China Price Index: When Will the Turning Point Arrive for China’s Pesticide Industry?

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also details the turning point for the industry and how changes in strategies from its key players is necessary to spur changes in the market landscape.

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also details the turning point for the industry and how changes in strategies from its key players is necessary to spur changes in the market landscape.

In Carlota Perez’s book, “Technological Revolutions and Financial Capital – The Dynamic of Bubbles and Golden Ages”, the Venezuelan-based economist describes how the four basic phases of each surge of development. The phases include “Irruption, Frenzy, Synergy and Maturity”.

There have been five technological revolutions in human history. Each of these revolutions was closely linked to geopolitics. According to Carlota, the influences of technological revolutions are complex and closely intertwined with the context of the times, the economy, the political system, and consumer demand.

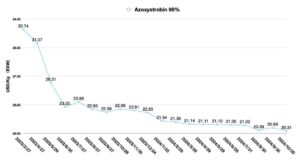

Chart 1: Recurring phases of each great surge in the core countries.

Two technological revolutions, in the true sense of the word, took place in the United States. Oil, the Automobile and Mass Production, which began around 1908, started in the United States and spread rapidly to Europe. At the same time, this technological revolution brought a great deal of vitality to the United States, and the result was a rapid increase in the power of the country. And European capital was the driving force behind the technological revolution in the United States.

By around 1970, information technology became the new trend. Under the new technological impetus, various Internet companies and hardware equipment companies competed with each other. This greatly stimulated the growth of capital and industry. From the discovery of breakthrough technologies, people became fanatical. The turning point followed the expansion of people’s desire and approached the industry. The bursting of the dot-com bubble later confirmed the existence of the tipping point. And today, when we look back at the development path taken by industry and capital after the technological revolution, it is only after consolidation that mature industries really enter the golden age of development.

If we have to give China’s pesticide industry a definition, I think China’s pesticide industry is in the turning point. The main problem at this stage is that the financial capital expects a return rate far exceeding the speed of the industry’s real profit-making speed.

On October 28th, Rainbow hosted a research event in the form of an online conference with the participation of researchers and fund managers from more than 110 brokerage firms and investment institutions. In addition to Rainbow’s detailed explanation of the company’s performance and future plans, one of the questions posed by investors stood out:

“Rainbow just released a restricted stock incentive plan that is based on 2024 net attributable earnings and sets growth targets of 30% in 2025, 45% in 2026, and 60% in 2027; is that target setting too low given that 2024 is the bottom of the industry cycle?”

In terms of the question itself, what is clear is that practitioners on the capital side in China have a completely different understanding of market growth than industry practitioners. Industry practitioners are unable to talk about growth without exploring the frontiers of market growth, especially at a critical stage when the industry is at a turning point.

Strong confidence in agriculture and food needs is probably the starting point for those of us in the agricultural crop protection industry. Investments in agriculture lag far behind those in other new technology areas such as artificial intelligence. This is also because of the financial capital’s desperate need for returns. However, all investment logic is based on a limited range of returns. When we take away the limited scope of return on investment to focus on the infinite possibilities of the future, then the financial capital in front of the vision is much narrower.

Chinese pesticide enterprises have gradually returned to rationality in the face of the limited market demand for generic pesticides after experiencing a nearly frantic wave of capacity expansion. However, the game between financial capital and the rationality of industrial practitioners is still continuing. More companies are becoming more and more cautious about borrowing from banks to expand their scale. In today’s Chinese market, capacity investment is shifting from listed agrochemical companies to formulation producers, intermediate producers and plant growth regulator manufacturers. While investment from new materials and pharmaceuticals should not be ignored, these companies are still in the early stages of recognizing the crop protection market, and it is too early for a trend to emerge.

Of course, there are also enterprises that have to “optimize” their organizational structure because they are controlled by capital. However, after such “optimization”, the question of how the capitalist will run the company becomes a new issue. After such adjustments, the possibility of the enterprise being packaged into assets for sale is increasing. Because the fundamentals of growth in the pesticide industry remain R&D and production of patented compounds that are about to expire, as well as the use of scale effect to dominate the market. The pursuit of operational efficiencies at the expense of exploring the possible margins of market growth may not be sustainable.

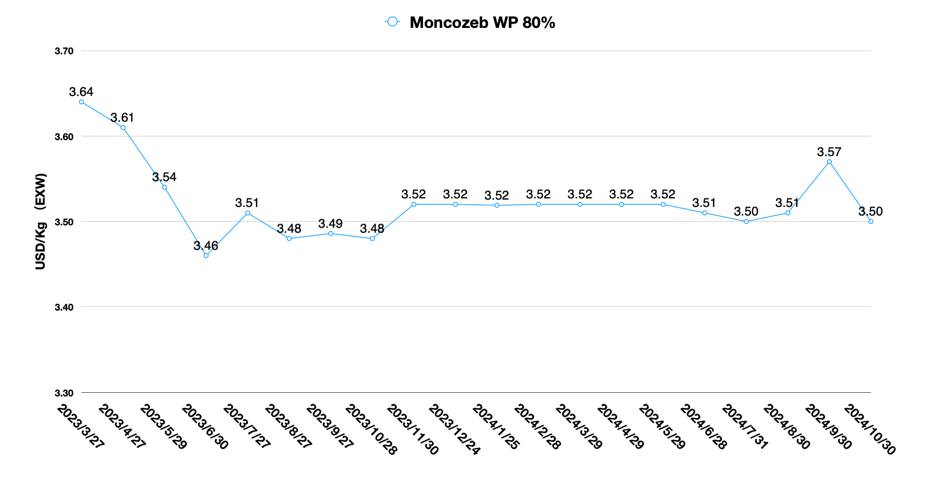

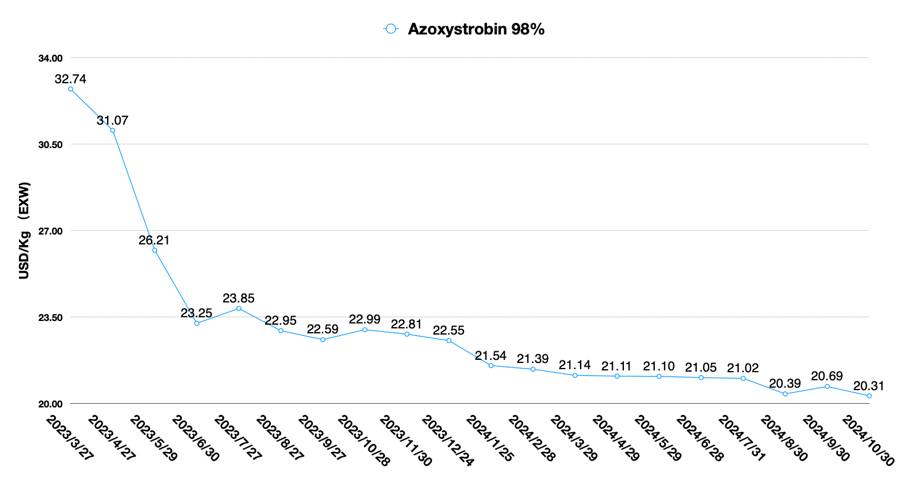

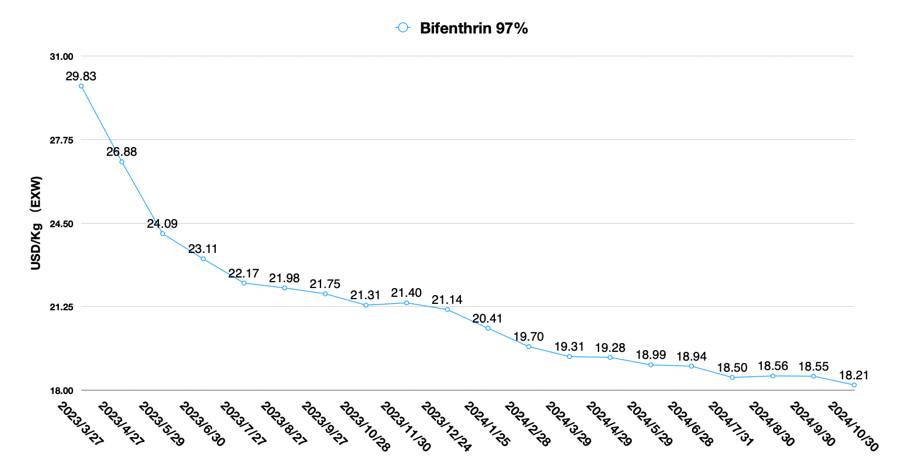

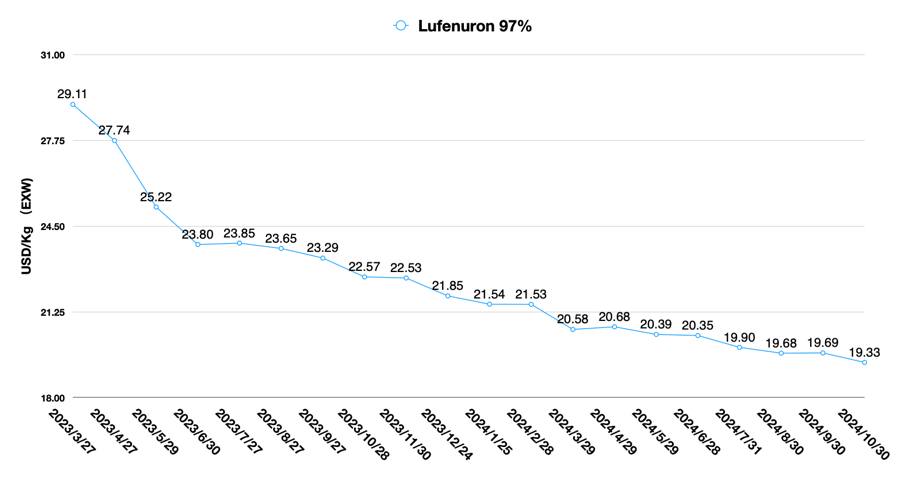

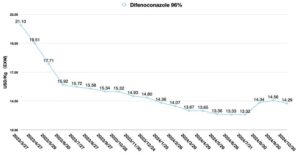

Details of the Turning Point

According to ICAMA Director, Mr. Xiuzhu Huang’s recent speech, China’s pesticide industry has seen year-on-year increase in export volume, a sustained decline in pesticide prices, and a large drop in profits from January to August 2024. The export volume of China’s pesticide industry has been on the rise since the beginning of the year. Generally speaking, China’s pesticide exports accounted for a stable 85% of China’s pesticide production. In the first eight months of 2024, exports accounted for 89% of the total China pesticide production. Moreover, from January to August this year, the volume of pesticide export goods was 2.662 million Mt, an increase of 26.8% year-on-year. But compared with the export amount of slightly longer, pesticide export prices still continue to slowly decline.

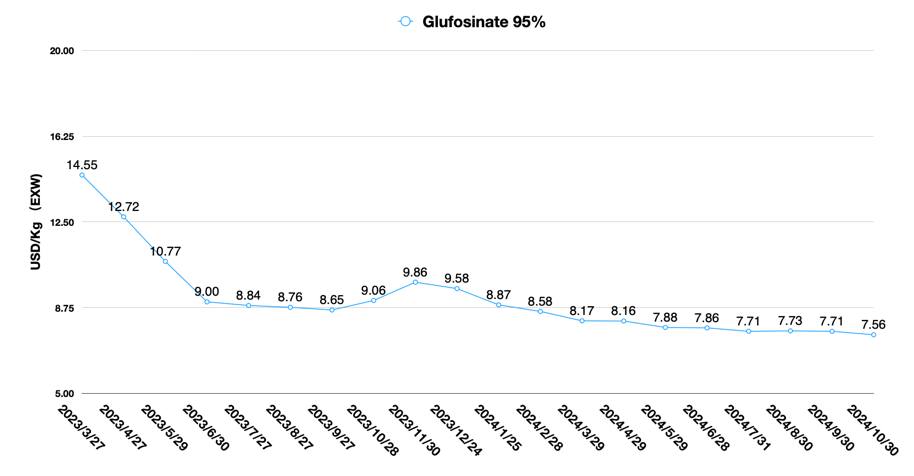

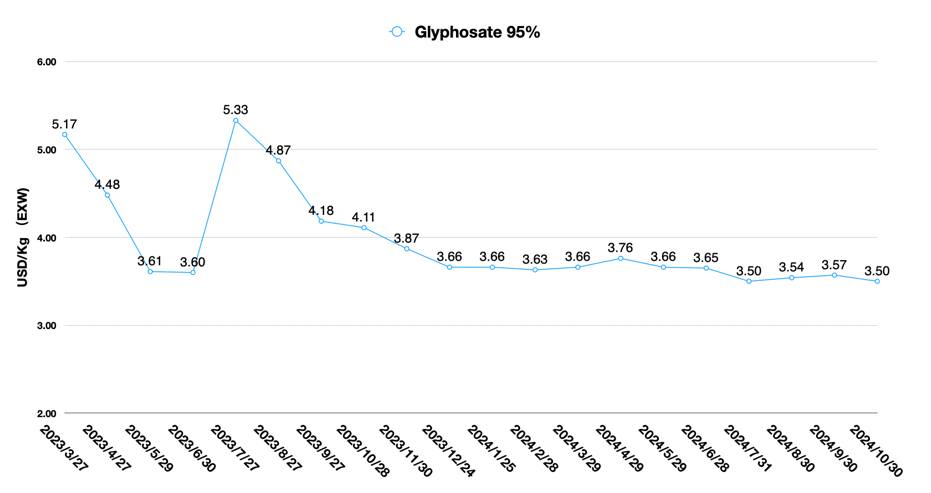

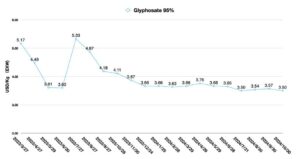

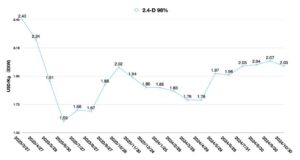

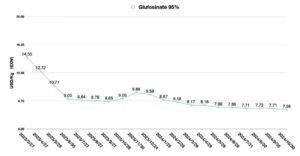

For burndown herbicides, glyphosate and glufosinate companies are generally facing difficulties. Although glyphosate enterprises have increased their export volume, their sales growth is less than expected due to price drag. For companies, overseas demand for glyphosate in the next three months is limited. North American buyers were more willing to place orders due to the low price of glyphosate in China. And North American market demand is nearing the end. China’s domestic winter reserve demand has a certain wait-and-see mentality. As a result, the overall glyphosate market has a stable trading activity. Demand in South America has not yet started. And with the Christmas holiday and Chinese New Year holiday approaching, glyphosate manufacturers are stepping up preparations for stockpiling for the demand at the beginning of next year, so the market inventory of glyphosate has been elevated. Due to the increase in downstream stockpiling, the price of upstream yellow phosphorus has been lowered. This has supported the profits of Chinese glyphosate companies.

It is worth noting that the CNY is under some depreciation pressure against the USD due to Trump’s election win. The Fed’s concern over inflationary expectations caused by future supply shortages triggered by additional tariffs has increased, so it is possible that the pace of the Fed’s interest rate cuts will slow down in the coming period. The downward movement of the CNY exchange rate is a boon for foreign exports of Chinese products. Currently the main influence on the price of glyphosate is currently the fluctuation of the exchange rate.

In the stage of supply and demand game, the pattern of glyphosate supply in China is also changing quietly. In October 2024, Hebang Bio announced that it planned to issue convertible corporate bonds to unspecified targets to raise total funds of not more than 4.6 billion CNY (657 million USD) for the 500 thousand Mt/a PMIDA project of its wholly-owned subsidiary, Guang’an Bimeida. For Hebang Bio, the company’s biggest advantage is mainly its continuous integrated IDA process. The company has invested in a 200 thousand Mt/a glyphosate AI project in Indonesia, which has already begun construction. As Hebang Bio has signed a strategic cooperation agreement with Rainbow, the competitiveness of Hebang Bio’s glyphosate products in overseas markets will be enhanced in the future with the Rainbow’s channel support.

Of course, challenges come along. Chinese companies may face certain difficulties in the operation of overseas production facilities and the management of globalized supply chain. Although it will take time for Hebang’s overseas production capacity to be successfully put into stable operation, the future global glyphosate production capacity pattern is likely to be mainly concentrated among Bayer, Hebang, and other Chinese glyphosate suppliers.

Glyphosate is just a cross-section of where the market is headed. At a time when almost all companies had the advantage of scale, the market responded with a sustained price slump. This situation is not uncommon when the market landscape enters a period of synergy after a technological revolution. However, the dilemma in front of Chinese pesticide enterprises has moved from the production side to channel management and market competition.

For Chinese pesticide companies, the biggest challenge is not the lack of innovation, but the understanding of the market trend and the changing needs of the global agricultural development is still in the primary stage. President-elected Trump is back in the White House, which will make the global geopolitical reshuffle. Trump’s attitude towards the neighboring countries of the trade would also affect the Chinese companies for the third country between the U.S. and China (for example, Mexico), the investment and capacity construction. At the same time, shifts in U.S. policy could also bring challenges of varying degrees to Western economies. Some “black swan” events may again impact the global agrochemical industry chain in 2025.

Chinese entrepreneurs can appear overwhelmed in the face of these issues. Some Chinese pesticide producers who once hoped to go overseas may revert to a conservative strategy in an era of uncertain political and economic environments, and revert to a firm ToB strategy from a period of swinging from a ToB to a ToC strategy. The lack of globalization talents in Chinese pesticide companies is also a contributing factor.

Despite the return to ToB strategy, this doesn’t mean the market is without opportunity. The continued low price of pesticides in China has also given a once-in-a-lifetime opportunity to ambitious entrepreneurs in the end market who want to start their own business. They are more likely to want to divest themselves of the shackles imposed on them by national distributors and thus contact Chinese pesticide producers directly since they all lack formulation facilities in the field. It explains the rapid growth in exports of pesticide formulations from China in 2024. And with that, the landscape is becoming more complex in overseas markets. Since Chinese formulation can reach to the same level with multinational companies. And some novel formulation from Chinese formulators even is better than global crop protection companies based on high efficient facilities, like DF/CS and OD. So multinationals are likely to come under pressure from both Chinese AIs, as well as Chinese formulations.

Perhaps we can conclude that market competition has passed from upstream to downstream in the supply chain. Strategies for supply chain and end-market competition and third-party collaboration must be linked if crop protection companies wish to gain a sustainable competitive advantage. Or, multinationals can also strategically cooperate with Chinese companies in the end market.

Changes in Strategies of Key Players to Spur Changes in the Market Landscape

On the other hand, the performance of multinational companies has a relatively large weight of influence on Chinese pesticide suppliers’ performance. MNCs and Chinese suppliers cooperate and compete with each other at the same time, but the competition is being reshaped by MNCs’ strategic shifts.

According to Mr. Rodrigo Santos, the President of Crop Science Division of Bayer CropScience, “In Q3, we experienced a decline in sales year-over-year, with our core business, however, holding steady. As we adjust our full-year guidance for Crop Science, it’s important to recognize the shifting landscape and how we must adapt.”

Syngenta also released the reports Q3 2024 results, their Q3 2024 Group sales was at $6.8 billion, flat versus prior year (up 4% at CER). The adverse weather conditions and prolonged destocking affected the first 9 months of 2024 for Syngenta Group.

As for Corteva, they mentioned the estimated financial snapshot during Corteva’s 2024 investor day. The total revenue would be around $17.1 billion, 0.75% YOY 2023.

MNCs’ performance has remained flat due to historical reasons over the past three years. In 2022 sales performance will take some time to retrace after peaking due to after-peak in the price of pesticide AIs. In 2024, the company can be called a milestone achievement if it can keep running smoothly. Obviously, the process of channel de-stocking will take longer than expected by Chinese suppliers. At the beginning of 2024, we already pointed out in the predictive analysis that adverse weather will make pesticide inventory depletion difficult in Europe and South America. The financial reports of multinational companies for Q3 2024 and their earnings forecasts also confirm our viewpoint from the side.

It is interesting to note that the strategic directions of individual multinationals vary considerably. Bayer CropScience is focusing on organizational restructuring to improve decision-making efficiency and bring in new internal drivers. With fewer patented products to follow, Bayer will need to focus on generic products and novel seed program in the future. And they also need to face the Chinese generic product’s impact on Bayer’s key remaining branded products in crop protection market.

Syngenta Group sales showed overall improved momentum in Q3 with Syngenta Group China delivering double digit sales growth. As a result, Syngenta Group can utilize the “twin engines” of the Chinese market and the global market to boost sales growth. Meanwhile, Syngenta has been focusing on R&D, not only internal R&D, but also third-party R&D collaboration with external chemical synthesis partner organizations and biological enterprises. So Syngenta’s strategic direction for the future is still to rely on patented compounds to drive the company’s growth.

In marked contrast to the first two MNCs, Corteva is a strong advocate of biological product lines. In the generic space, Corteva hasn’t shown much positivity to the market. But in Biologics, the company is growing rapidly and ambitiously in Brazil.

Internal Governance: Strategic Strengths and Weaknesses

In the ancient Chinese book, “Shang Junshu, Li Ben (商君书. 立本)”, Mr. Shang Yang suggested to the Qin empire at the time that there were three stages to winning a war: first, a reasonable military law and system should be established if the army had not yet been sent out; second, the military law and system should be implemented widely internally; and lastly, a culture and trend should be formed based on the implementation of the military law and system. In this way the preparations for going to war are complete. These three steps must be carried out within the country before the army can go to war. Shang Yang’s wisdom applies just as well to today’s competitive agrochemical market. Crop protection companies are actively adapting their internal decision-making mechanisms to cope with more unknown market changes.

For Chinese pesticide companies, their product lines as well as capacity facilities are already very well established. After 2025, we may see more Chinese companies registering formulations in end markets. Although their brands do not have a long history like multinationals, reliable quality assurance, efficient supply, and reasonable prices may be an advantage for Chinese companies.

However, as Mr. Shi Liu, vice president of DBN, mentioned, “Decisions on commercialization of agricultural production and business activities are multivariate, quantitative and complex in a specific environment.” Agronomic services might be a shortcoming that Chinese companies need to face in the long run. Although partners in the target market may help to make up for this deficiency. But just as we can’t sell functional off-road mountain bikes in supermarkets, companies need to have specialized teams to provide in-depth services to farmers, and marketing is not as simple as just putting a product in the middle of a customer’s warehouse. This is clearly a long-standing strength of multinationals. In general, a deeper engagement with the consumer is that drives R&D and production in a more efficient and profitable direction.