China Price Index: Analysis of Sichuan Power Restriction and Historical High Temperature Impacts

Contributing writer David Li addresses how the short-term power supply restrictions will impact the country’s overall capacity and pricing for key agrochemicals.

Scroll Down to Read

BY DAVID LI

CONTRIBUTOR

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he provides insight on how power restrictuion in Sichuan coupled with unusually high temperatures is expected to impact manufacturers of crop inputs.

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he provides insight on how power restrictuion in Sichuan coupled with unusually high temperatures is expected to impact manufacturers of crop inputs.

The need for agrochemical intelligence in China is deepening for both multinational and generic companies, but opportunities always come with challenges. Insufficient information available to multinational companies may be a constraint to their decision making — the more information a company gets, the more noise it contains. The key is to filter out the noise leaving useful information to help form the right decision.

Price trends can, at times, be very important. For small- and medium-sized buyers, price trends can help them estimate budgets for the next sales season. At the same time, price trends are of limited value to small- and medium-sized teams, because they do not provide fundamental cost savings by influencing their purchasing strategy. For MNCs (multinational companies), there is no shortage of price information for the intelligence teams, as sales from Chinese suppliers will be the first to provide those larger organizations with the latest prices with the hope of additional purchase orders.

So, what is at the heart of strategic analysis? To answer this question, it depends on how long the team is making strategic judgments with a strategic interest in mind. If we look at strategy in terms of the company’s earnings over the next six months, then our judgment of the supply chain and market trends need only be on the “best timing” of purchases and the prediction of a reasonable price range. But if we consider the long-term strategy for the future, say five to 10 years, then the analysis team should consider the competitive advantage of the supply side as a whole and make a comprehensive analysis of the political, economic, humanistic, efficiency, and innovative environment in which the supply side is located.

More importantly, it should also anticipate the possible decisions of each stakeholder that are manifested in the integrated environment. This anticipation of the decisions of the practitioners in the environment is something that information teams need to experience and have time to build and cultivate. It is critical for the company to gain a competitive advantage on the supply side. Based on this, the company can further strengthen its competitive defenses and maintain an optimal posture in the target market for the long term.

POWER PLAY

On August 14, Sichuan Electric Power issued a notice, that in order to face the hot weather, all industrial power users on the Sichuan power grid were required to shut down production from 15 to 20 August. The Sichuan local electric power suggested the manufacturers have a high-temperature day-off, so that they can provide electricity to the people.

On 22 Aug., Lier Chemical, the leading Chinese glufosinate producer, announced the production sites in Mianyang City and Guang’an City, Sichuan Province, recently received a notice of production power restriction. Due to the tight power supply, the two bases started implementing the local government’s policy by shutting down production on 15 Aug. (only the security load was retained). The two bases were later notified of an extension of the power restriction (security load only) until 25 Aug.

The impact of the recent power restriction in Sichuan may provide some inspiration to the local intelligence teams. Source: https://weather.cma.cn/web/channel-32.html

Production bases outside Sichuan province were generally less affected by the power restrictions. In view of the large-scale production restrictions at the Mianyang and Guang’an bases, the total period of the restrictions reached 11 days. It is expected to have a negative impact on the company’s operating results.

Different from other restrictions, Sichuan power’s regional policy is due to necessity. The drought brought on by the high temperatures has put a huge strain on Sichuan’s power system, as Sichuan mainly uses its abundant hydropower resources to power production in the province. Continued high temperatures turned the power supply and demand situation in Sichuan Province from the “shortage” in the July peak period to the “double shortage” of whole days without power and electricity. According to Chuan Guan News reports, Sichuan province’s maximum electricity load was expected to increase 25% over the same period last year. Sichuan power noted the load of Sichuan power grid increased 14% compared to the same period last year.

The average daily electricity consumption of residents YOY 2021 increased by 93%. At present, Sichuan province residents account for about 30% of electricity consumption. Industrial enterprises account for about 60%.

As the ancient Chinese used to say, things always turn to their opposite. Aug. 23 was “the end day of high humidity and high temperature weather” in the Chinese lunar calendar. From this day forward, most of northern China enters a period gradually dissipating heat.

Daytime electricity loads for residents in

northern areas reduced, which allowed

energy suppliers to provide

power needed in Sichuan.

WEATHER EFFECTS

Even though the extreme hot weather was short-lived, the power restrictions had an impact on upstream, high-energy consuming yellow phosphorus and chemical production.

A lower operation rate was the most directly impacted. But the view of the overall phosphorus chemical upstream and downstream should be monitored from a broader perspective. July and August are considered a part of the traditional low season for agrochemical production. Overseas demand and peak production come into China’s supply market between September and October.

And August was also a common practice for suppliers to reduce their operating rates to overhaul and maintain equipment during the off-season. Moreover, it is worth noting that the overall demand for glyphosate and glufosinate might have been weak in the second half of 2022. The short-term power supply is not expected to impact the country’s overall capacity.

On the other hand, extreme droughts due to climate change are also likely to cause extreme cold in the winter, especially in the spring of 2023 when the risk of cold snaps increase. A frozen future brings high uncertainty into the mix for chemical production in early next year.

In addition to weather challenges, local policies issued by the local electric grid, will certainly be designed to protect local tax from key enterprises in the policy implementation process, especially related to increasing fiscal deficits in various provinces and cities of China. Sichuan’s local government is trying to ensure energy supply, rather than the total cut-off of power.

Sichuan increased its daily supply of coal for electricity production. CHN Energy Group also continues to supply coal to Sichuan, thus increasing the capacity of thermal power generation in Sichuan. In addition, the State Grid Corporation of China is also supporting Sichuan’s power resource allocation by increasing cross-provincial power transmission. Sichuan’s main sources of electricity from other provinces are currently Shaanxi and Gansu. As the current northern power load continues to operate below peak capacity, Sichuan’s power supply will be greatly relieved soon. The negative impact on production supply and industry will also end.

AFFECTS ON PRICING

To verify the previous judgment, a deeper look at the recent price fluctuations of glyphosate and glufosinate is also needed. For now, this negative factor has limited impact on the overall phosphorus chemical industry.

Yellow phosphorus prices rose by about 17% from mid-August compared to

early August due to power restrictions in Sichuan and insufficient production

operation in Yunnan and Guizhou.

However, due to the weak demand for glyphosate, the brief rise in yellow phosphorus prices has not yet been passed downstream. There are still certain stocks of glyphosate in the supply market. Therefore, even the low operation rate and the power restriction in Sichuan did not boost the declining price of glyphosate.

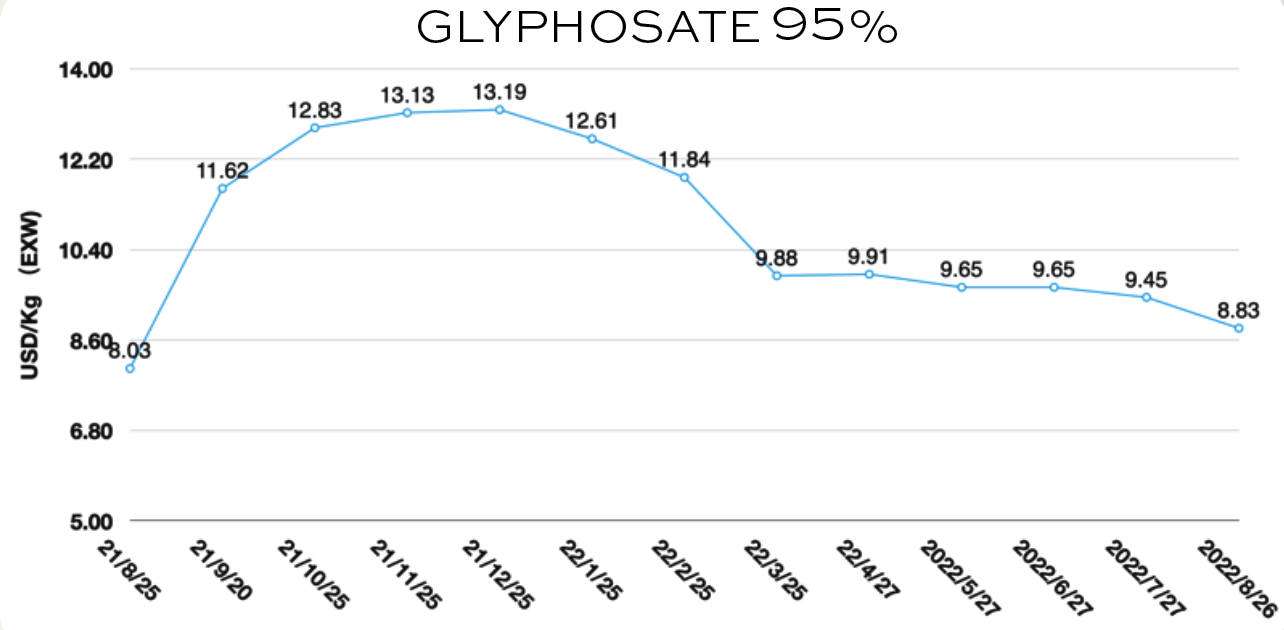

The EXW price of glyphosate 95% active ingredients (AI) dropped to US $8.83/Kg in August, which was the first time below US $9/Kg in the last 12 months. According to our previous forecast for glyphosate, the price trend is still within the forecast range. For the supply of glufosinate, Sichuan production capacity has been affected to some extent. However, the overall market supply/demand balance did not deviate seriously, and the extent of this short-term negative impact was limited. Glufosinate 95% AI EXW price continued to drop to US $32.85/Kg in August.

Good news arrived with the fall. According to the State Grid Corporation of China, all general commercial and industrial electricity consumption in Sichuan Province returned to normal at noon on 28 Aug. Except for high-energy carrying industries, electricity consumption for large industries is being gradually restored. After the continued improvement of hydropower, all large industrial electricity consumption will be converted to normal soon.

Such extreme weather conditions may become more frequent due to climate change. As a result, local industrial policies related to energy consumption in Sichuan are willing to be further optimized. Predictably, Sichuan is likely to increase investment in photovoltaics, wind, and other power sources in the future to ensure a diversified power supply. At the same time, there will be some restrictions on traditional energy-intensive mining and chemical production. Local enterprises will also pay more attention to the improvement of traditional energy-intensive processes under the impact of power restrictions. This is also the goal of China’s pesticide industry during the 14th Five-Year Plan period. After upgrading processes in accordance with environmental emission requirements, process improvements aimed at reducing energy consumption is becoming a new focus for the whole of China’s agrochemical industry.

It is also worth mentioning that the measures taken by China to address regional emergent risks and the efficiency of implementing them. As a major global pesticide producer, China’s actions in response to the extreme drought and persistent heat in Sichuan provide another perspective for global buyers to assess China’s willingness to ensure sustainable supply and its determination to implement actions. For global intelligence teams, it could be a good time to upgrade the analysis model of drivers and impact from a relative longer beneficiary of the company strategy like Chinese ancestors did. Chinese ancestors “looked” 700 years into the future. We are considering the next 70 years. •