DunhamTrimmer’s Biologicals Outlook 2025: EU

The European Union (EU), (along with the U.S.) has been instrumental in launching the ag biologicals revolution. And despite the fact that other markets — Latin America and Asia/Pacific in particular — are coming on strong, the EU continues to be a source of innovation for biocontrol and biostimulant products. Richard Jones, Vice President, Content and Client Engagement for DunhamTrimmer, an AgriBusiness Global contributor, asked DunhamTrimmer’s Mark Trimmer, President and Founding Partner and Manel Cervera, Managing Partner and Chief Commercial Officer to share their perspectives on what’s working in this region as well as potential hurdles companies should be aware of.

ABG: Why have biological products done so well in the European market?

Manel Cervera

Manel Cervera: For biocontrol in Europe, what is really relevant — and probably much more than in the U.S. — are the secondary standards of the supermarkets, the value chain, and the agrofood system.

The European consumer wants less chemicals, especially on fresh products. The supermarkets took this concern and created their own set of standards, which we call secondary standards. They looked at the maximum level of allowable residues for all kinds of pesticides, for which there is already a lot of science.

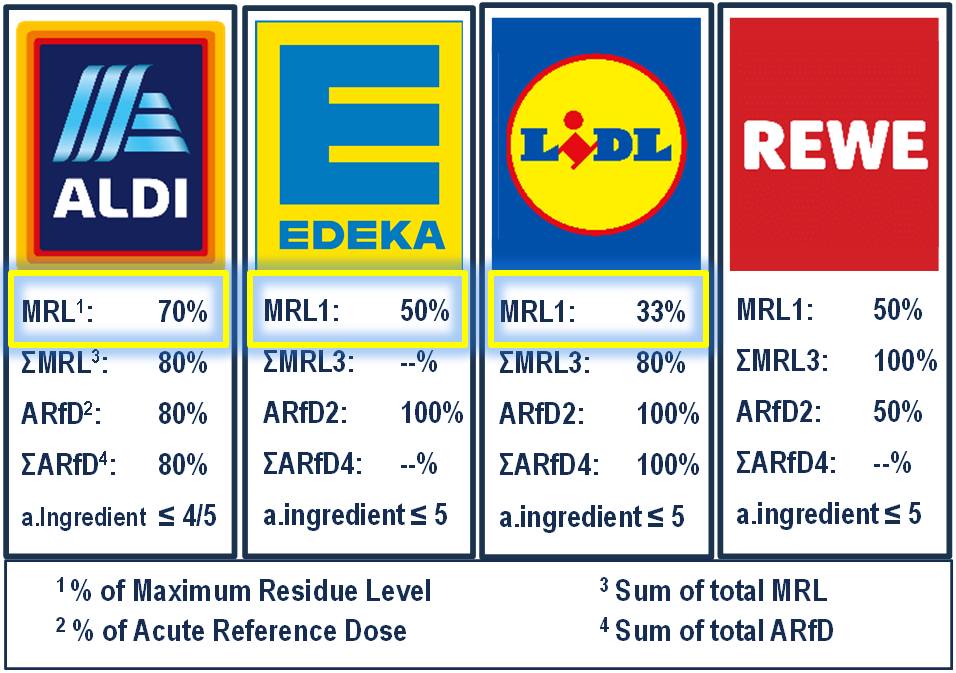

Then many of them tried to position themselves as offering products that are “more healthy” than the other supermarket chains by cutting their own allowable residue limits to half or even 33% of the regulated standards. Biocontrol products are typically exempt from many of these residue standards, and this is helping drive more adoption.

Many EU grocery chains have tried to position themselves as offering products that are “more healthy” than their competitors by cutting their own allowable pesticide residue limits to half or even 33% of the regulated standards. Source: DunhamTrimmer research, 2017

Another factor for biocontrol in Europe is politics, and concerns about the environment and public health. They sometimes seem less concerned about the needs of agriculture. They have banned many insecticides and fungicides, reducing the number of tools available to the farmer and in doing so, have reduced the available modes of action for a pesticide to work. And we know if you always apply insecticides or fungicides that have the same mode of action, at the end of the day you increase the risk of resistance.

For biostimulants, I think in the high-income European markets — which is a lot of consumers in Europe — there is a willingness to pay for products out of season, as well as for good quality products and produce qualities like size, shape, color, sugar content, etc. Biostimulants play an important role in meeting these demands on fruits and vegetables.

And abiotic stress is still impacting agricultural farming systems in many areas, of course. In Southern Europe there is risk of desertification. In other places, there is risk of toxicity of heavy metals from heavy applications of chemical products, for example. It seems there is a rising opportunity for biostimulants in that niche also. Enhancing Nutrient Use Efficiency is going to be an increasing opportunity in Europe.

ABG: What types of biocontrol products are doing well in Europe?

Mark Trimmer

Mark Trimmer: It’s completely opposite in Europe compared to the U.S. We see a very small share for microbial products in Europe. It’s mainly dominated by pheromones, plant extracts, PGRs, and other mineral-type products that are used on a broad scale. And that’s really a response to the regulatory system. It just takes forever to get a microbial product on the market, especially if it’s a new species not previously approved as a biocontrol agent. If it’s something that has been registered in the past — a Bt, for example — that can enter the market a little bit more easily, but it still takes a very long time.

The EPA review in the U.S. takes about two years. Typically, a company will have one to two years of research at a minimum into that product before they submit it, so you’re looking at a four- or five-year timeline until a product enters the market.

In Europe, it’s double that. It really takes a significant amount of time. A big challenge is the EU employs a regulatory system that was designed for chemicals, not biologicals. Some of the guidelines don’t clearly apply to biologicals, which creates confusion for both the company and the regulatory agencies. In contrast, the U.S. EPA created the Biopesticide Division in 1994 with registration guidelines designed specifically for biological products.

I’m cautiously hopeful that eventually Europe will rationalize their registration system and will begin to see something that is a little bit more open that recognizes the unique properties of biological products, allowing them to be placed on the market more quickly, on a timeline that is closer to what we see in the U.S.

If that happens, then I think we would see a dramatic acceleration of the growth in the biocontrol market in Europe, particularly for microbial products. There’s just a whole range of microbial products that are used commonly in the U.S. and Brazil that have not been approved in Europe. So, there’s a real potential for significant growth once that regulatory system is rationalized to facilitate the commercialization of these products.

I think there’s also growth potential in Central and Eastern Europe — places like Poland, Romania, Hungary, and eventually, if the war ever subsides, Ukraine has growth potential. There’s a lot of opportunity in those parts of Europe that still have not widely adopted biological products the way they have been adopted in Western Europe.

ABG: What biostimulant products would you expect to do well in the EU in 2025?

MC: I would say that in the biostimulant segment, as mentioned before, Nutrient Use Efficiency is going to be a strong target, because there is a concern to make more efficient use of resources. This is something that biostimulants are already doing well, but it’s going to be improved, particularly with the application of microbial-based products; if — and this is a very important “if” — the regulatory system in Europe starts to be less restrictive on the registration of new microbial products.

As a step in this direction, the Austrian Institute of Technology (AIT) has been contracted by the European Commission to help evaluate new microbials that could be allowed under the Fertilising Products Regulation (FPR). The AIT is currently reviewing 56 bacterial proposals (corresponding to 14 bacterial strains) and one fungal proposal submitted by companies wishing to have their products included in the FPR. The hope is this will eventually allow companies to bring a number of valuable new biostimulant tools to the European market.

ABG: What types of companies are successfully bringing biostimulant products to the EU market in 2024?

MC: A number of companies started developing this market decades ago. Most of them are now leading the market and they’ve been improving formulations, but it’s still based on these natural substances and those products are still working very well. Sometimes in biostimulants, market access, how you address the market, and the technical support you can provide at the farm level is as important as the product itself.

Of course, innovation is coming through better understanding on how the actives and the products work and that allows companies to do more specific target applications for concrete problems. There is innovation in all parts of the process — in the extraction, in manufacturing, in the formulation, and in the delivery systems. But understanding more about the product, how to allocate the product, when to apply, what it is doing, what it is not doing, what the limitations are — I think that’s increasing.

There is also another new segment that DunhamTrimmer has identified. There are some companies working in what we call “single biostimulant molecules.” This is not a natural substance that has many metabolites where we know some of them, but we don’t know others. These companies are really focusing their core activity on developing a concrete metabolite, which can give more specific target activity and probably higher probability to replicate high-efficacy results. This will be something to watch.

ABG: What about biocontrol? What companies are seeing the most success in the EU?

MT: It’s no surprise. It’s the companies that are in those plant extract, pheromone, and PGR spaces. We see a few microbial-based companies. Probably the most successful is Andermatt with their virus products. They’ve been able to bring a number of those to the market across Europe as well as outside Europe.

The other area that is quite successful in Europe is the macrobial products. Koppert and Biobest, who focus on macroorganisms, are two of the largest bio companies in Europe and in all of biocontrol. They really focus on the greenhouse markets in the Mediterranean region as well as the Netherlands. They have been extremely successful there and I would expect them to continue to succeed in those markets.

ABG: What are some of the big hurdles companies should be prepared for in getting into the EU biostimulant market?

MC: The top challenge is the regulatory system for microbials. That’s clearly the first one which is really hindering innovation.

Another issue is that a biostimulant’s effect depends not only on the substance itself, but also on the plant, on the agricultural conditions, and on the farmer management of other inputs. So, the replicability of results, especially on row crops and cereals, where the number of applications is more limited, is not always as high as we would like. That may limit the increase in the level of adoption in row crops and cereals, not only in Europe, but in general.

Another challenge to consider is the risk of commoditization. If biostimulants are starting to be seen more as a commodity, that makes it more difficult for companies to innovate or differentiate.

On the positive side, there is new regulation of fertilizer product that includes biostimulants. Europe has been the leading region doing this in a very professional way and we already have biostimulants in a regulation — I think that is important to note. Having that level of certainty with this category of products can help companies try to innovate.

ABG: Are there any different challenges for companies bringing products into the EU from the biocontrol side?

MT: Just as it is with biostimulants, regulatory is by far #1. The length of time it requires is significantly longer than in almost anywhere else in the world.

Another hindrance is the cost of doing all the efficacy trials that are required for registration. We don’t have that here in the US — with the exception of California, we don’t have to do efficacy testing. And in Brazil, it’s much less onerous and difficult than it is in Europe. So that can often be a significant challenge in time and added cost.