Crop Protection Market Development

CHINA

Scroll Down to Read

By Derek Oliphant

This article will outline the development of the crop protection market in China, examining the current situation as well as the key future trends expected to influence market development over the next five years.

Market values are Agbiolnvestor’s estimates of the value of crop protection products used on the ground in the agricultural year, expressed in US$ terms at the ex-manufacturer level.

The most recent full data year available is 2023, with preliminary estimates provided for 2024, as well as a longer-term outlook.

China

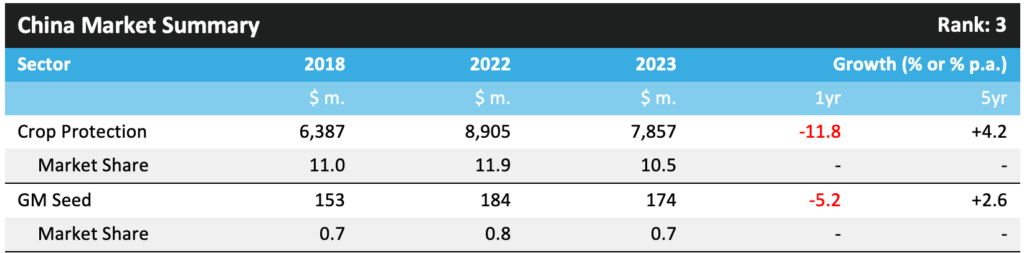

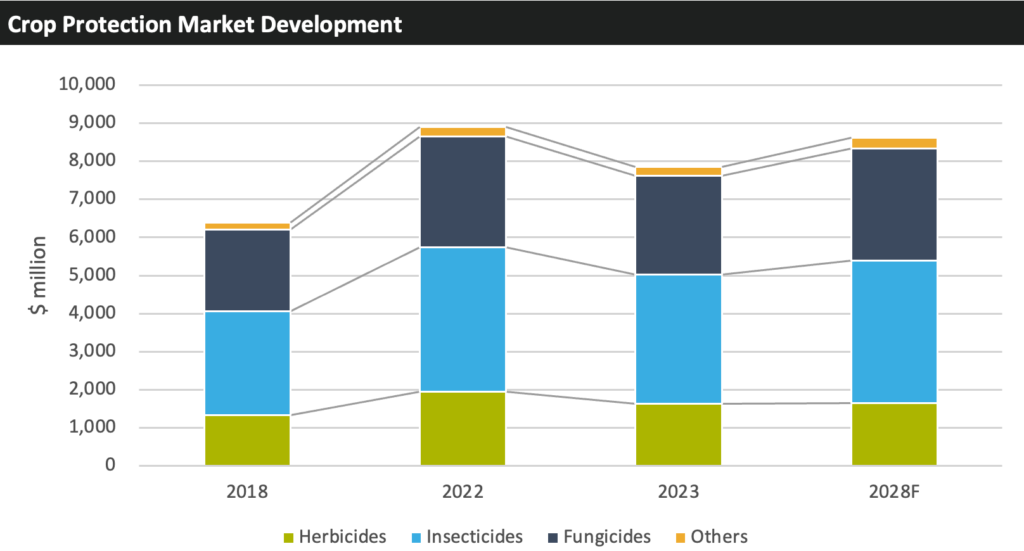

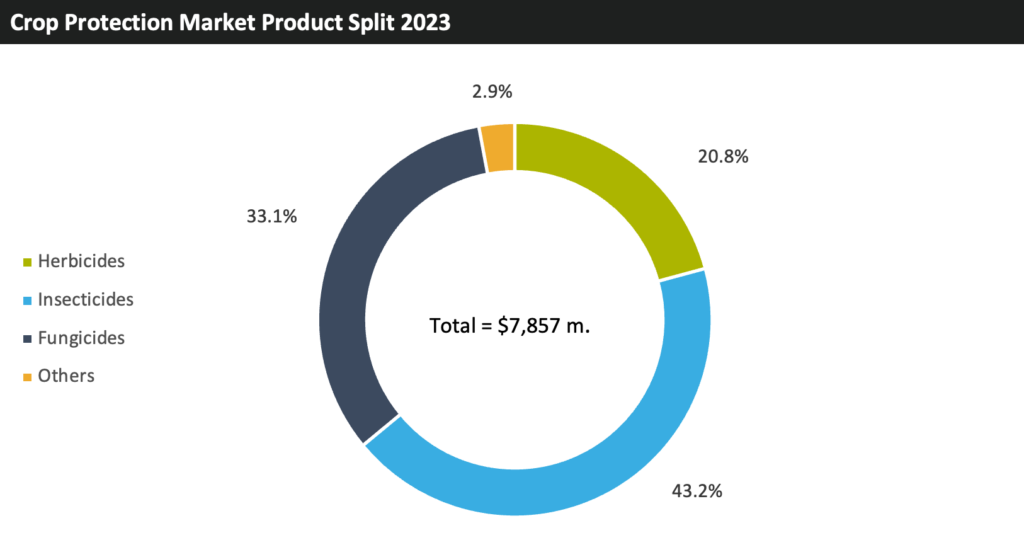

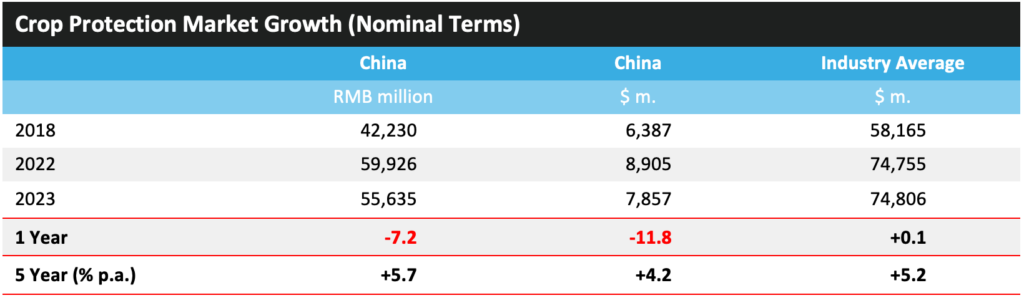

The value of the crop protection market in China fell by 11.8% in 2023 to $7,857 million, making the country the third largest in the global crop protection industry in terms of value. In local currency terms, the value of the market declined by 7.2% to RMB 55,635 million.

Although agriculture still represents a significant share of the Chinese economy, accounting for just more than 7% of the country’s GDP, this has generally declined year-on-year since the 1970s and 1980s, when the proportion was closer to 30% of total GDP. China’s latest Five-Year Plan (2021 – 2025) calls for the country’s urbanization rate to reach 65% of the population by 2025 and 75% by 2035, which is expected to reduce the country’s agricultural workforce, which currently accounts for approximately 25% of the total population.

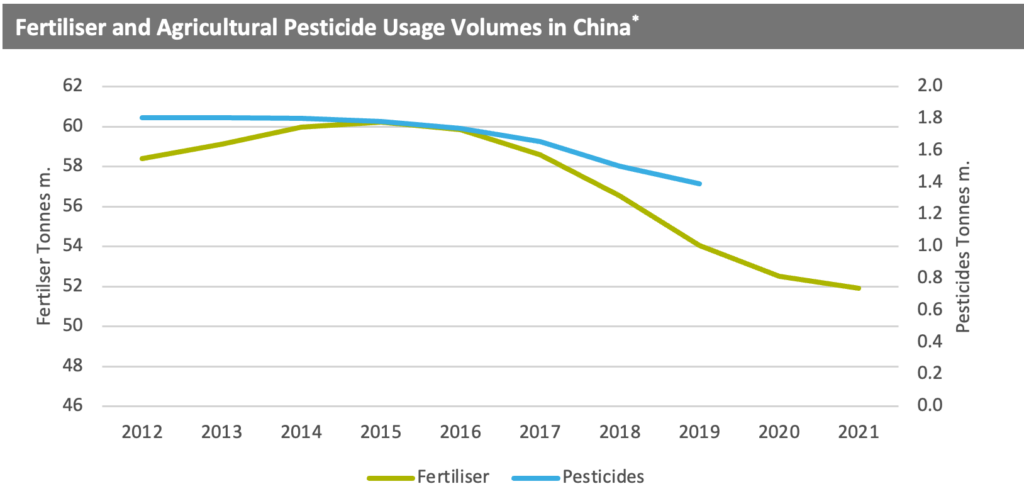

The crop protection market in the country came under following the implementation of a 2015 policy aimed at zero-growth in the volume usage of crop protection chemicals and fertilizers. However, in recent years this provided an overall benefit to the value of the crop protection market in the country, with product choice favoring those which can provide effective levels of control at lower volumes, generally corresponding to more advanced and higher-priced technology. Regulatory action against many older chemistries also increasingly affects product availability and choice.

The chart below highlights the impact of the zero-growth policy on the usage of crop inputs in the country. As can be seen, fertilizer usage peaked in 2015, immediately before the implementation of the zero-growth policy, while pesticide use has declined each year since 2013.

*No stats available for pesticide usage volumes after 2019 and for fertiliser usage volumes after 2021 at time of writing.

China has implemented a number of commodity-specific price schemes to support its agriculture industry and continues to maintain a considerable support program. Prior to 2015, grain growers were provided with direct payments while subsidies were also in place to purchase seeds, fuel, fertilizer, and machinery. This was subsequently altered with seeds, fertilizers, and pesticide payments being combined into a single direct payment subject to eligibility based on a producer’s production area and the types of crops being grown.

A key factor that has impacted agriculture in China in recent years is the reduction in the area of arable land available for crop cultivation. According to China’s Institute of Soil Sciences, approximately 400,000 hectares of arable land is lost each year due to several factors, including construction, contamination, and erosion. As a result, there is currently only around 128 million hectares of arable land in the country.

In 2023, China’s climate was characterized by warm and dry conditions; the country recorded its highest annual mean temperature on record, while annual precipitation was the second lowest since 2012. Rainstorms were also frequent during the year, and many parts of China experienced both drought and flooding.

Severe drought experienced during early July was followed by heavy rains and flooding. Summer grain harvest production estimates were lowered as a result, with the wet conditions having a significant impact on wheat yields. In addition, while the country’s spring crop harvest was finalizing, maize and wheat crops in northwest and north-central regions were negatively affected by hot and dry weather. Projections for rice output were also lowered following very dry and hot conditions in the south and southwest, which negatively affected the harvest of the single-season crop and led to concerns for the late-season crop. The country also experienced extreme heat and rainstorm in south of the Yangtze River and typhoons in coastal areas of South China in July. Higher temperatures and increased precipitation led to increased pest pressure on rice crops in the region, particularly for sheath blight, rice blast, and false smut. Despite this, conditions were generally favorable during the growing season for most of the country’s major crops, supporting yields and leading to increased production.

In efforts to mitigate against the weather-related impacts, the country approved a RMB2.4 billion (approximately $330 million) grant fund for the purchase of fertilizers and crop protection products in the north of the country to support maize and soybean production following the heavy rains and flooding. In addition, the country has allocated RMB 732 million (approximately $101 million) in disaster relief funds to support agricultural production in nine provinces impacted by Typhoon Doksuri.

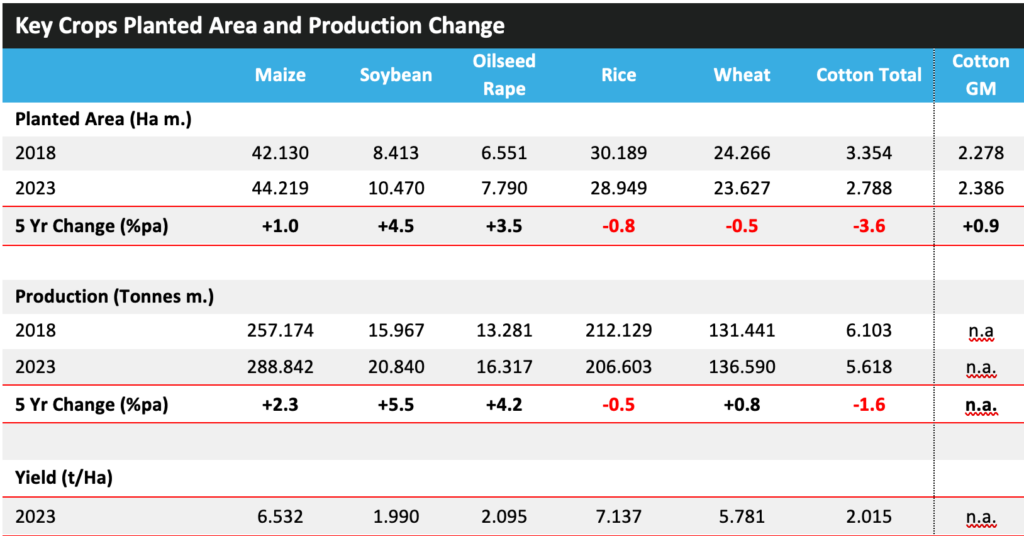

By the end of the season, the National Bureau of Statistics reported its highest-ever annual grain output in 2023 driven by an increase in the country’s total planted area, which expanded by 0.6% to reach 119.0 million hectares. Overall grain output increased by 1.3% from 2022 levels to reach 695.4 million tons, representing the ninth consecutive year that China’s grain harvest has surpassed 650 million tons. Although wheat and rice production declined in 2023, this was offset by increases for other key crops, including maize, soybean and oilseed rape.

China’s significant size and diversity of geological and climatic conditions mean that a wide variety of agricultural produce can be cultivated. In addition to these key arable crops outlined, China also cultivates significant areas of sugarcane, fruit & vegetables and other crops.

Market Performance

Following robust growth in the previous year, buoyed by a high pricing environment, the Chinese crop protection market fell by 7.2% in local currency terms in 2023 to RMB 55,635 million, equivalent to a decline of 11.8% in U.S. dollar terms to $7,857 million. At this level, China represents the third-largest crop protection market globally in terms of value.

Pest pressure on key crops increased sharply during the year, with a reported rise of 20% in the incidences of the main insect and disease pests. However, the value of the market was significantly impacted by sharp declines in agrochemical prices throughout 2023. There was an overall shift to a ‘wait-and-see’ approach to product purchasing to avoid more product entering the market and further depressing prices, with the situation exacerbated by relatively weak global demand due to high inventories and strong pre-buying last season in many key markets.

The market in China has also been characterized by a continued rise in demand for food and animal feed. The massive scale of the country’s imports of grains and oilseeds for these purposes has led to a large number of infrastructure improvements and regulatory changes to boost domestic production and curb imports where possible.

Between 2018 and 2023, the Chinese crop protection market increased by an average of 5.7% per annum in local currency terms. Growth was slightly less positive on conversion to US dollars at an average of 4.2% per annum in the same timeframe, behind the 5.2% p.a. growth achieved when looking at the wider industry.

Companies

Previously, the primary route to market in the country for overseas companies was through joint ventures, as the Chinese government precluded foreign investors from holding a stake of more than 49% in domestic companies. However, following China’s ascension to the WTO, the system altered and state-owned cooperatives now have to compete directly with private distribution companies, which, from 2005 onward, could include overseas-based organizations.

ChemChina’s merger of Syngenta, Adama and the agricultural assets of Sinochem to form Syngenta Group has had a significant impact on the domestic market, with the wide product portfolios offered by this group able to achieve significantly enhanced penetration in the Chinese market. In addition, alterations to the registration system have benefited companies with proprietary product offerings, with these products being protected for six years post-registration before local companies can apply for similar registrations.

Despite this, illegal product usage is still a significant problem, with reports suggesting that as much as 30% of the market can be attributed to products which are mislabeled or counterfeit.

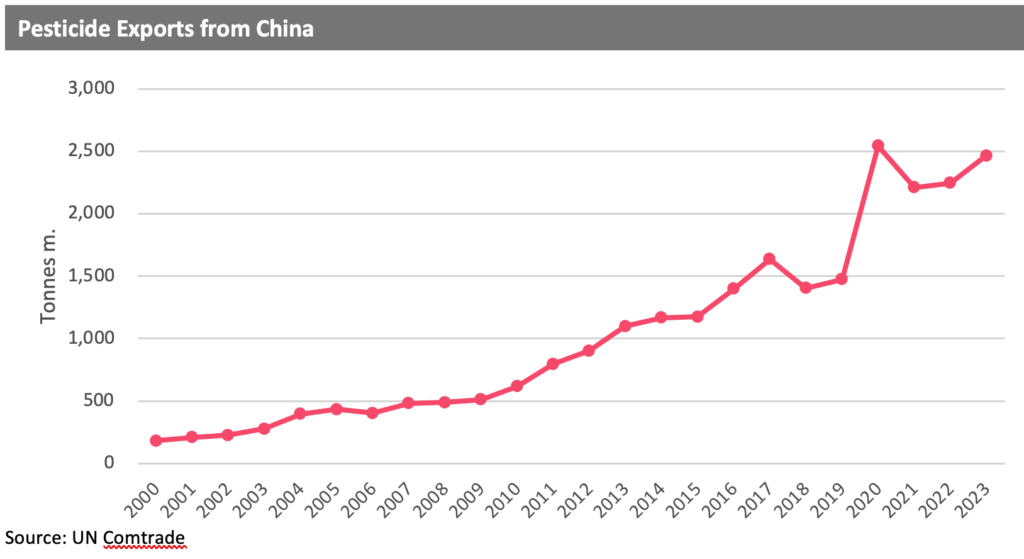

There has been a push in recent years by the Chinese government to reduce the number of agrochemical companies operating in the country, including through consolidation. This, coupled with the country’s focus on stricter environmental regulations in agrochemical manufacture, has led to a number of smaller companies leaving the market. These environmental regulations have also resulted in increased manufacturing costs and, subsequently, product costs, which has reduced the competitiveness of Chinese products on the global market somewhat.

As can be seen in the chart below, in 2018, Chinese pesticide exports declined for the first time since 2006, with the sector being impacted by the tighter controls placed on production. This was, however, followed by recovery in 2019 and a substantial rise in 2020, supported by a series of favorable policies. In February 2020, during the height of the COVID-19 lockdown, the Chinese government opened a green channel for agricultural inputs, which allowed pesticide shipments to pass through the country unimpeded despite coronavirus-related lockdown restrictions. Pesticide exports in 2020 were also bolstered by an increase in the tax rebate rate for formulated pesticides and a clarification of the requirements for export-only registration.

Market Outlook

Following robust growth in the previous year, buoyed in particular by a high pricing environment, the Chinese crop protection market fell by 7.2% in local currency terms in 2023 to RMB 55,635 million, equivalent to a decline of 11.8% in U.S. dollar terms to $7,857 million. At this level, China represents the third-largest crop protection market globally in terms of value.

Weather conditions were once again quite variable across China in 2023, with severe droughts in summer followed by heavy rainfall and flooding. Overall, China’s climate in 2023 was characterized by warm and dry conditions; the country recorded its highest annual mean temperature on record, while annual precipitation was the second lowest since 2012. Rainstorms were also frequent during the year, and many parts of China experienced both drought and flooding. Despite this, by the end of the season the National Bureau of Statistics reported its highest-ever annual grain output in 2023 driven by an increase in the country’s total planted area, which expanded by 0.6% to reach 119.0 million hectares. Overall grain output increased by 1.3% from 2022 levels to reach 695.4 million tons, representing the ninth consecutive year that China’s grain harvest has surpassed 650 million tons.

In 2024, China’s National Agro-tech Extension and Service Center (NATESC) issued its forecasts for pesticide demand and the occurrence of crop pests and diseases. Overall, NATESC expects total demand for pesticides in 2024 to have been stable. Within this, the volume of biopesticides is forecast to have risen, driven by regulatory requirements, increased promotional activities, and a rise in areas using these products. Insecticide volumes are estimated to have declined in 2024, largely as a result of the country’s ‘early control’ initiative, whilst fungicide and herbicide volumes are expected to have increased. NATESC estimated that occurrences of major pests and diseases on crops in 2024 affected a total area of 2.04 billion mu (136 million hectares), representing an increase of 15% over 2023 and 11% higher than the 2018-2022 average.

Various parts of China were impacted by excessive hot and dry conditions during late spring and early summer 2024, prompting drought alerts and actions from authorities to minimize the impact on agriculture, water and energy supplies, with China’s Water Resources Ministry launching emergency responses in Gansu, Shaanxi, Shanxi, Henan and Shandong provinces. Temperatures reached record highs and are reported to have adversely impacted summer planting. The Emergency Management Ministry alerted several affected regions to protect water and food production, including north-western Shaanxi, northern Hebei and Shanxi, eastern Anhui and Shandong as well as central Henan. This was then followed by a prolonged heatwave in the country’s eastern, central and southern regions during July, which may have impacted rice and cotton production.

As a result of these conditions, China’s Ministry of Finance allocated RMB 443 million (approximately $61.1 million) for a disaster relief fund to support drought prevention work in seven provinces, including Hebei, Shanxi and Henan. The fund was to be used for works such as watering, replanting and adding fertilizer in areas that are affected by heat and low rainfall.

Despite these unfavorable weather conditions, China’s grain production reached record levels of 706.5 million tons in 2024, up by 1.6% over the previous year and reportedly marking the first time output has exceeded 700 million tons. Increased production has been achieved in cereals (+1.7%), with rises also recorded for rice, wheat, and maize, while tuber production increased by 1.5%. However, soybean production declined by 0.9%. Overall production benefited from a marginal increase in planted areas (+0.3%) and a 1.3% improvement in yields, driven by generally favorable weather conditions, despite localized floods, droughts and typhoons, impacting production in some regions. This included a prolonged heatwave in the country’s eastern, central and southern regions, with the conditions impacting rice and cotton production in particular.

Summer temperatures in Zhejiang, Jiangxi, Hunan, Fujian, Guangdong, Guangxi, Gansu and Ningxia are expected to be 1 to 2°C (1.8 to 3.6°F) above normal. Record-breaking temperatures impacted key grain producing provinces in the northwest and east, leading to delays in maize planting, while torrential rain in other regions flooded soybean and rice fields.

The Chinese maize area increased by 1.1% to 44.7 million hectares in 2024. While the maize crop price has fallen, the movement in price increased the crops attractiveness for feed use, boosting domestic demand. The area of maize increased despite greater subsidy for soybean production. Following a four-factor increase in the previous year, the Chinese GM maize area is expected to increase again in 2024, amounting to an estimated 670,000 hectares, although the technology is still in the pre-commercialization stage.

At the consumer level, there is still reluctance to accept GM technologies, however, it is expected that GM will become increasingly favored in terms of regulation as the country aims to ensure domestic food security and reduce its exposure to international markets. Whilst the pending uptake of GM maize can be viewed as a potential negative for market development, this is expected to be more than offset by a number of positive factors, such as increased technification in terms of product usage, partly driven by regulation; an increasing focus on maintaining domestic food security and reducing reliance on imports, to be achieved by driving yields; increased commercial farming through consolidation and digitization; and expectations for higher pest pressure due to climatic shifts.

In 2024 China’s Institute for the Control of Agrochemicals (ICAMA) proposed the approval of seven glyphosate-based products targeted for use in GM crop production, with an additional two glyphosate products proposed for approval earlier in the year, taking the total to nine. The intention to approve herbicides for use with GM crops represents a significant step toward industrial scale GM crop production in China.

Factors which could hamper increased crop production in the country include the threat of continuing loss of suitable arable land, through soil erosion and salinization; the intensifying issue of herbicide resistance, for rice in particular; and the use of outdated cultivation techniques and agronomic practices in many regions.

Much of China’s demand for crop imports is expected to be satisfied by Brazil and Argentina, however, the country is developing closer trade relations with Russia, a country which has placed an increasing focus on the production of exportable surpluses of a number of key crops. The two countries have reached an agreement to double their trade over the next five years, despite a number of other countries having placed trade sanctions on Russia following the invasion of Ukraine. This agreement includes the removal of tariffs and regulatory barriers on the exchange and trading of various goods such as agricultural, industrial, and technological products and services.

China imported 12.56 million tons of maize in the first eight months of 2024, representing a decline of approximately 16% compared to the same period in 2023. Increased imports at the beginning of 2024 were offset by a slowdown from May onwards. The decline is understood to be driven by a reduction in imports from both the U.S. and Brazil. China began increasing its maize imports during late 2020, with the U.S. representing its primary supplier. However, Chinese imports of U.S. maize have fallen in recent years after China approved Brazilian maize for import in 2022 and increased the number of authorized Brazilian exporters in 2023.

The country has outlined its intention to reduce reliance on overseas purchases with the implementation of the food security law, which aims to achieve absolute self-sufficiency in staple grains. The law provides a framework for boosting agricultural production, including protections for cropland against conversion to other uses, protection of germplasm resources, and prevention of waste. The law also holds central and provincial governments accountable for incorporating food security into their economic and development plans, ensuring food supply remains a key priority. Other elements include the formation of a national grain emergency plan and a food security monitoring system.

The country’s ‘zero-growth’ policy has led to a trend of higher-value, low-volume products. Another factor which may boost the value of the market through product replacement is the increasing number of older products being regulated out of the market in the country, with restrictions or bans being placed on several products in recent years (notably paraquat, endosulfan and methyl bromide), bringing product usage more in line with developed countries and opening the market to more advanced technologies. In 2021 China announced plans to ban 10 pesticides due to concerns over toxicity: aldicarb, ethoprophos, isocarbophos, phorate, isofenphos-methyl, carbofuran, omethoate, methomyl, aluminium phosphide and chloropicrin are to be removed from the market by the end of 2024.

Agrochemical prices reached peak levels towards the end of 2021; however, since this period, the prices of many key agrochemicals produced in China have declined, in many cases falling below prevailing levels from pre-pandemic. Prices further softened throughout 2023: the situation has been far more stable in 2024, albeit being sustained at levels substantially below the 2019 indexed level. Continuing capacity increases in the country, coupled with a resumption of the overall supply situation following the cessation of pandemic-related lockdown restrictions, can be expected to continue to stifle price improvement, although the trend does indicate a much more stable situation than in the years immediately post-pandemic.

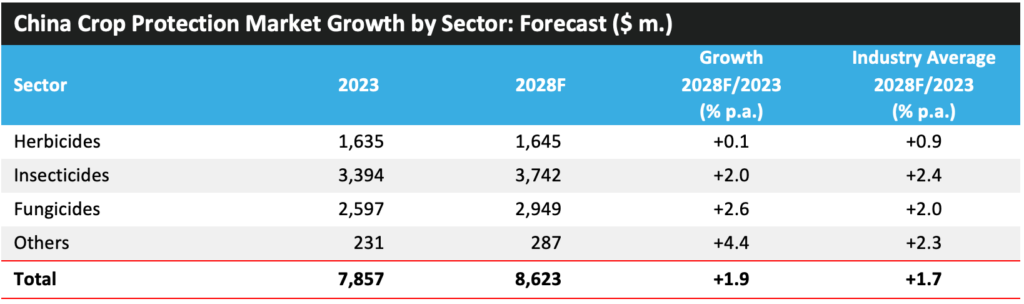

Due to the factors discussed above, the crop protection market in the country is expected to increase by an annual average of 1.9% between 2023 and 2028 in nominal US$ terms to reach $8,623 million, slightly ahead of the projected 1.7% p.a. growth for the wider industry average. •