RaboResearch: Mercados globais de fertilizantes enfrentam mais um ano desafiador

The geopolitical challenges that marked the beginning of 2025 have created uncertainties in various markets. Agricultural inputs like fertilizers have been particularly affected. Fertilizer prices are showing an upward trend for 2025 and eroding farmers’ purchasing power, as commodity prices are not increasing in tandem.

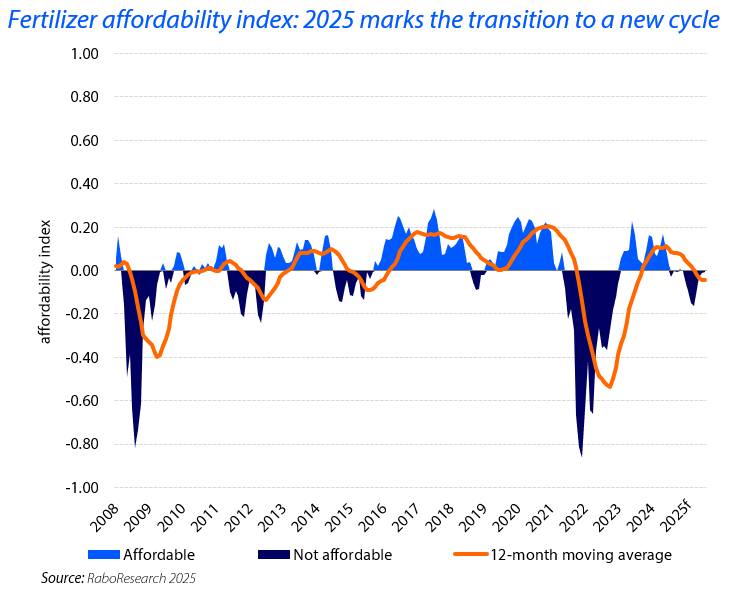

“RaboResearch’s fertilizer affordability index indicates a transition between cycles, moving from a period of relative affordability to one where fertilizers are less affordable and the index turns negative,” notes Bruno Fonseca, Senior Analyst – Farm Inputs with RaboResearch. “We expect this unfavorable scenario for the fertilizer market to persist throughout the year.”

Considering the various factors at play, the fertilizer market is likely to face yet another challenging year in 2025. This is particularly the case for nitrogen and phosphate-based fertilizers. “Farmers will struggle with reduced purchasing power for these nutrients, which may not immediately result in demand cuts in 2025, but the negative affordability index indicates such reductions will occur eventually,” explains Fonseca.

Buyers are adopting a wait-and-see approach amid supply restrictions

Despite all this geopolitical uncertainty, fertilizer needs remain stable in regions such as Africa, Australia, South America, Europe, and the US. India has consistently been a major buyer in the fertilizer market, standing out as a very important player and ensuring necessary liquidity at times. However, seasonal demand in India has decreased and stocks have been depleted. Consequently, market activity has diminished as participants adopt a wait-and-see approach before taking any new action.

Furthermore, supplies of some nutrients, such as phosphates, remain constrained due to changes in the global dynamics of the main players and restrictions on exports from China. These restrictions are also impacting nitrogen fertilizers. “We expect that China will resume exports in the second half of 2025, once domestic demand decreases after top-dressing applications are completed,” adds Fonseca.

Markets and farmers face uncertainties from all directions

Regarding agricultural commodities, market sentiments vary based on the dynamics of each sector. The corn market has significant upside price potential due to tight global stocks and a multiyear decline in the stocks-to-use ratio. Soybeans lie on the other end of the price spectrum, as the prospects of a record Brazilian crop and declining US soybean exports to China paint a bearish scenario for soybean prices.

But tariff threats are the main issue. Tariffs disrupt and damage long-standing trade relationships. In the case of the US, market share will shift to its competitors (for example, Brazil) and will be difficult to regain. Expectations are that tariffs and ongoing trade conflicts will weigh on agricultural commodity prices, which have already been depressed for the past two years. “We have long cautioned that US growers will suffer the most from the newly imposed tariffs. Ultimately, the economics of supply and demand and the price of marginal tons will prove relevant. Over the last year or more, policy changes have led to scarcity, resulting in higher prices for US fertilizers compared to global markets, and this trend may continue in the future,” warns Fonseca. “However, corn, soybean, and wheat markets are still trading within the range established in the summer of 2024, despite all the market volatility and bearish sentiment, and the increased volatility provides opportunities for all.”

Furthermore, supplies of some nutrients, such as phosphates, remain constrained due to changes in the global dynamics of the main players and restrictions on exports from China. These restrictions are also impacting nitrogen fertilizers. “We expect that China will resume exports in the second half of 2025, once domestic demand decreases after top-dressing applications are completed,” adds Fonseca.