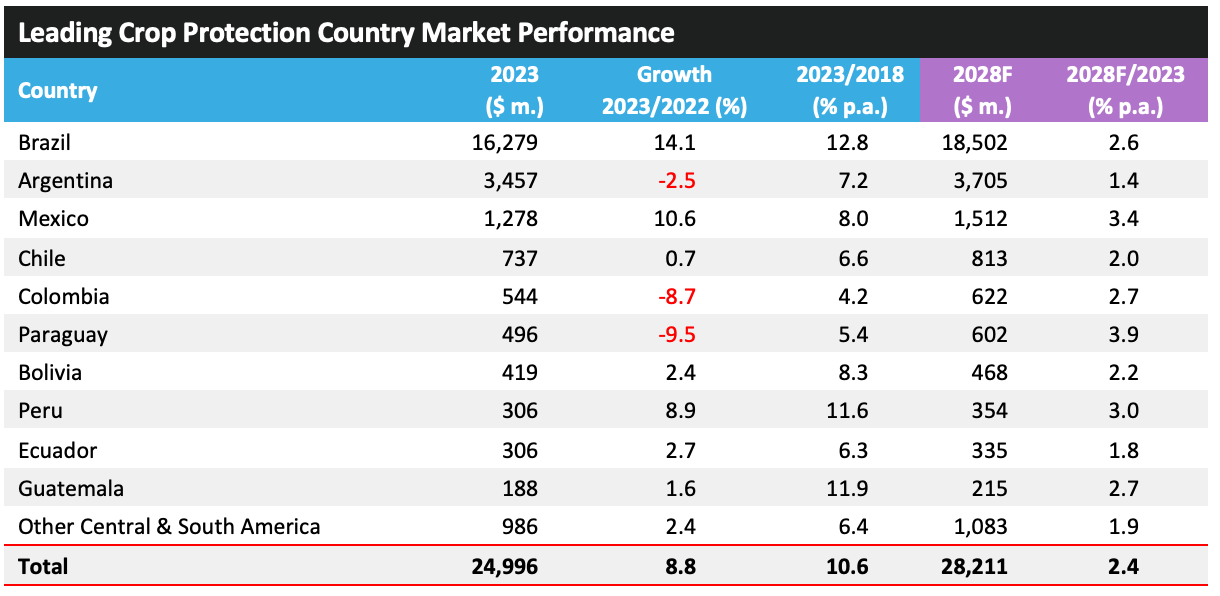

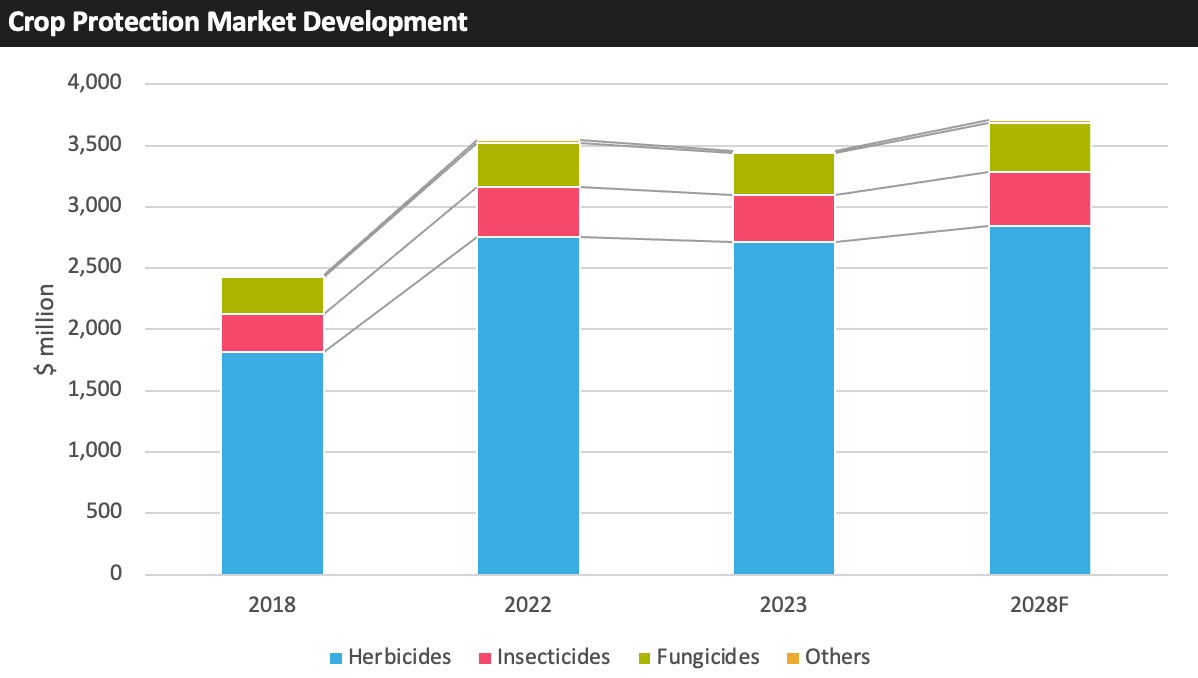

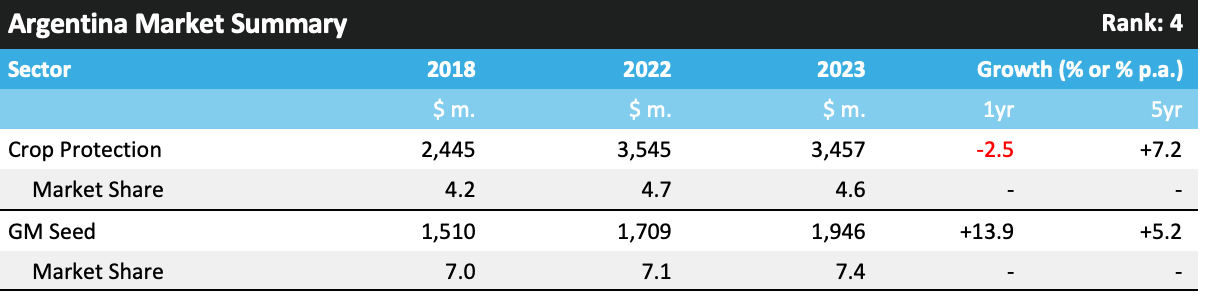

In 2023, the market for crop protection products in Argentina amounted to $3,457 million, representing a decrease of 2.5% from the prior year. At this level, the country was ranked as the fourth most valuable in terms of crop protection market value in 2023.

The Argentine agricultural economy has faced significant challenges in recent years. Economic instability and major currency devaluation have impacted both the agricultural sector and the broader economy. Farmers have struggled with reduced profitability due to adverse macroeconomic factors and prolonged climatic challenges, particularly a severe drought during the 2022/23 crop cycle. These conditions, coupled with previous years’ issues, have created a difficult environment for the agricultural industry in Argentina.

Following the introduction of the ‘Soy Dollar’ program in 2022/23, Argentina announced a broader scheme, offering preferential exchange rates for maize, sunflowers, grain sorghum, and barley. The program aims to generate $2 billion, helping the government secure hard currency amid negotiations with the International Monetary Fund. However, some in the agricultural sector have been critical of these programs for distorting markets, with industry leaders favoring a unified, competitive exchange rate over temporary measures that may negatively impact future exports.

Argentina’s maize export prospects have improved following an update to phytosanitary measures to meet China’s requirements during 2023. Subsequently, in 2024, China’s Ministry of Agriculture approved two maize genetic events for import, enabling Chinese importers to obtain biosafety certificates for all maize biotechnologies cultivated in Argentina.

This development facilitates the commencement of maize exports to China, which became the world’s largest maize importer in 2023 at 23 million metric tonnes. The trade is expected to boost Argentina’s agricultural economy and positively influence the local crop protection market, given the high use of crop protection products in maize production.

GM areas in the country are now mature, with future disruption on the crop protection market expected to come from the adoption of new technologies, including soybeans with stacked herbicide tolerance, which can be expected to impact the herbicides sector. In addition, insect resistance traits in soybean are expected to have a negative impact on the value of the soybean insecticides market.

However, the introduction of new products in the market, including herbicides such as bixlozone which provides a new mode of action for ryegrass control in wheat, and new insecticides such as isocycloseram, are expected to continue to benefit the market in the coming years.

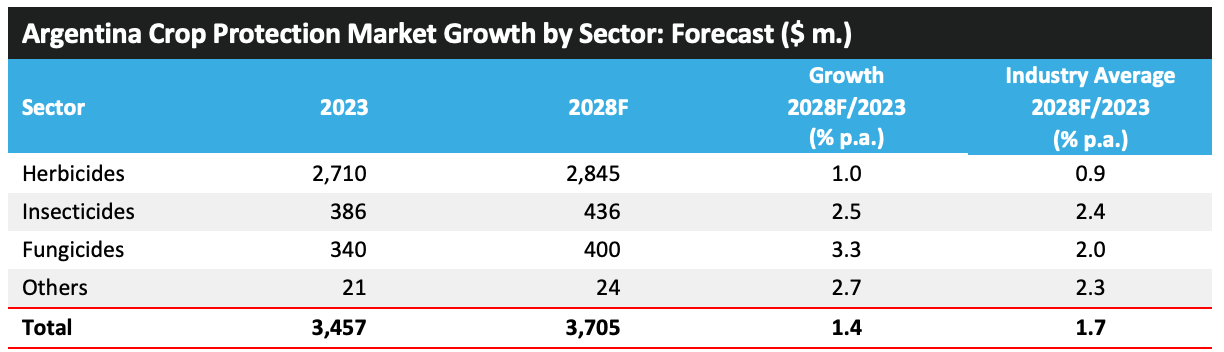

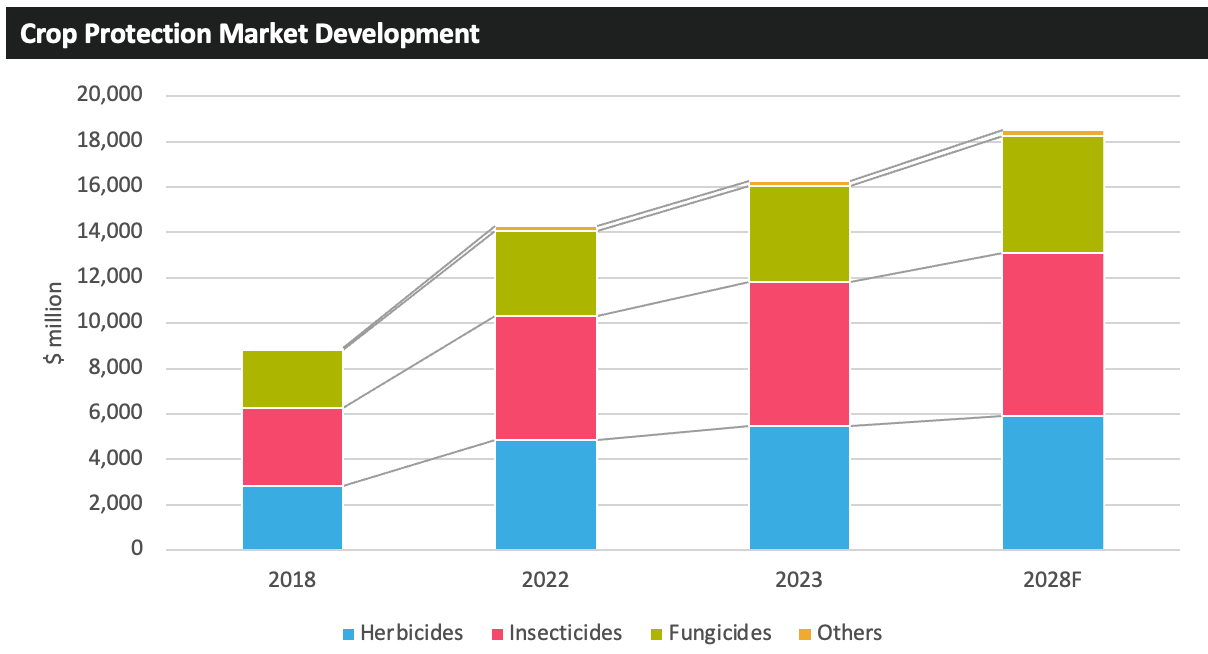

The crop protection market in the country is forecast to rise by an average of 1.4% per annum between 2023 and 2028 to reach $3,705 million, marginally behind the forecast growth rate for the global total over this period.

BRAZIL

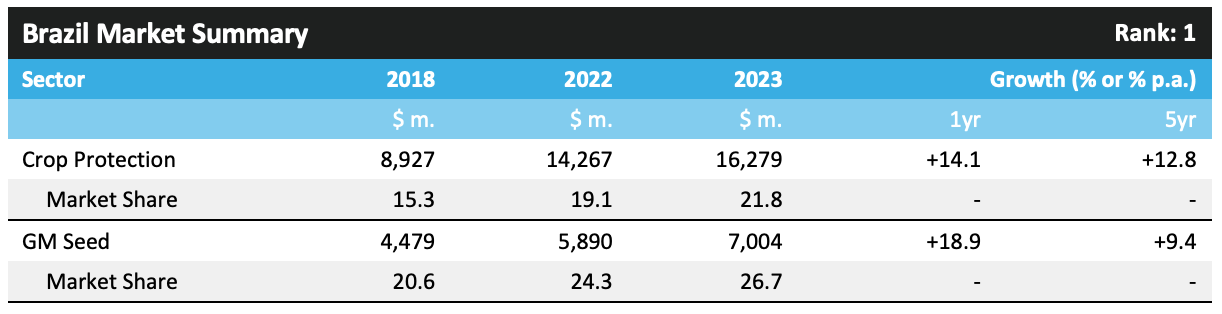

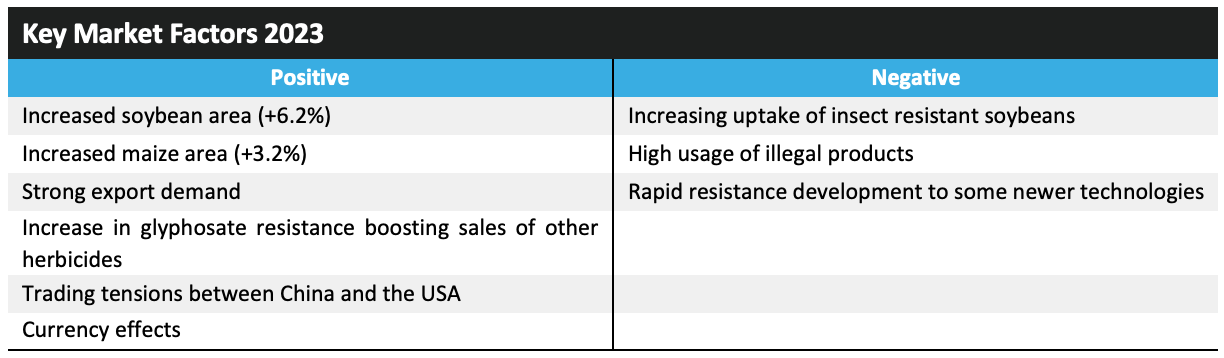

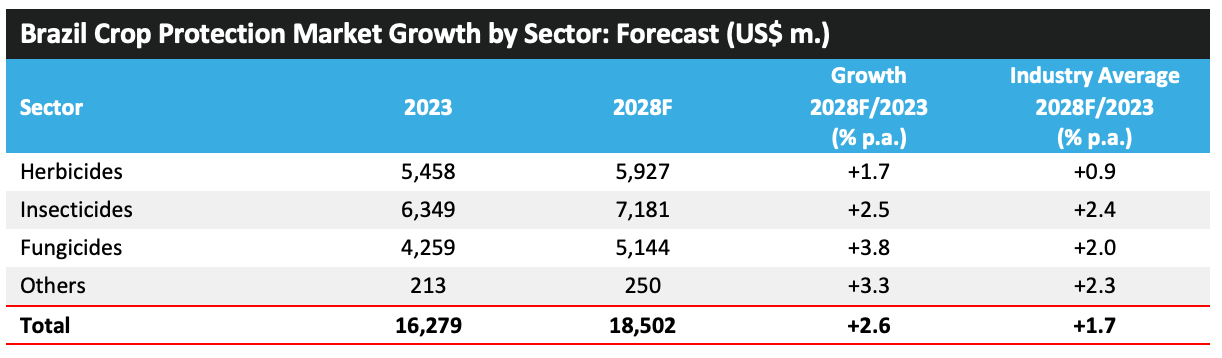

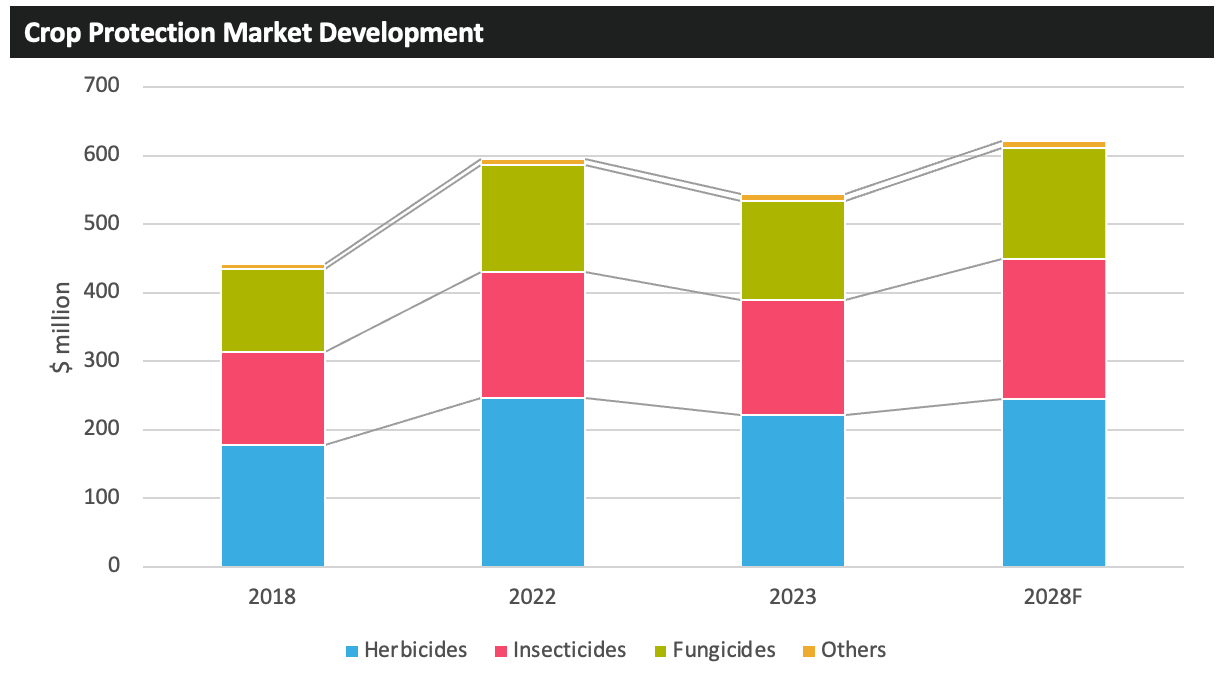

In 2023, the value of the Brazilian crop protection market increased by 14.1% to reach $16,279 million. This strong level of growth was driven by high agrochemical prices during the agricultural year (Jul 2022 – Jun 2023); a continued strong agricultural economy; higher planted areas for key crops; and relatively high pest pressure in more northern regions, where wetter weather was conducive to disease development. For soybean, the area benefited from strong demand for exportable production, particularly from China. In addition, the weakening of the Brazilian real increased the attractiveness of Brazilian soybeans. The Brazilian maize area also increased, as growers looked to capitalize on high maize trading prices.

The Brazilian market is somewhat cyclical in nature, with reoccurring weather phenomena such as the El Niño–Southern Oscillation partly responsible for change within the country. Pest pressure similarly has tended to occur in waves, with strong market performance during 2013 and 2014 associated with a severe infestation of Helicoverpa being followed by a weakening of the local market and the onset of the aforementioned El Niño system between 2014- 2016.

For Brazil, declining agrochemical prices through the 2024 agricultural year (Jul 2023 – Jun 2024) were a key negative for market value in 2024, while lower commodity prices hampered grower spending somewhat. The crop protection market in the country is estimated to have declined by 9% in 2024 to $14,815 million, representing the first value decline in US$ terms since 2017.

On a more positive note, pest pressure was relatively high, including for Asian soybean rust and for a number of significant insect pests. However, poor weather conditions and lower maize areas were severe negatives to market development. For 2025, while agrochemical prices and commodity prices remain low by historical standards, projections of higher areas of key crops and expectations for improved weather conditions will be a positive for market development. While agrochemical prices remain relatively low, there is now less volatility, and this stability should prevent further market contraction through price erosion.

The long-term outlook is positive, although growth is expected to slow down compared to recent years, tempered by a normalization in agrochemical pricing and a pressure from the international community to slowdown deforestation leading to limited planted area increases for the major crops. Export demand for produce, particularly from China, looks set to increase as it continues to shift from U.S. to Brazilian supplies. Consequently, the crop protection market in Brazil is expected to increase by an annual average of 2.6% p.a. to reach $18,502 million in 2028, with further uptake for new products and alternative herbicides for the control of glyphosate resistant weeds being key drivers.

COLOMBIA

Colombia is a country with a diverse geography that includes the Andes Mountains, tropical rainforests, coastal plains, and expansive savannas. This varied terrain supports a robust agricultural sector, which plays a critical role in the nation’s economy, contributing approximately 9% of the country’s total GDP and employing around 14% of the labor force in 2023. Agriculture is a key driver of rural development and a major source of export revenue. In terms of trade, Colombia has a geographical advantage due to access to both the Atlantic and Pacific oceans and ports on both oceans for bulk (solid and liquid) and container cargo. Primary ports are Buenaventura, Cartagena, Barranquilla, and Santa Marta.

Colombia is one of the world’s leading producers of several agricultural commodities. It is the second-largest exporter of coffee globally in terms of volume and the fourth-largest exporter in terms of value. The country is primarily known for its high-quality Arabica beans, which are primarily grown in the Coffee Axis region (Eje Cafetero). The country is also a top exporter of bananas, with production concentrated in the Urabá and Magdalena regions.

Other significant crops include sugarcane, used for sugar production and ethanol; palm oil, which supports the biofuel industry and is cultivated in regions such as Meta and Cesar; and cocoa, which has gained international recognition for its fine flavor profiles. Colombia also produces rice, maize, potatoes, and cassava, which are essential for domestic food security.

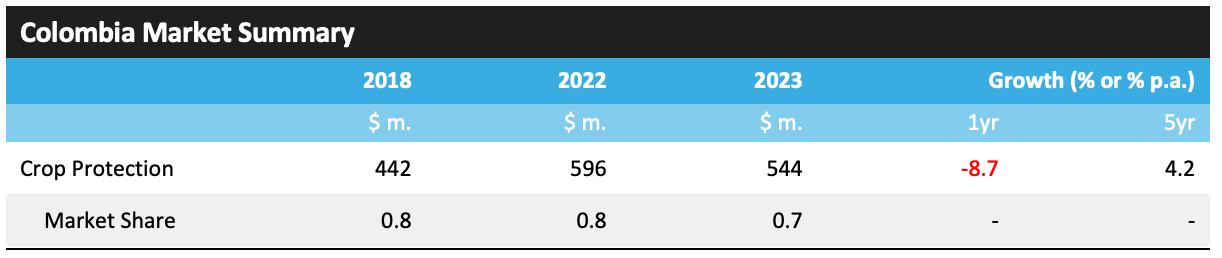

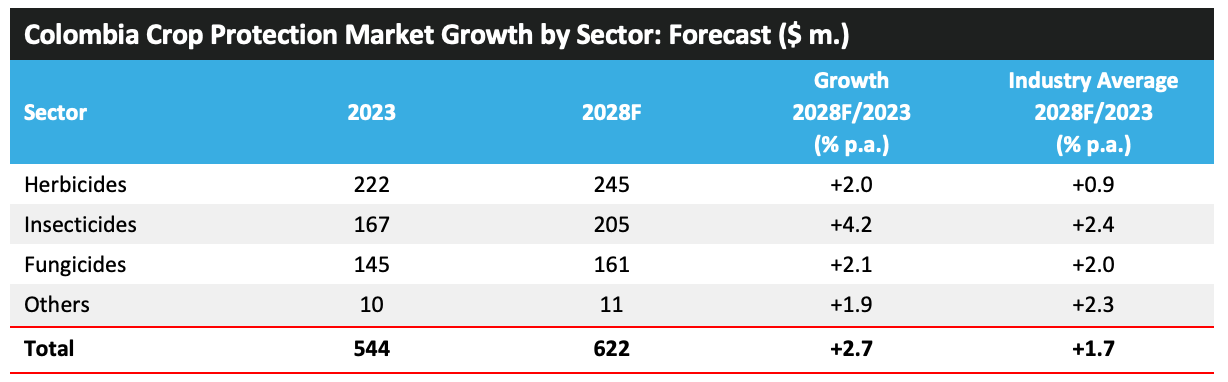

Although behind the industry average of +5.2% per annum, the growth of the Colombian crop protection industry over the past five years (+4.2% per annum) has remained relatively strong, supported by increased volume usage as growers attempt to maximize yields to benefit from rising export demand for much of Colombia’s produce.

The country’s lesser focus on grains and oilseeds in favor of fruit & vegetables means growers are less susceptible to price fluctuations for key crop commodities. In 2023, the value of the Colombian crop protection market declined by 8.7% to total $544 million.

The Colombian agricultural sector has traditionally been one of the most important economic sectors in the country. Colombia allocates more than 50% of its soil to coffee, rice, maize, palm oil and plantain production. However, despite having more than 39 million hectares suitable for agricultural production, the country currently cultivates only approximately 5 million hectares.

Colombia’s agricultural sector has significant potential, although export growth may be held back by several challenges, including poor internal infrastructure and resultant high logistics costs faced by farmers and companies operating in the country. Despite the implementation of a number of reforms by the government, Colombia’s transport infrastructure still lags behind other countries, particularly its roads. The country has around 25% less kilometres of roads than a country with similar characteristics. Colombia’s road infrastructure is 204,389 kms long, of which only 16% is paved (as of 2021) and a large part of its secondary and tertiary road are in average or poor condition. Furthermore, the railway infrastructure in Colombia is commonly regarded as the worst in South America. Of the nearly 3,500 kms of railways built in the entire country, only around 40% is considered usable.

Other potential barriers to growth in the agricultural sector include climate change, with increasing risks of droughts, floods, and soil degradation. There is also limited access to financing and technology for growers– many smallholder farmers lack access to credit, modern farming equipment, and training. A third issue is the spread of pests and diseases such as coffee rust and Fusarium wilt (TR4), which can result in severe production losses.

However, there remain significant opportunities for further development should these issues be addressed. Growing global demand for organic and sustainably produced goods presents an opportunity for Colombian farmers to tap into premium markets, especially in regard to the country’s key crops (bananas/plantains, coffee, and palm oil). Several free trade agreements have also been established with countries including the U.S., the EU, and China, which provide preferential access to large markets for agricultural exports. In general, these agreements reduce tariffs and open new opportunities for products such as avocados, cocoa, and tropical fruits. In order to meet anticipated export demand growth, farmers in the country will likely need to invest more heavily in crop protection and seed technologies to increase yields, to the benefit of the crop protection market.

Companies are actively working to develop and launch new products to the Colombian market. In 2024, FMC announced that it has submitted regulatory applications for the herbicide active ingredient tetflupyrolimet in Colombia. The product offers a new mode of action for season-long control of resistant grass weeds in rice, regardless of the cultivation method.

With key trading partners including the EU, crop protection product usage in Colombia may have to change in-line with increasing regulatory scrutiny and restrictions on maximum residue limits (MRLs) imposed by these trading partners. This may benefit the value of the crop protection market as growers switch from older, generally higher volume and lower cost, technologies to newer, premium products regarded as having a more favorable environmental profile.

This may also support the development of the biological crop protection market in Colombia, with more notable recently launched biological products including Rovensa’s bioinsecticide Santem (pyrethrin extracts) for use on fruit crops including bananas; and Seipasa’s bioinsecticide Pirecris and the botanical-based acaricide, fungicide and insecticide product Seican (cinnamic aldehyde).

As a result of the above factors, the crop protection market in Colombia is expected to increase at an annual average of 2.7% between 2023 and 2028 to reach $622 million, outpacing the anticipated growth for the global crop protection market (+1.7% p.a.).

GUATEMALA

Agriculture is the main export revenue earner in Guatemala, while fuel, machinery, electricity, chemicals, grains and fertilizer are the major imports. The main industries in Guatemala include coffee, textiles, paper, petroleum, pharmaceutical products, rubber processing, and tourism.

Guatemala is considered one of the highest risk countries in the world from geological activity and climate change. Hurricane Mitch in 1998, and the 12E tropical depression in 2011, had a detrimental impact on economic development. However, due to prudent macroeconomic management, Guatemala has been one of the strongest economic performers in Latin America in recent years.

The major crop exports are bananas, coffee, palm oil, sugar, and melons. Many commodities have to be imported into the country, the most important being grains and cotton. Guatemala has a positive balance of trade in arable produce, with exports four times greater than imports. Agricultural produce is the largest sector for exports.

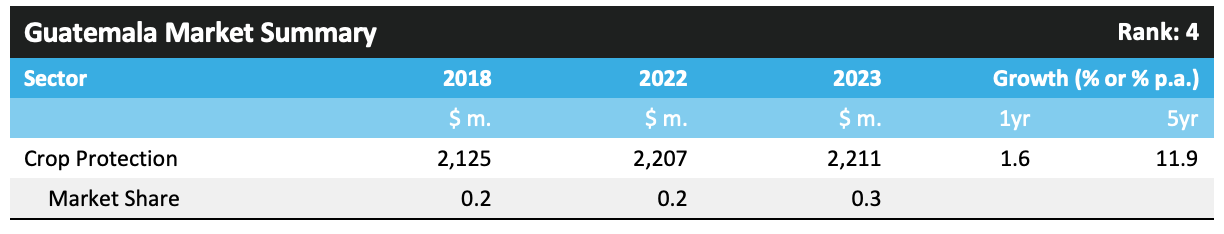

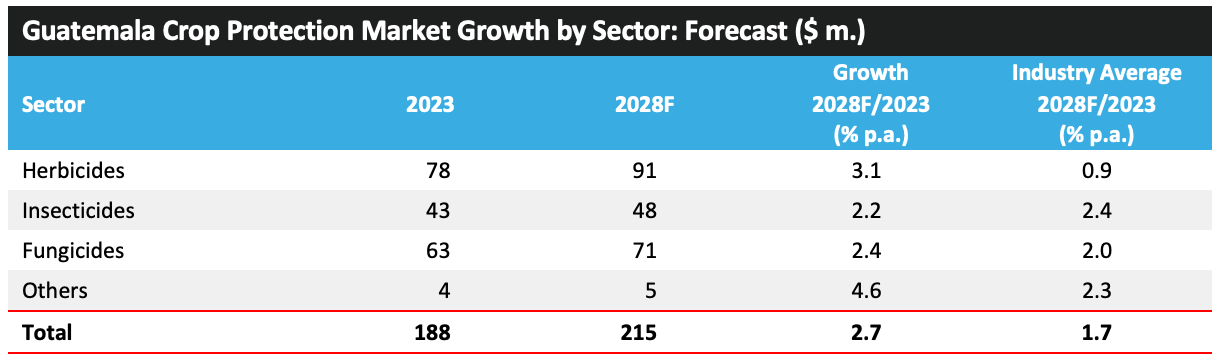

The Guatemalan agrochemical market enjoyed sustained growth through the first two decades of the 2000s but has since stabilized. Agriculture in Guatemala has shifted in emphasis toward plantation crops grown for export, and the slowdown in the growth of the agrochemical market corresponds with a period of depressed prices for these commodities.

Guatemala is still a country in the earlier stages of development where agriculture accounts for a major share of GDP (13.3%) and export income (32%). Agriculture is developing on two fronts: quality fruit & vegetable production, mostly for export, and plantation crops – not so much for staple crop production of maize, beans, and rice. The country still has low labor costs that allow it to be price competitive in export markets. Average expenditure on agrochemicals on a $/ha basis is relatively high, probably due to the large share of the markets attributable to fruit & vegetables.

Key trends in production are the increase in the planting of oil palm and melons, but a fall in rubber and sorghum. The maize area has been essentially static, although there has been a limited improvement for dry beans and the small area of rice.

Compared with other developing countries, Guatemala has a stronger agrochemical active ingredient manufacturing infrastructure, but a significant formulation capability, indicated by more than 60% of imports being of technical material. The major source of product is China, but with more advanced products coming from the EU and U.S. Guatemala is a member of the World Intellectual Property Organisation. Industrial property law is overseen by the Ministry of Economic Affairs Registry of Intellectual Property.

Guatemala is considered one of the highest risk countries in the world from geological activity and climate change, with drought affecting agrochemical market performance in 2018. Cyclones, volcanic activity and natural disasters are a threat. Poverty and the impact of rising plantation crop production have affected subsistence farmers, with migration from the country a significant issue. However, the continuing increase in the value of crops for export should continue to drive growth of the agrochemical market, particularly if weather conditions are favorable.

MEXICO

Agriculture in Mexico is heavily reliant on export markets, with the key export crops being fruits, nuts, vegetables, and coffee. Although maize production is significant in the country, much of this is for domestic consumption. The country has a heavy reliance on grain imports in order to satisfy internal demand, with much of this being derived from the U.S., a key trading partner. Mexico is a member of a number of trade agreements that have boosted the country’s export capabilities and, hence, economy in recent years.

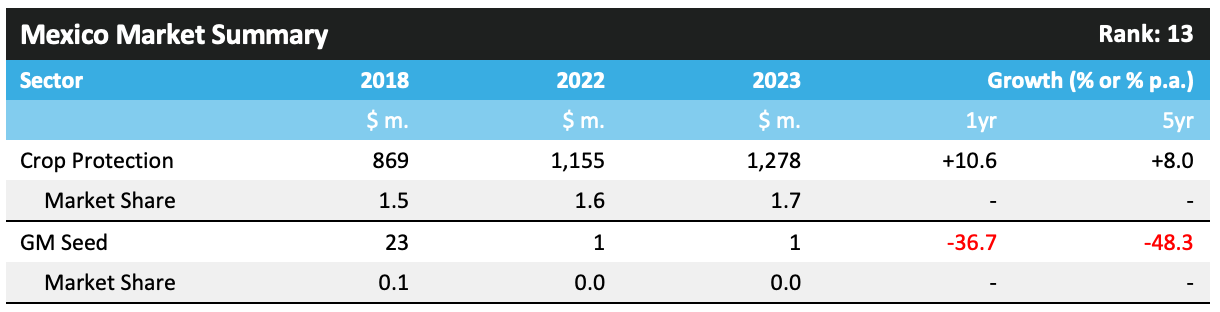

In 2023, the crop protection market in Mexico increased by 10.6% to $1,278 million. At this level, the country is ranked as the thirteenth most valuable in terms of crop protection sales in 2023.

The Mexican crop protection market increased by 10.6% in 2023, amounting to $1,278 million. Between 2018 and 2023, the crop protection market in Mexico increased robustly at an annual average of 8%, outpacing the wider industry as a whole.

The GM seed market in Mexico is limited, at $1 million in 2023, all attributable to GM cotton varieties. The GM seed market value has declined significantly, as the government’s stance on GM technologies has hardened with the 2020 decree calling for the phasing-out of GM maize for human consumption, while the Ministry of Environment and Natural Resources has intimated that it will reevaluate the appropriateness of genetically modified crops in light of their responsibility to protect the country’s genetic reservoir of native cotton.

The geography of Mexico, being bordered by the Pacific and Atlantic oceans, provides a variety of topographical conditions, ranging from deserts and mountains in the north to more tropical conditions in the south.

In recent years, grain crop yields have been improving for smallholder farmers in the central and south regions. This has largely been driven by assistance from research organizations such as the International Centre for Improvement of Corn and Wheat (CIMMYT) in efforts to meet increasing domestic demand. Much of the grain crops produced in the county are destined for use in animal feed, a sector which has been expanding rapidly in recent years.

Dry conditions are a frequent issue for Mexican agriculture, particularly in the country’s north. More than 90% of the total crop area is rain-fed, so any significant drop in rainfall levels can impact a large proportion of the overall area.

In efforts to boost crop production and meet rising domestic and overseas demand, the country has been investing in improving its irrigation infrastructure in recent years, including through increased technification. Mexico ranks sixth in the world regarding irrigated agricultural land, with more than 60% of the value of national agricultural production requiring irrigation, including maize, wheat, and sorghum.

Mexico as a country has significant growth potential, with the middle class expanding rapidly. Over the next five years, this middle class is expected to drive increased demand for produce, including fibres for clothing production, and maize, cereals and oilseeds for use in food production and for animal feed.

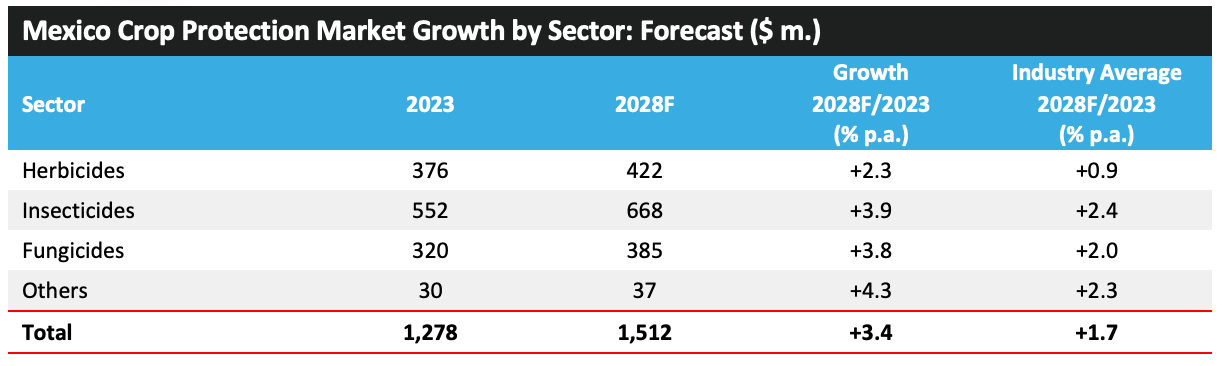

The increasing focus on fruit and vegetable production has benefited the crop protection market in recent years, with the expansion of this sector expected to continue in the coming years. The high number of biological crop protection products that are being introduced is also expected to drive growth, with this sector in line for rapid expansion, ahead of the growth rates expected for conventional crop protection products.

Due to the above factors, the value of the crop protection market in Mexico is expected to increase by an average of 3.4% per annum to reach a value of $1,512 million in 2028. However, this growth could be tempered if the country is afflicted by any prolonged dry spells, as has been experienced in some recent years. Any further advancements toward improving irrigation in the country would clearly mitigate the potential negative impacts of dry conditions.

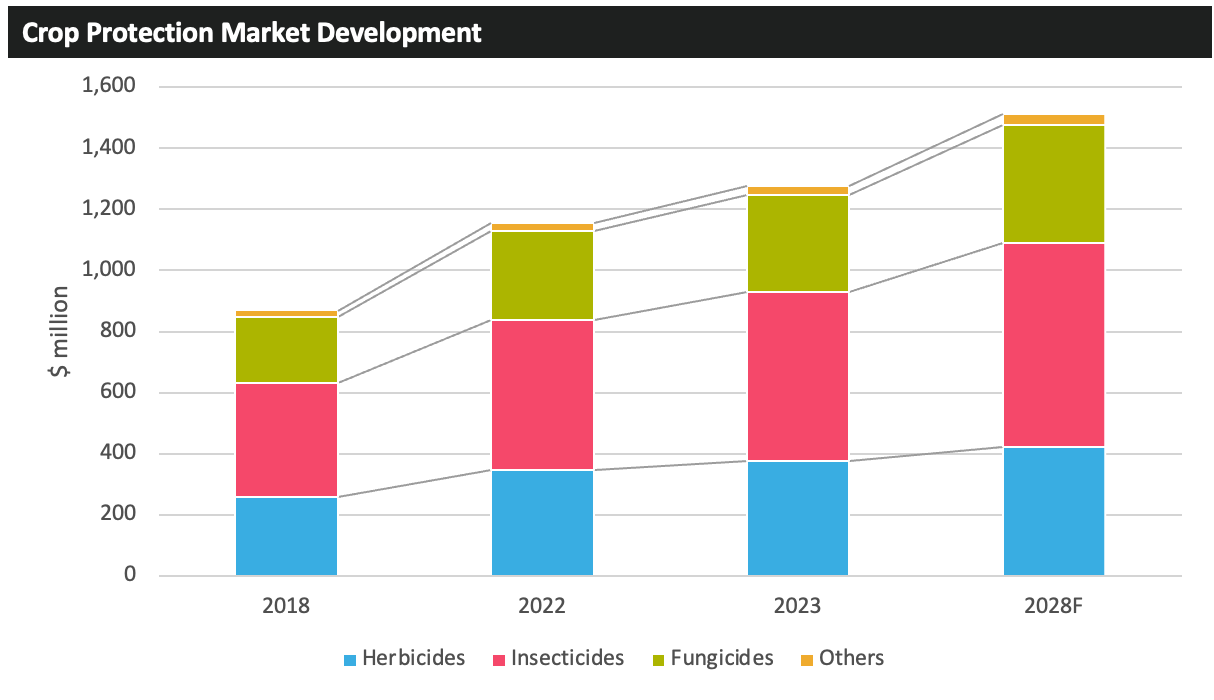

LATIN AMERICAN OUTLOOK

Outlook 2025

In 2024, the impact of low agrochemical prices through the growing season and poor conditions in Brazil hampered market development. However, conditions in Argentina were generally much improved, with crop production rebounding from the severe declines experienced in the drought-ravaged 2022/23 crop. Despite this, maize production was negatively affected by high corn leafhopper pressure, with this pest being a vector of corn stunt disease.

For Brazil, the declining agrochemical prices were a key negative for market value in 2024, while lower commodity prices hampered grower spending. On a more positive note, pest pressure was relatively high, including for Asian soybean rust and for a number of significant insect pests. However, as a result of the poor weather conditions and lower maize areas in Brazil as well as falling commodity prices and lower agrochemical prices through the full agricultural season, the value of the crop protection market in Central & South America is estimated to have declined by 6.8% in nominal terms in 2024 to $23,307 million. In constant currency terms, this reflects a fall of 8.4%.

For 2025, while projections of higher areas of key crops in Brazil and Argentina and expectations for improved weather conditions will be a positive for market development, agrochemical prices and commodity prices remain low by historical standards, holding back the positive from volume development from the crop and weather situation.

Markets less susceptible to crop commodity prices, where alternative crops such as fruit and vegetables or plantation corps such as cocoa and sugar, can be expected to continue to improve, based on improved weather and continued high demand for high quality produce from key export markets, such as the EU.

For 2024/25 in Brazil, the total planted area is forecast to increase by 2.1%, with soybean expected to rise by 2.8%, while maize is expected to increase by 0.7%. Total production is forecast to increase higher than planted areas, rising by 9.4%. Soybean output is to increase by 12.4% and maize production is set to increase by 5.5%, representing a substantial rebound from the weather-impacted crop in 2023/24.

In Argentina, the maize area in 2024/25 is expected to fall by 15.3%. However, this represents an upward revision from previous estimates. Area expansions are forecast for all other key crops, including wheat (+6.8%), barley (+6.7%), sunflower (+5.3%), and soybean (+8.4%). Notable new products approvals in Argentina include BASF launching the pre-plant herbicide Voraxor (trifludimoxazin / saflufenacil) for use on soybeans, maize, wheat, barley, and peanuts, and Sumitomo Chemical receiving approval for the herbicide Rapidicil (epyrifenacil). •

Derek Oliphant: AgbioInvestor

nickalbi – Adobe.stock.com