Crop Protection Market Development in India

Scroll Down to Read

By Derek Oliphant

Co-Founder

AgbioInvestor

This article will outline the development of the crop protection market in India examining the current situation as well as the key future trends expected to influence market development over the next five years.

Market values are Agbiolnvestor’s estimates of the value of crop protection products used on the ground in the agricultural year, expressed in US$ terms at the ex-manufacturer level. ‘2023’ refers to the value of products used on the ground between approximately October 2022 and September 2023.

India Crop Protection Market

Market Outlook

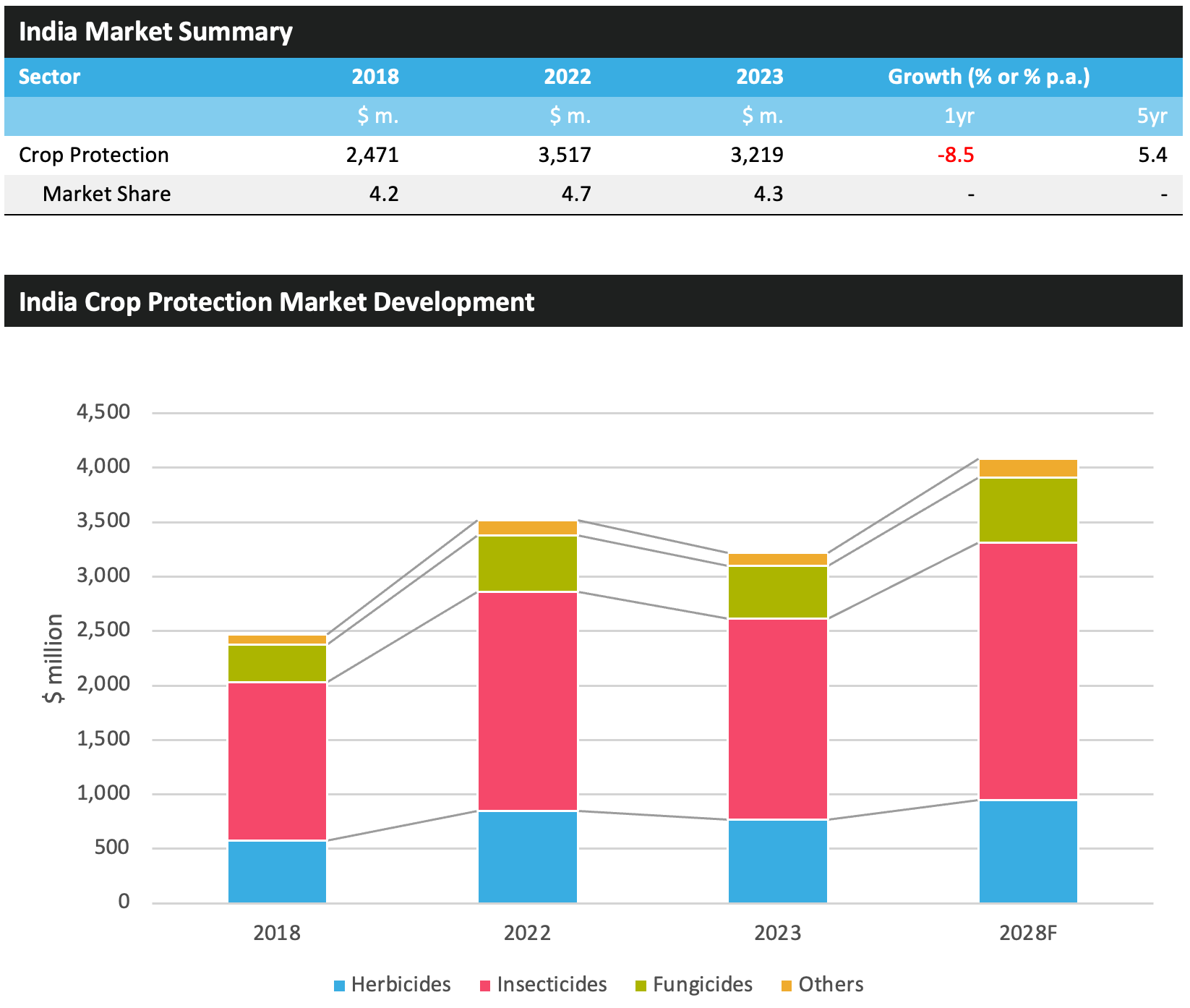

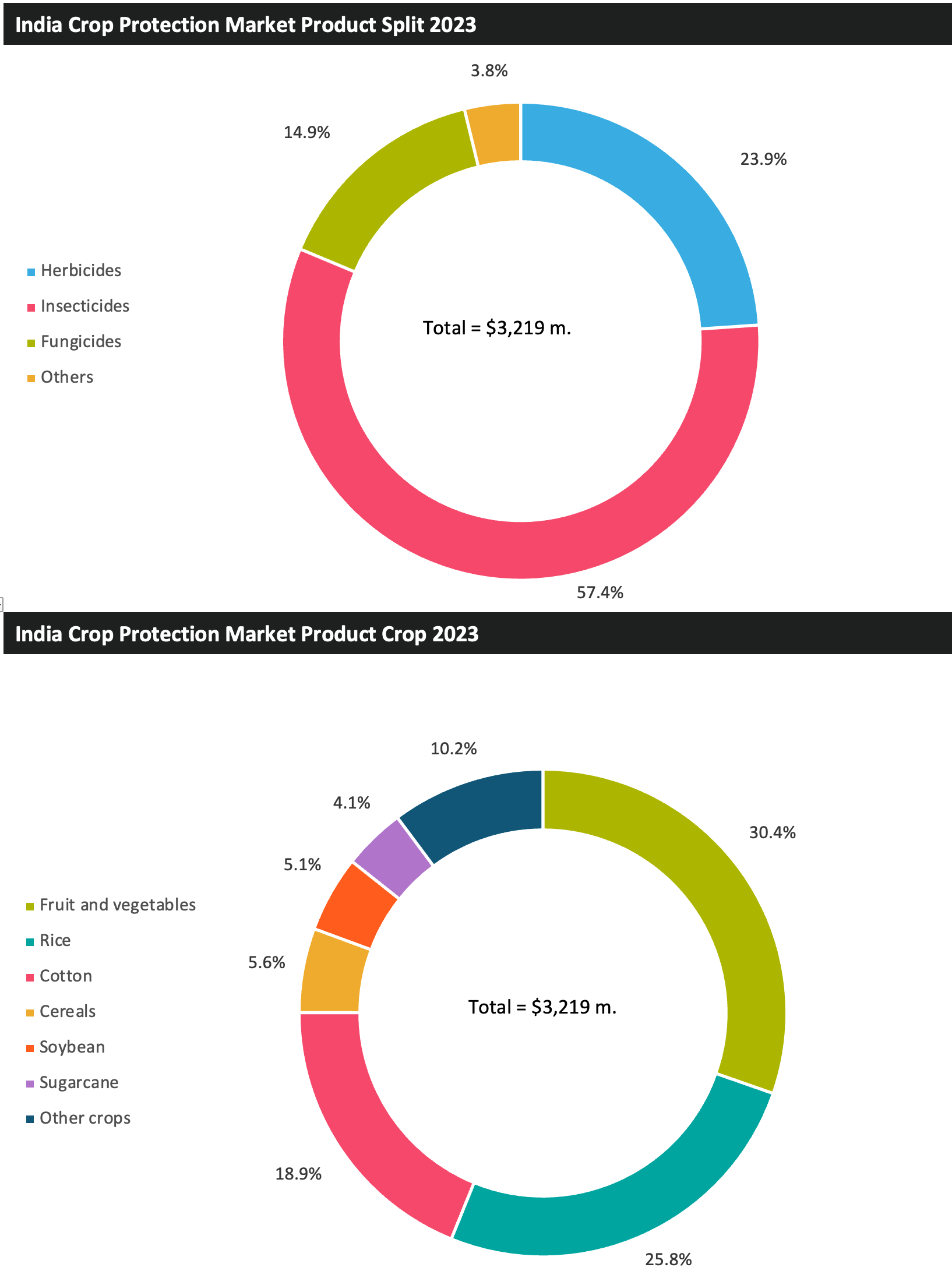

The crop protection market in India declined by 8.5% in 2023. Although this decrease followed a significant rise in 2022, where the market had been buoyed by very high agrochemical prices as well as favorable climatic and economic conditions for growers in the country. The market in 2023 was impacted by less favorable conditions, with inventory build-up and highly variable weather conditions hampering market development.

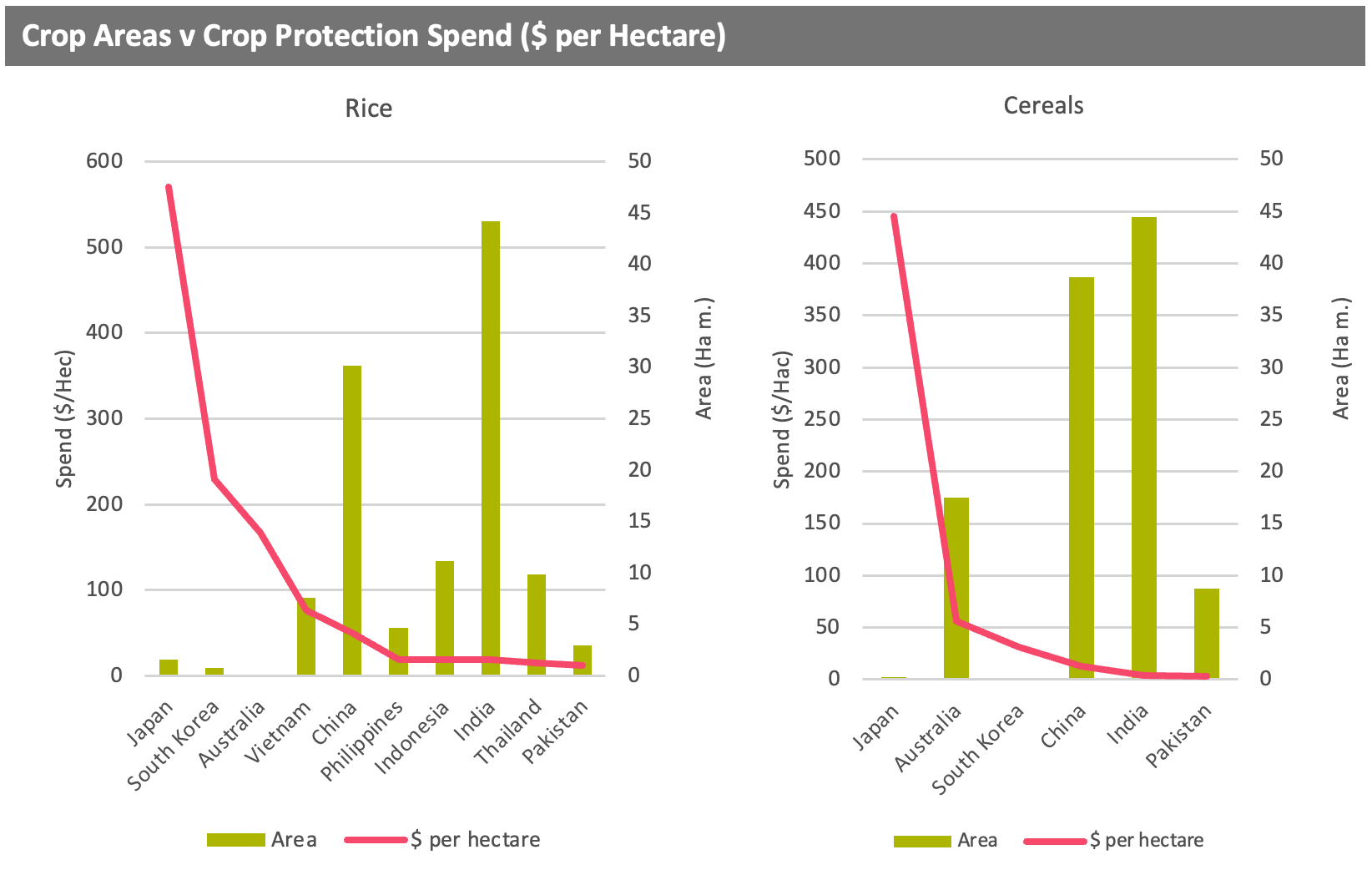

However, over the five years between 2018 and 2023, the value of the crop protection market in the country advanced at an annual average rate of 5.4%, considerably ahead of the industry average during this time frame. Growth in the Indian market in recent years has benefited from rising demand for domestically grown crops, increased government support for agriculture, and economic growth. This has resulted in an increase in intensity of product usage, with a higher number of farmers being able to afford crop inputs. However, as it currently stands, the crop area in India which is treated with crop protection inputs is still very limited, lagging someway behind other leading crop protection country markets. The figures below highlight the disparity in planted areas and crop protection product usage between India and other Asian countries:

The charts show that in the case of rice, while India has the highest planted area, only Thailand and Pakistan of the major crop protection markets in the region have a lower average spend per hectare on the crop. For cereals, India also has the highest planted area, however, spend per hectare is lower than all other major Asian crop protection country markets.

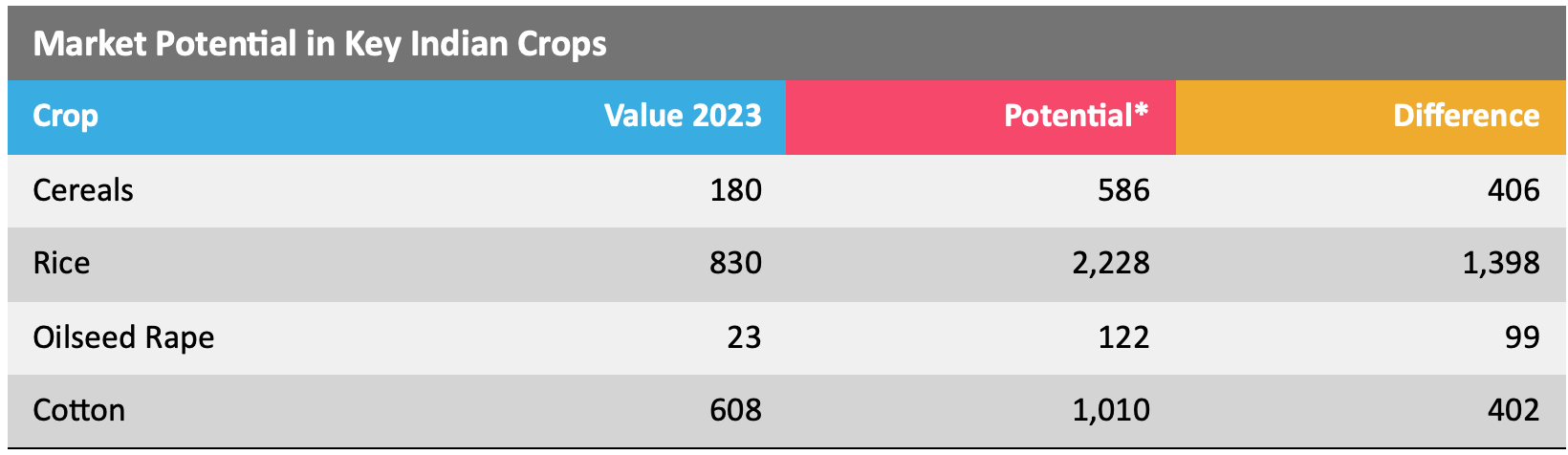

The table below shows the value potential that could be unlocked in the Indian market if spend per hectare was the equivalent to that of China:

*If India’s spend per hectare on crop protection products was at the same level as China’s, the value of the market would increase significantly.

Clearly as Indian growers become more technified and move toward increased usage of crop protection products, as expected, there is significant value potential simply from treating more of the crop, and/or super-treating more area with multiple sprays. This can be expected to also result in improved yields and could unlock vast potential for Indian growers in producing higher exportable surpluses, to the benefit of both the ag economy and the overall economy in the country.

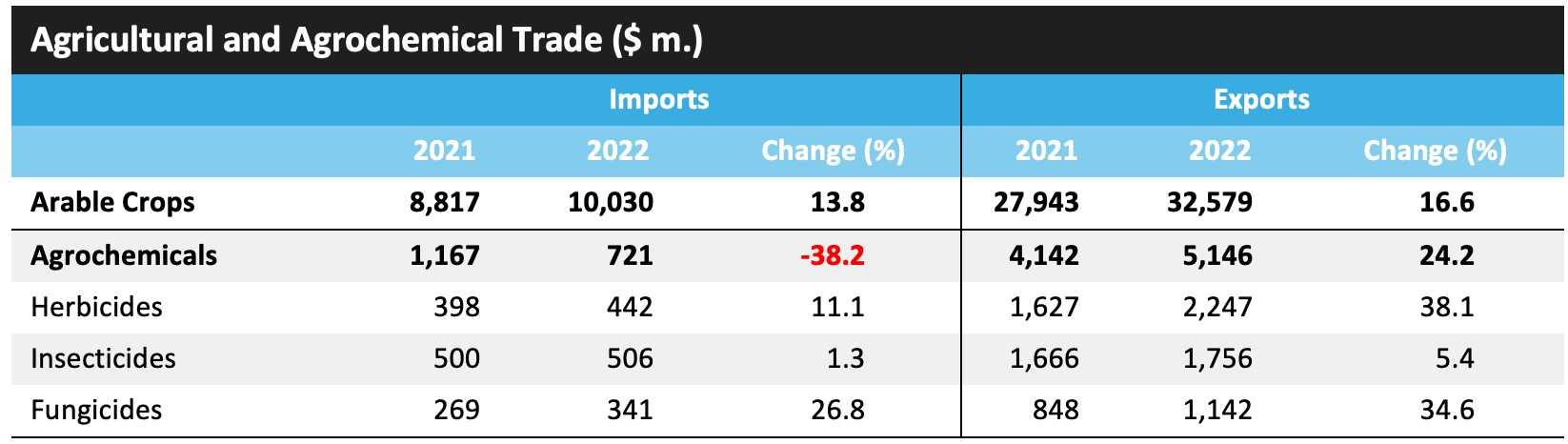

The Indian crop protection market has a well-developed local manufacturing base, with many technical material manufacturers supplying export markets and local formulators. A number of companies produce formulated products from their own technical material, primarily intended for the local market, although a number of companies have been targeting increased exports of higher value formulated material. The development of a strong manufacturing base can be linked to historical tariffs on imports, while a number of initiatives have also been put in place to make manufacturing in India more attractive. The low-cost base and relatively high quality and technification of Indian manufacturers has made it attractive for inward investment, with a number of foreign companies setting up manufacturing and distribution deals, with particular interest from Japan.

Improved intellectual property legislation which incentivises the introduction of proprietary technologies can also be expected to bring value to the market moving forward, with any product patented post-1995 gaining additional protection in the form of companies having to gain manufacturing approval from the registration holder. This has led to a positive environment for the introduction of new products and has helped to alleviate some issues of resistance to older chemistries.

While low-cost commodity products have long been a mainstay of Indian crop protection, product choice will become more limited in the coming years. In 2020, the government issued a draft order, Banning of Insecticides Order 2020, which prohibits the import, manufacture, sale, transport, distribution and use of 27 pesticides: acephate, atrazine, benfuracarb, butachlor, captan, carbofuran, chlorpyriphos, 2,4-D, deltamethrin, dicofol, dimethoate, dinocap, diuron, malathion, mancozeb, methomyl, oxyfluorfen, pendimethalin, quinalphos, and sulfosulfuron. An addendum was later applied allowing the manufacture of these 27 pesticides for export purposes. A similar draft order has also been issued for the fungicide tricyclazole and the insecticide buprofezin.

In addition, the Government of Punjab ordered a ban on the sale and use of nine agrochemicals, aimed at protecting the quality of paddy rice, with immediate effect. The ban prohibits the order, sale, stocking, distribution, and use of acephate, triazophos, thiamethoxam, carbendazim, tricyclazole, buprofezin, carbofuran, propiconazole and thiophanate methyl. These moves could accelerate adoption of newer, higher-priced technologies in the crop protection sector, to the benefit of the overall value.

Foodgrain production in India is forecast to fall in the 2023/24 season. Within this, kharif (summer-sown) foodgrain production is projected to decline by 1% to 154.187 million tonnes, while rabi (winter-sown) foodgrain production is forecast to fall by 1.7% to 155.161 million tonnes. Total rice output is expected to decline by 8.8% in the 2023/24 season, amounting to 123.815 million tonnes and representing the first production fall in 8 years. However, the country’s wheat output is expected to increase by 1.3% to reach 112.019 million tonnes. In efforts to break a deadlock with protesting farmers, the Indian government has offered guaranteed support prices for pulse, maize and cotton crops. The government has reportedly proposed five-year contracts for a minimum support price to farmers who diversify their crops to grow pigeon peas, black gram, red lentils and maize, while a similar price guarantee is understood to be suggested for growers of cotton.

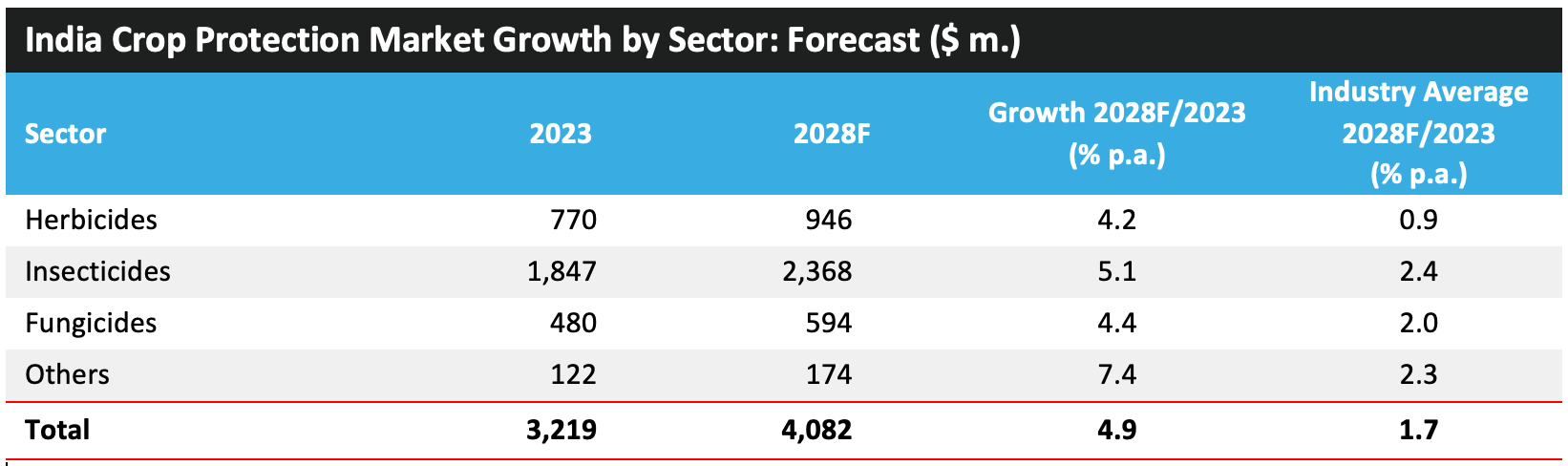

As a result of the above factors, the value of the Indian crop protection market is anticipated to expand at an average annual rate of 4.9% p.a. between 2023 and 2028 to reach $4,082 million. This level of growth places the country ahead of the industry average, cementing India’s position as a developing market, with considerable scope with the market still some way from maximizing its potential, based on the coverage of crop type and crop areas which can be cultivated in the country. •

Derek Oliphant – AgbioInvestor