South American Crops Are Driving Demand for Inputs, but Prices Rise and Shortages Loom

The Latin-American Southern Hemisphere will produce more than half of the world’s soybeans in the 2021-22 season.

With the beginning of the austral summer, the sowing of grains from the southern hemisphere in Latin America has already begun. The professional producing countries are important for grains and other crops and are very busy during these times preparing the land and the sowing in each of the relevant zones. Professional grain exporters such as Brazil, Argentina, Bolivia, Paraguay, and Uruguay are oriented toward high production and exports, using intensive agriculture with a very efficient use of resources, as they have a very strong agricultural potential focused on grains. They are fast adopters of technology for production but are very sensitive to the cost vs. benefit ratio.

The area planted for the 2021-22 season in the southern hemisphere will be 3.9% larger than that of the 2020-21 season and 7.3% larger than that of the 2019-20 season. The sowing for this year will be approximately 100 million hectares, including the areas of soybean, corn, rice, sunflower cotton, sorghum, and peanuts.

The soybean area planted in the southern hemisphere will be 62.9 million hectares, which represents 63% of the total area planted in this region, followed by corn with 28 million hectares, representing 28% of the area. In third place is rice with 2.13 million hectares, representing 2.14% of the total; cotton also follows with 2 million hectares and 2.07% of the total. Sunflower with 1.86 hectares, Sorghum with 1.75 million and peanuts with 550 thousand hectares of the total.

Planting of soybeans for the 2021/22 harvest has started and weather patterns need to be monitored as, according to IRI, La Niña has a 78% chance of developing in the fourth quarter of 2021.

La Niña corresponds to a cooling of the waters of the central and eastern equatorial Pacific, which disturbs the circulation of winds, atmospheric pressure levels and precipitation. According to the Forecast Center of the National Weather Service of the United States (NWS), the probability that this phenomenon will manifest itself again between next November and January is 70%. La Niña generally manifests itself with drought in Peru, Bolivia, southern Brazil, Argentina and Chile, which could possibly affect the proper development of important crops in these countries.

Several of the latter countries have experienced an intense drought since last year, which affected crops, dried up rivers, and impacted hydroelectric generation.

Now, there are fears that La Niña will further delay the rainy season in the Southern Cone and make 2022 an even drier year.

Brazil ranks first in the area of crops in the region.

Of the almost one hundred million hectares, it will sow 65.5 million hectares, which corresponds to 66% of the total area to be sown.

Here are the soybean crops with 40.4 million hectares, followed by corn with 20.8 million hectares, then rice with 1.7 million, and sorghum with 900 thousand hectares.

Soybean cultivation is the most important crop in the country with 40.4 million hectares, which will be 4% more than the sowing of the 2020-21 season where 38.9 million hectares were planted and 9.5% more than about the 2019-20 season.

Brazil will occupy the first place in soybean planting worldwide, 15% above the United States, which plans to sow 35 million hectares. Brazil will have an approximate harvest of 144 million tons, being the first in the region, followed by Argentina with 50 million tons. Paraguay forecasts a harvest of 10.5 million tons, while the harvest is expected to reach 3 million tons in Bolivia and 2.4 million tons in Uruguay.

A worrying development is the availability of inputs, including herbicides, insecticides, fungicides, and fertilizers. In this scenario, global production areas have been affected by increases in the prices of agrochemical products due to the lack of active ingredients, especially in producing countries such as China, coupled with the problems of transportation and the availability of containers for offices.

According to Bloomberg, the reduction of phytosanitary products for the protection of crops is proving a harsh reality for producers, not only in Brazil but in the entire region.

Despite having sold a large part of the products for the 2021-22 season, the industry itself did not rule out delays in both deliveries and cancellations of purchases.

The feeling of the producers is that the lack of inputs could put the next harvest at risk, and the situation is becoming more complicated every day.

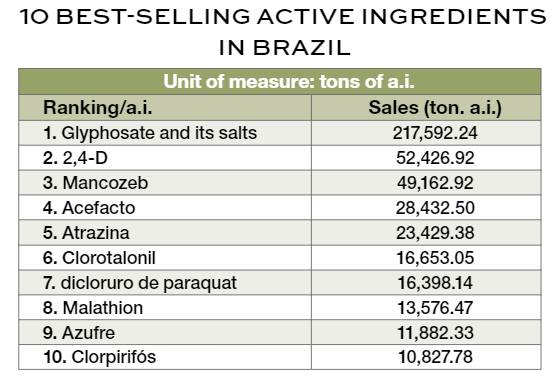

It is important to note that the lack of phytosanitary products is very critical, especially due to the need to have herbicides to prepare the soil before sowing and also to apply again once it has been sown. Brazil imported less than 100 tons of glyphosate in the period between January and September 2021, this represents a drop of 20% in volume compared to the same period last year.

It is important to note that the lack of phytosanitary products is very critical, especially due to the need to have herbicides to prepare the soil before sowing and also to apply again once it has been sown. Brazil imported less than 100 tons of glyphosate in the period between January and September 2021, this represents a drop of 20% in volume compared to the same period last year.

The crop protection products industries estimate that the second half of 2021 and the first quarter of 2022 will be difficult months for the sector, with impacts on national production, mainly due to the increase in production costs and the reduction of the supply of raw materials used for the preparation of formulas.

According to the comments of the National Union of the Phytosanitary Products Industry (Sindiveg) regarding the issue, they indicate that:

“We are going to have difficulties with some products. Some more than others. Chinese suppliers are not meeting deliveries, and some companies are worried about not being able to deliver products to distributors.”

The concern lies in the import figures from Brazil. From January to June, Brazilian pesticide imports fell almost 3% compared to the same period last year, despite the appreciation of the dollar.

In Brazil, according to the same Bloomberg chain, it may suffer a reduction in the supply of inputs for the next plantings that are already on the way, since the industries do not rule out delays or even cancellation of deliveries due to lack of raw material.

The increase in production costs and the reduction in the supply of raw materials used for the preparation of formulas used in crops are generating two consequences — price increases and the possibility of product shortages.

In the case of fertilizers, the situation is not very different from phytosanitary products, since those who postponed the purchase have delayed deliveries.

From January to March, Brazil experienced a boom in fertilizer purchases. Brazil imported 1.15 million tons in the first quarter, a volume 41% higher than that accumulated in the first three months of 2020. In the second quarter of the year, the volume acquired was practically the same as in 2020, slightly more than 1 million tons. Between July and September, however, purchases fell 6%, totaling just over 988,000 tonnes.

In Argentina, for the agricultural case, the situation is quite different, since the corn harvest will exceed that of soybeans and possibly reach 55 million tons while the soybean harvest will be 50 million tons.

Soy is experiencing dry environmental conditions in Argentina, and an export tax that is limiting the area planted.

Export taxes on soybeans in Argentina of 31% to 33% on soybeans are subtracted from the profit margin. Raw soy is taxed at 33%. Soybean oil and soybean meal are taxed at 31%. The USDA forecasts soybean production in Argentina for the 2021-22 business year at 49.5 million metric tons, which is 7% more than last year. The area is estimated to be 16.4 million hectares, less than 1% change from last year.

The yield is set at 3.02 tons per hectare, 8% more than last year. Soybean planting expectations have decreased, and farmers have benefited from soybean prices that decreased relative to corn. In addition, the selection provides farmers with more flexibility. Although soybeans are grown and produced at the lowest cost of production, they do not have the profit margin that they currently have due to prices.

Argentina is the world’s leading exporter of soybean oil and flour, and the second of corn. However, it is very likely that Argentine fields will suffer from rain shortages again due to the effects of meteorological phenomena in the country for the second year in a row, and these effects of La Niña in Brazil and Argentina could increase the demand for corn in United States.

Despite the seasonal dryness, corn in Argentina is expected to have a larger area. A larger corn area is forecast in the southern country for the 2021-22 business year due to better yields for corn and corn seed. The maize area is estimated at 6.8 million hectares, 6% more than last year. Corn production is expected to be at 54.5 million metric tons, up 8% from last year. The yield is established at 8.01 tons per hectare, 2% more than last year.