Biopesticides Continue to Make Inroads Around the World

Science, efficacy, and formulation improvement — along with consumer and regulatory forces — converge to help the global biopesticides market shake off its dubious reputation. Here’s what to look for in ’23.

Scroll Down to Read

BY JACKIE PUCCI

SENIOR EDITOR

The Brazilian biological market is exploding, growing at a rate more than double that of the United States or Europe, driven largely by biocontrol products in row crops, according to research firm DunhamTrimmer.

“We see a Brazilian regulatory system, where in the recent past it took three to four years to bring a product to market transition, to where today you can bring a new biopesticide to market in less than a year,” Mark Trimmer, DunhamTrimmer Managing Partner, said.

Government initiatives to support biologicals that provide startup companies in the space with funding opportunities, in addition to policies that encourage growers to use biologicals more frequently, are helping fuel Brazil’s bio boom. “All of these things are coming together,” Trimmer said, noting that Brazil currently represents 60% of the total Latin American bio market, and by the end of the decade he expects that to grow to 70%.

In the U.S. and Europe, the biopesticides boom may be over, but there’s no bust in sight. The maturing market means growth rates will trickle to the mid-single-digits by the end of the decade and will only reverse course if biopesticides succeed with more widespread uptake in row crops. In the U.S., approximately 10% of biological control products today are used in row crops — the vast majority of their use remains in the specialty markets, according to Trimmer.

The tipping point, he said, could potentially be an effective bioherbicide as North American growers’ most pressing need is weed control versus insects or disease. No bioherbicide has yet succeeded in capturing significant market share, although multiple companies are focused on this opportunity and have leads in their pipelines.

Biologicals continue to make inroads nonetheless, as educational outreach, partnerships, product improvements, and consumer and regulatory forces propel the once-niche space to the mainstream.

“Our biggest growth barrier today is just having enough capacity,” Mike Allan, Vice President, North America with Certis Biologicals said. The biologicals pioneer, which does business in 50-plus countries, has invested more than $27 million to ramp up capacity over the past two years to meet demand with equipment upgrades and higher throughput volumes at its production plants.

“Our biggest growth barrier today is just having enough capacity,” Mike Allan, Vice President, North America with Certis Biologicals said. The biologicals pioneer, which does business in 50-plus countries, has invested more than $27 million to ramp up capacity over the past two years to meet demand with equipment upgrades and higher throughput volumes at its production plants.

“I think one of the big things that is going to help adoption especially in the row crop space is trying to provide a bridge — a transition to biologics,” Matthew Dahabieh, Senior Vice President and Head of Green Chemistry Solutions with Terramera, tells AgriBusiness Global™ from the company’s headquarters in Vancouver, BC.

“We’re not going to get to a biological based-crop protection world all in one go. There is going to be a transition that happens over time. Whether you talk about combination products, rotational strategies, or tank-mix partners, these are all steps along the way that I think are necessary to build that trust and critical mass.”

There is a big focus on discovery of active ingredients (AIs) in the bio space, but a comparatively smaller focus on actual formulation, Dahabieh said. Individual products with a narrower focus in terms of application is more characteristic of biologics than the broad-spectrum nature of synthetics. Therefore, a concerted effort to develop and bring high-performance products to market quickly and efficiently is key.

Formulation is a part of that requirement and exactly the focus of Terramera’s newest launch (coming later in ’23) Socoro, a best-in-class neem oil-based product for use in corn, soy, wheat, and other row crops. Socoro is a line extension of Terramera’s flagship neem oil-based product, Rango, which has been sold into the specialty crop market since 2019.

Matthew Dahabieh, Senior Vice President and Head of Green Chemistry Solutions with Terramera.

“The playbook used historically as an industry for formulating conventionals is not going to work for formulating biologics, and we need to rethink that paradigm,” he said.

SummitAgro USA this year is rolling out a new formulation of the hybrid fungicide developed by Israel’s STK Bio-Ag, Regev HBX, specifically for use in soybeans, rice, and pecans.

Eric Tedford, Head of Field Research, SummitAgro USA, explains that the formulation has a lower concentration of tea tree oil, as pecans, rice, and soybeans need less of it to be effective, saving the grower money. Tea tree oil provides the producer with another mode of action in a market that is flooded with Group 3, 7, and 11 fungicides, and combinations thereof, Tedford said.

Eric Tedford, Head of Field Research, SummitAgro USA, explains that the formulation has a lower concentration of tea tree oil, as pecans, rice, and soybeans need less of it to be effective, saving the grower money. Tea tree oil provides the producer with another mode of action in a market that is flooded with Group 3, 7, and 11 fungicides, and combinations thereof, Tedford said.

“Tea tree oil came from a living organism — it’s a biological — but you don’t have it keep it living … It’s more akin to a chemical, and that’s why I’m so excited about it,” he adds, because growers don’t need to learn special techniques to handle or apply it. “(Biologicals) are all about reducing residues, resistance management, and taking the pressure off fungicides.”

PARTNERSHIPS, EDUCATION

Certis is seeking to move beyond a transactional approach to partnerships and collaboration with a growing range of companies and their technologies, dedicated to creating a better package and better opportunity for the adoption of biologicals, Allan said.

In the past two years, the company has also stepped up efforts to get the message out about biopesticide use in row crops.

“The education in the row crop side is really where specialty crops were 15 to 20 years ago, and (row crop producers) are now adopting it even faster. Industry efforts are doing a great job at communicating and creating an education platform to build row crop-specific programs that includes biopesticides,” he adds. “It’s about getting growers the information that biopesticide options are just as essential (as synthetic chemistries) and can be integrated into their tank mixtures that will enhance resistance management, efficacy, and pest spectrum.”

Albaugh LLC is traditionally a post-patent manufacturing giant, but is quickly expanding its biologicals portfolio in the U.S. Jay Stroh, Biological Seed Treatment Lead and Key Account Manager, talked about what is driving that strategy in early February.

“Biological product offerings have gained momentum in the last decade and that is only going to continue to grow. When you look at conventional chemistries, there are not a lot of truly new products being developed. On the biological side, there is significant investment going into researching natural products that will fit (with conventional chemistries),” Stroh said. “For us, it’s all about partnering with those biological companies and bringing new products forward.”

“We want biological products that are compatible with conventional seed treatment products because we’ve seen enhanced activity — whether on insects, nematodes, or diseases — when we combine biological products with our conventional offers,” Stroh said. “It’s really taken off, and it’s all about consistent performance, year after year.” He adds, “That’s the important thing about biologicals. People think they aren’t as consistent. We conduct trials across a range of crops and geographies to show to our customers that these are products we can add to a conventional system and deliver another mode of action to help with the target pest.”

Much of AgBiome’s work also centers around partnerships: In January, it granted exclusive distribution rights to Summit Agro Mexico of Howler biofungicide for high-value fruits and vegetables in Mexico, where it expects registration by the end of ’23. It is also in a development agreement with BASF for Howler in Europe, Africa, and the Middle East. In addition, AgBiome has a deal with Chilean company ANASAC to develop, register, and commercialize Howler in Peru, Colombia, Ecuador, Guatemala, Honduras, Nicaragua, Panama, and the Dominican Republic, with a focus on protecting export crops such as fresh fruits, vegetables, and cut flowers.

“We are getting more questions from row crop growers and associations around, ‘hey, when are biologicals going to make a big splash in row crops?” said Toni Bucci, Chief Operating Officer at AgBiome.

“We think our products Howler and Theia have a good fit there, but we’re continuing to do development so that we can really promote the value proposition in terms of yield benefits for using a biological.” This year, the company will continue field trials in countries outside the U.S., including in row crops.

BIOPESTICIDES ARE A HEDGE

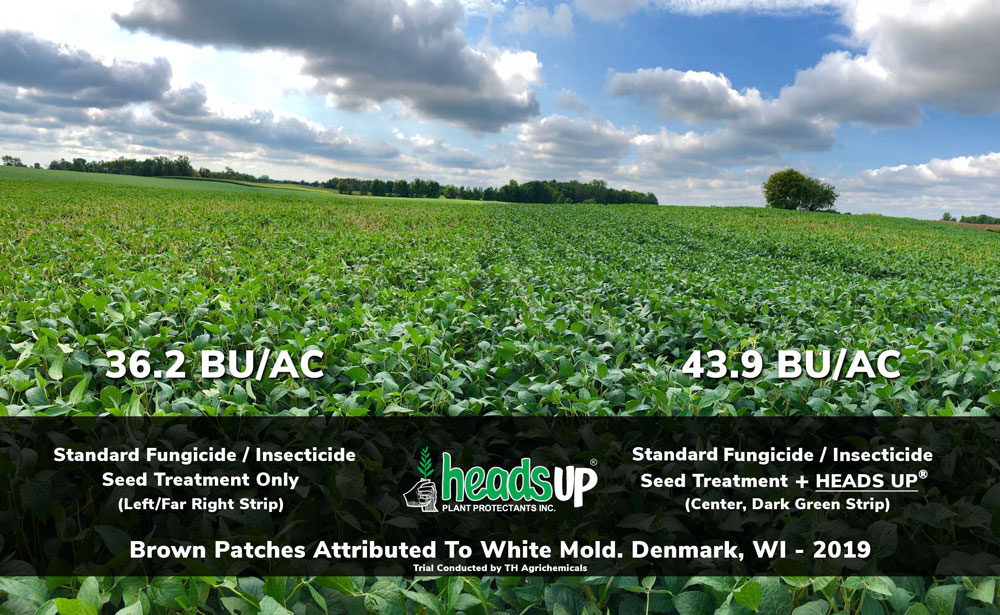

Third-party data is critical for Heads Up Plant Protectants Inc. in Saskatoon, Sask. Heads Up is the company’s signature product, which is a biological seed treatment for white mold and sudden death syndrome and is applied on about 10 million soybean acres in the U.S. In essence, it makes the plant think it’s under attack by disease so it boosts its defenses and becomes hardier as a result.

“We’ve always focused on doing third-party trials, because (biologicals and biopesticides) have been a hard concept for people to accept. Having third-party data is important for any new company to build trust,” said Jared Cottenie, Marketing Manager, Heads Up Plant Protectants Inc.

It is a hedge to have proven biologicals in your portfolio at a time when environmental regulations are changing and the risk of bans on synthetic compounds are high, Cottenie said. Not only that, but the cost is low. “We average about a two-bushel increase over 15 years of trials,” which works out to about a 4X return at today’s bean prices, he said, adding, “Guys also don’t have to worry about timing of fungicides — you apply at the beginning of the season and it protects the crop all season.”

Agrauxine, known for its yeast-based biosolutions including Romeo and Smartfoil, with parent company Lesaffre in 2021 acquired Ohio-based Advanced Biological Marketing (ABM), a developer of bionutrition products for field crops in the Midwest.

“Taking a company that had a niche product line that could be expanded rapidly, with a sales force that has already been established in the row crop industry, is the strategy behind what we’re trying to accomplish in the next few years,” said Vince Wertman, Technical Sales Manager, North America with Agrauxine.

Furthering this strategy, it licensed Atroforce, its seed treatment bionematicide for nematode control, to UPL for commercialization in the U.S. EPA approval is expected this spring, Wertman said, adding that the company also pays close attention to the organic market.

“The organic market will continue to expand as needs from the consumer to have something more naturally derived grow. It adds value to our portfolio and the depth of what we’re working on now and in the future because of consumer safety. We have nonexistent MRLs and products that are very safe for applicators and the environment,” Wertman said.

“Chemistry will always be necessary. That is the foundation. But chemistry in the volume we are using today is not necessary and that is where we can replace with biocontrols,” said Patrice Sellès, CEO of Biotalys, a Belgian manufacturer of protein-based biocontrol solutions, including novel biofungicide Evoca.

Sellès notes the dissonance that arose at the onset of the Ukraine war and the fears about food and energy shortages with the EU Farm to Fork Strategy, which aims to halve pesticide use in the bloc by 2030. He recalls the potato famine in Ireland. “If we follow what the regulation would do in Europe over the next 10 years, there would be no more chemical products to treat the disease.” Neonicotinoids are another example — they were banned in the EU, then unbanned because there was no alternative treatment.

“I think this is the key challenge for us, is to discuss with the European community and to balance the act of the carrots and the stick. You can’t just eliminate everything without planning for something else,” Sellès said. •