China Price Index: Is Upward Integration Really the Right Decision for Chinese Agrochemical Companies?

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also details why horizontal integration — and not upward integration — may become a strategy for many companies in the next decade.

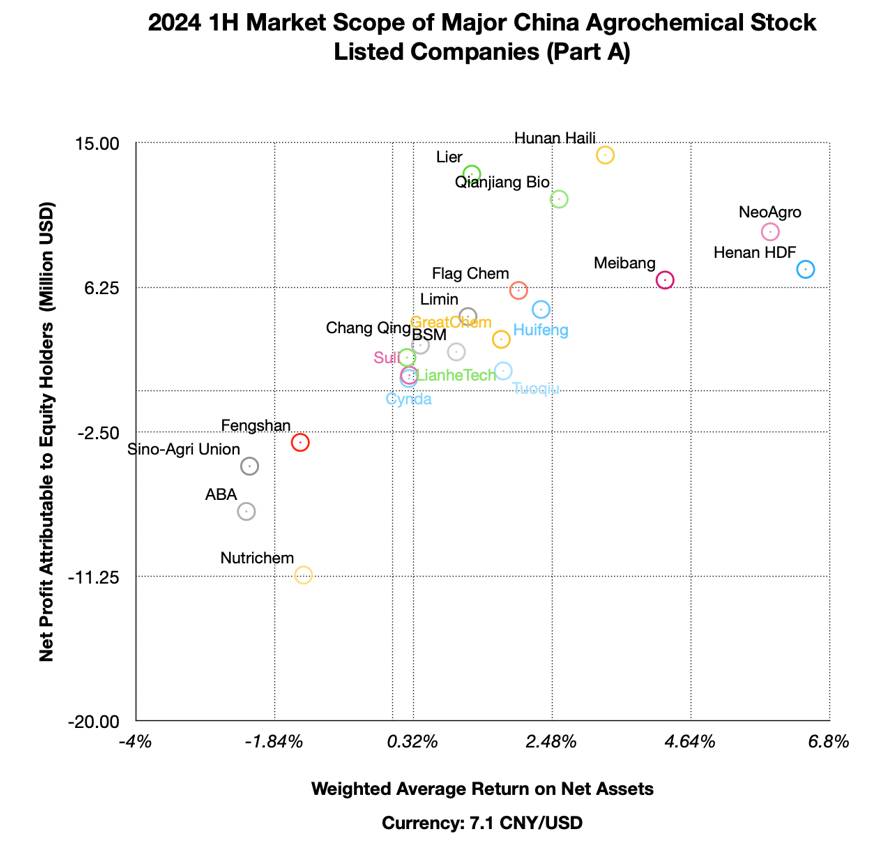

With the release of the first half 2024 financial results of listed Chinese pesticide companies, companies are facing serious challenges to their performance. Continued global inventory digestion coupled with increased competition in China’s pesticide supply market is causing listed Chinese pesticide companies to re-examine the underlying logic of future performance growth, market strategies, and internal management changes. More importantly, is upward integration really the right decision?

The Cage of Heavy Assets

In a phase of sluggish business growth, many Chinese pesticide companies are already deep in the late stages of upward integration. In addition, new players from basic chemical and pharmaceutical companies are utilizing their existing upstream raw material and industry chain advantages to attack the fine chemicals market in the life sciences sector, the pesticide business. Chinese companies continue to invest in heavy assets, which has led many of them to fall into the “logic trap” of scale effects.

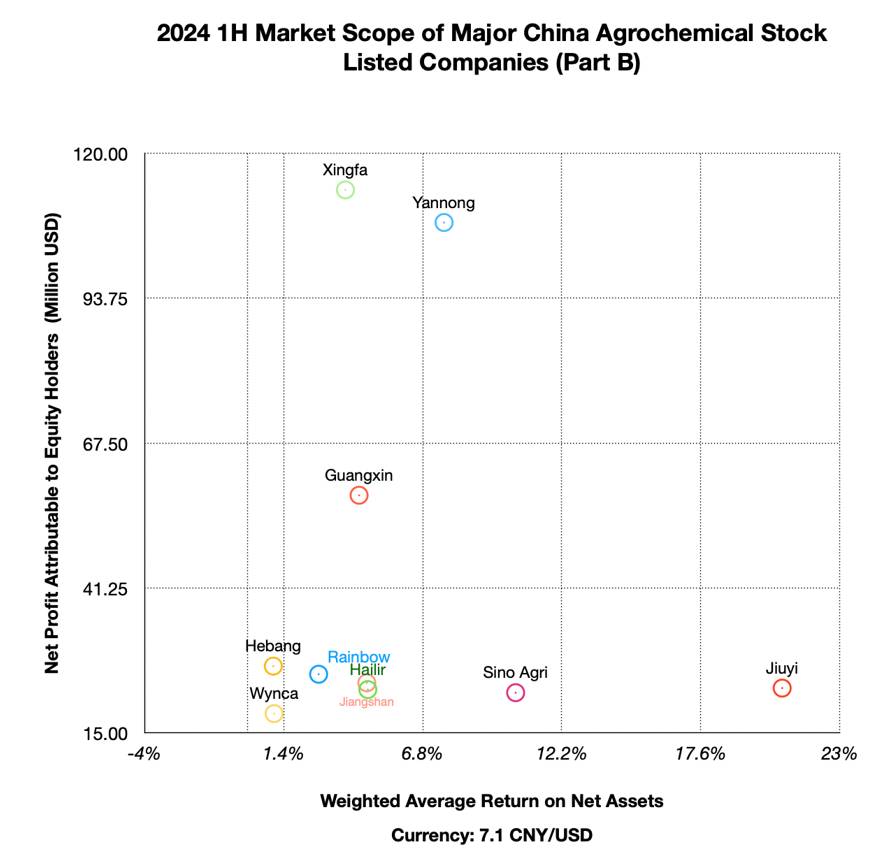

During the first half of the 2024, the profits generated by listed pesticide companies in China utilizing their net assets per unit for the company were shrinking. The weighted average return on net assets of each company is leveling off to a lower level. This also confirms that the profitability of Chinese pesticide companies is generally weakening.

While lower prices for pesticide products are certainly a key influencing factor, continued investment in upward integration has also brought about low asset utilization. At a time when Chinese pesticide companies are under pressure to perform, those with less ability to manage their supply chains tend to be more inclined to choose to invest in production capacity as well as in the production of upstream intermediates. Although this can, to some extent, improve the company’s ability to control the supply of upstream raw materials. But this could also trigger upstream capacity to become an inferior asset, which could result in the company being forced to divest the asset.

It is well known that in the field of innovation in large firms, internal innovation is no longer sufficient to lead the company’s development. This is mainly because the internal innovation of large enterprises is more about satisfying in-house inquiries. As for third-party external innovation companies and organizations, they satisfy various customer needs at one time. Third-party R&D and innovation firms have more obvious competitiveness under the challenge from the customer needs. This is why multinational companies have been relentless in acquiring innovative companies. In the case of biologics R&D collaborations, such external collaboration sourcing is more common. In short, external innovation is more dynamic.

As a result, they will face similar difficulties in the future for companies that have been upwardly integrated by stock-listed Chinese pesticide companies. Upstream raw material and intermediate companies mainly serve internal AI production. Since they do not directly compete in the market, such raw material and intermediate companies cannot be more efficient in R&D and innovation than external independent intermediate companies. Without severe pressure to survive, these subsidiaries will be gradually blunted in terms of management and individual thinking, thus dragging down the performance of listed companies.

In the short term, why are so many companies investing in upstream raw materials and intermediates? This is mainly due to the general lack of supply chain management expertise in Chinese pesticide companies. The deficiencies in corporate governance go far beyond the imagination of company executives. Collaboration among Chinese pesticide companies depend more on the ability of the founders. The founders of a company need to have multiple roles. They need to manage directly in a variety of areas such as sales, supply chain, production, and human resources. The lack of hiring and training of professionals is largely constraining Chinese companies from moving to the high asset utilization and high profit quadrants.

Increased asset-heaviness is making many Chinese pesticide companies face a more difficult transition. Some companies may need to lay out future product lines five to eight years in advance. However, at the critical point of product launch, the low price of China AI market makes it impossible to minimize the cost of depreciation of fixed assets due to meager profits. Some enterprises have good cash flow due to the deep collaboration with multinational companies, but the problem in front of them is how to select products and moving on investment in the future.

Chinese pesticide companies are becoming cautious about future product launches and capacity investments. Companies that already have heavy asset investments in the upstream may not be able to transform at all. This is mainly due to the fact that the transformation of the company requires resources, mainly the company’s human resources and capital. For companies that have paid huge sunk costs, recognizing the failures of previous strategies is inherently impossible. This is the fundamental reason why some large companies are phasing out of the market.

High tech CEOs often refer to the phrase “we are always six months away from bankruptcy.” This statement still has some warning significance in the era of economic downturn. As agrochemical industry practitioners, we should not just focus on Chinese listed pesticide companies. But looking at where companies are in the industry. We can make simple judgments about which companies are growing. The all-in decisions of CEOs and boards of directors are deeply affecting the industry’s landscape. And the changing landscape is also telling us that China sourcing needs to be forward-looking.

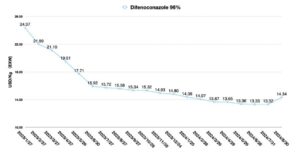

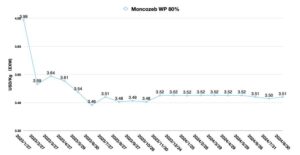

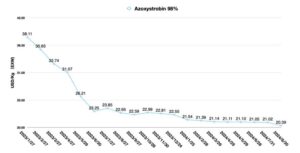

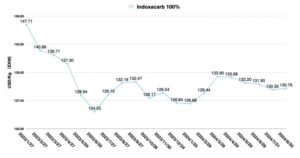

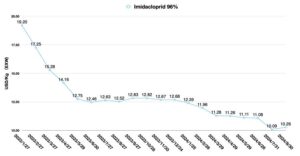

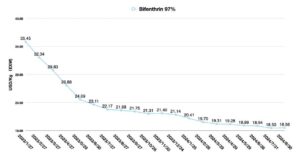

Price Influencing Factors

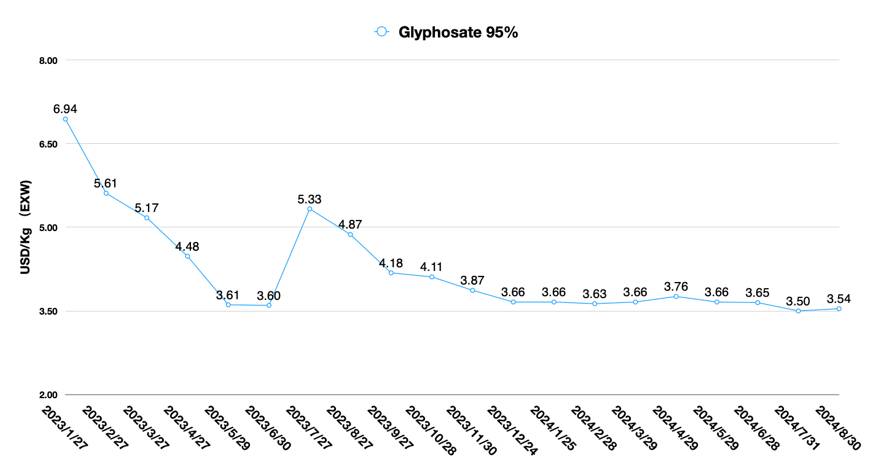

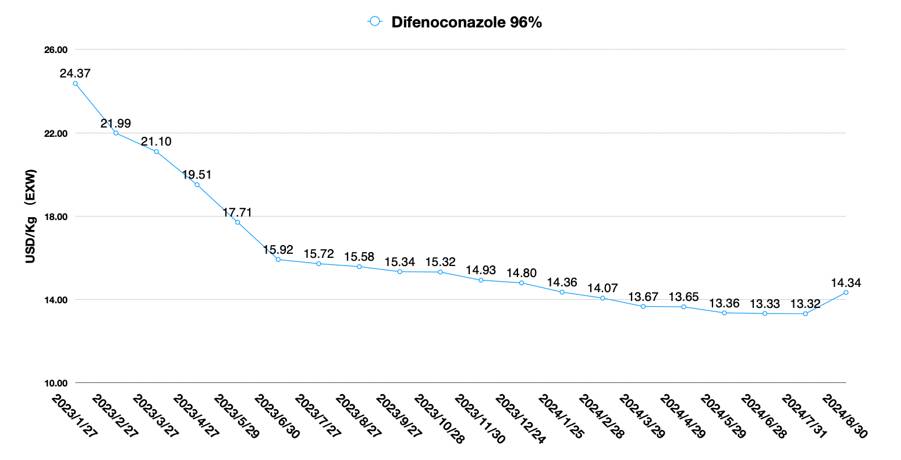

Recently, Wynca, Goodharvest, Xingfa, and Limin have issued price notification letters that will increase the prices of their agrochemicals by 5% to 15% (the range varies from company to company) based on the cost of the product and the assurance of quality.

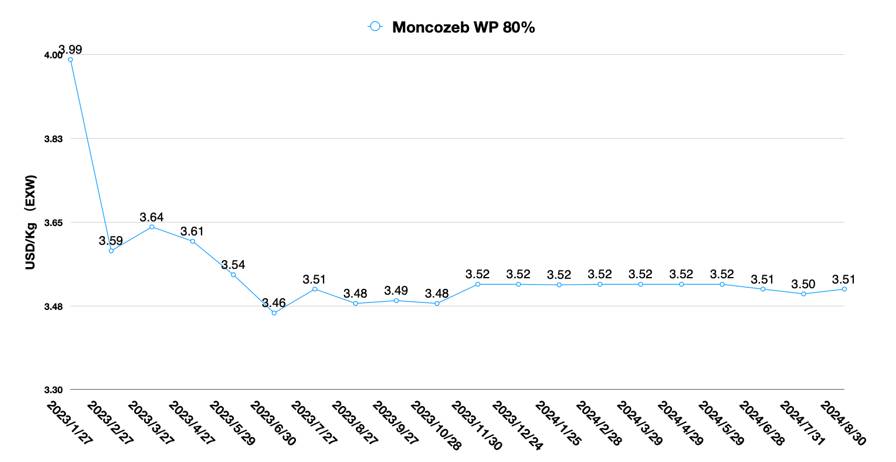

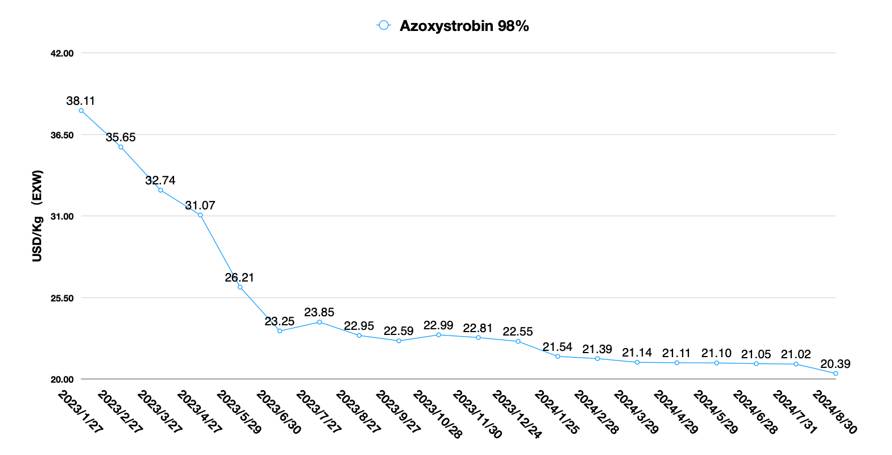

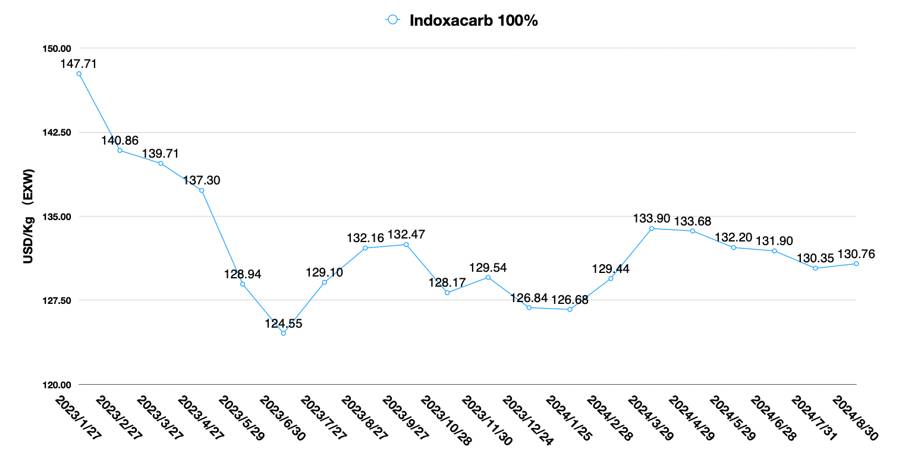

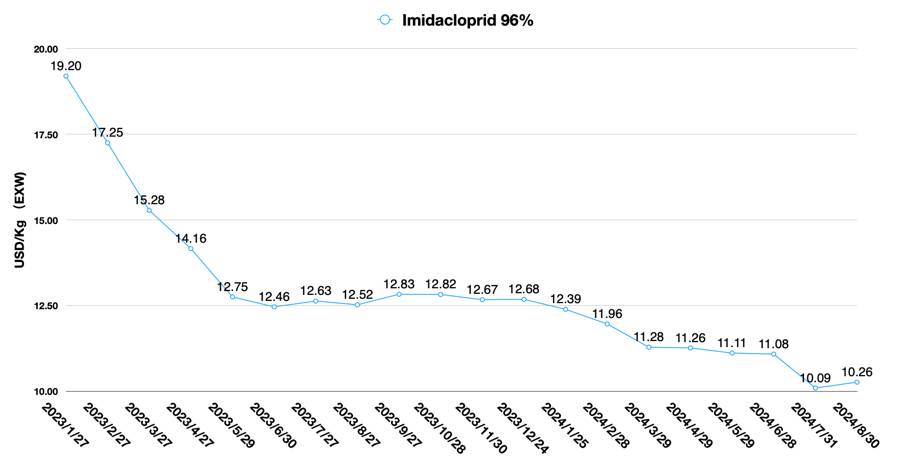

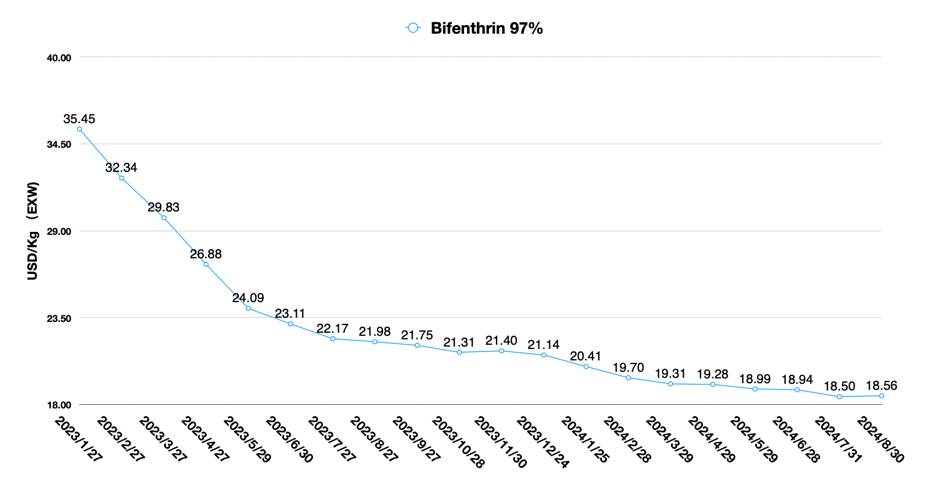

Prices of pesticide products in China are at historic lows. With the exception of some niche products, there is little room for downward movement in the prices of most AI products. To be honest, this is not good news for buyers. Because the low price will lead to more uneven product quality. Hoping to get low prices as well as high quality products at the same time is an almost mission impossible.

Some MNCs even require Chinese companies to make a long-term commitment to keep prices low in order to get contract. This behavior can be attributed to a lack of ability on the part of procurement team to manage Chinese suppliers. For Chinese teams with long-term growth potential and a high level of cooperation, releasing some price space may be a more permanent decision for the purchasing team. The phase of low prices can be considered a good opportunity to foster supplier loyalty. It is also an opportunity to build the company’s future China supply chain strategy. This window of opportunity is somewhat similar to China’s ambition to partner with global companies 20 years ago.

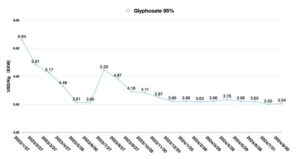

Wynca, Goodharvest, and Xinfa are the major glyphosate producers in China. It is normal and reasonable to adjust glyphosate prices appropriately to cope with the winter stockpiling in the Chinese domestic market starting in the third quarter. Due to the whip effect in the supply chain, the prices of upstream yellow phosphorus and key intermediates have started to rise steadily. This also shows that the uncertainty of downstream demand has already had an impact on the capacity rollback of upstream. However, in the glyphosate supply sector, the prices of Chinese companies also have to take into account the impact of Bayer’s global RoundUp strategy. Bayer has lowered glyphosate earnings for a long time, and the gross margin of sales is mainly dependent on the development of the seed business. Therefore, Bayer’s sales strategy could offset some of the demand for Chinese glyphosate from distributors and end farmers. Moreover, Chinese companies have already made high North American safety stocks. As a result, the price hike may have a greater impact on China’s domestic glyphosate price than on export offers.

On the other hand, the likelihood of a U.S. Federal rate cut in September is already more than 50%. U.S. monetary policy could have a profound impact on the global monetary and financial system in the fall of 2024. Fluctuation in the exchange rate of CNY against the U.S. dollar may make the price of glyphosate in China somewhat supportive. The dollar index may weaken in the third quarter of this year. And the CNY has more possibilities of being forced to appreciate. Once this happens, then the dollar offers of China’s pesticide AI will move higher. Therefore, the macroeconomic trend in the coming month is worth watching.

Transformation with an Asset Light

Since China’s accession to the WTO in 2001, Chinese suppliers have consistently borne the burden of heavy asset for both MNCs and overseas distributors over the past 23 years. The shift of production from developed countries to China by overseas customers has also provided global farmers with affordable prices for crop protection products. This has also enhanced the return on investment in genetically modified seeds and crop protection products for the world’s agriculture.

Nowadays, asset-heavy has become an issue that Chinese enterprises must face up to. Of course, we are not denying heavy assets. For example, in the aerospace, automotive and chip manufacturing sectors, heavy assets are an unavoidable barrier for companies. But barriers are not moats, and heavy assets cannot protect companies from competition, and it also cannot lead the companies to reach to higher profit market frontier.

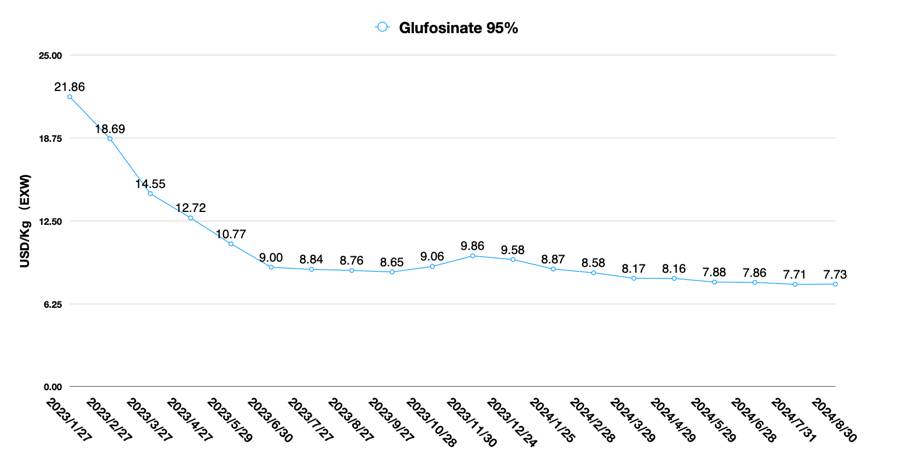

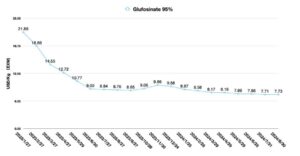

As can be seen from the financial reports of listed Chinese pesticide companies, relatively asset-light companies such as SinoAgri as well as Jiuyi have achieved considerable returns. In particular, SinoAgri has a strong advantage in supply chain management of Chinese AI suppliers. Unlike other companies that have integrated upwards, SinoAgri relies mainly on its financial strength and supply chain management capabilities. Lier’s heavy assets are a drag on its profitability in 1H2024 due to its huge investment in production capacity. And low price of glufosinate and flumioxazin are also key factors. While Yang Nong, as Syngenta’s core supplier in China, can ensure its net profit. But Yang Nong’s continued large-scale investment in the industry chain is also a drag on its profitability per asset. Yang Nong is a special case that we don’t need to mention too much.

Horizontal Integration is the Future

For most Chinese pesticide enterprises, what needs to be considered now is how to innovate in the cooperation mode and management of the upstream supply chain, to make full use of the capacity investment in the Chinese pesticide market. Horizontal integration is the future of Chinese pesticide enterprises.

Nutrichem is currently facing a difficult situation. The closure of the Yancheng South production base and the investment of assets in the Shangyu were two key decision points for the company. During Nutrichem’s period of rapid growth (2008-2012), the company had the advantage of managing its external supply chain, an asset-light strategy that has made it one of the most competitive pesticide companies in China over the first decade of the 21st century. Horizontal integration has allowed Nutrichem to continuously develop its product lines to meet customer needs. This had been the cornerstone of the company’s sustained growth in turnover and net profit.

After being hit hard by the shutdown of Yancheng South, Nutrichem was in dire need of restoring supply. The company’s strategic direction shifted to upward integration. Upward integration continues to crowd out the company’s resources for new product development to a certain extent. Not only R&D, but also the company’s overseas registrations and new product launches require financial and human resources to support. But Nutrichem has been forced to invest in capacity with limited resources.

On the other hand, changes in the external environment were also a trigger for Nutrichem to turn to asset-heavy investments. The product development capability of Chinese pesticide enterprises has been gradually strengthened, and the pace of the multinational companies’ chemical pesticides on the market has been gradually slowed down. The dependence of Chinese domestic producers on Nutrichem’s technology licenses continues to decrease. As a result, Nutrichem has faced strong market competition over the past five years. These external factors also contributed to the stagnation of Nutrichem’s R&D in the five years following 2013.

As the Nutrichem team lacked the ability to manage the supply chain effectively in the long term, they had to choose to invest in capacity itself, which is why Nutrichem acquired Shandong Fuer and Kaisheng New Material. Tight raw material supply during the COVID justified upward integration for a short period of time. However, the continued capacity release of Chinese AI dealt a heavy blow to Nutrichem.

Losses and concurrent capacity investments have caused the company to tighten its funds in the R&D area. The company’s organizational restructuring will also be accompanied by layoffs. For a company that uses R&D as a core competency, this is a strategic orientation that is like climbing a tree to find a fish. Without subsequent sustained production of new products, Nutrichem could be in a deeper dilemma in 2024.

FlagChem, GreatChem, and Hailir’s performance in the first half of 2024 demonstrates their growth potential. It is worth noting that the most important characteristic of companies with potential growth possibilities is a cautious approach to upward integration. These companies are unlikely to have the same combination of financial strength, upstream raw material strength, and horizontal integration capabilities as Xinfa. However, the resilience of their management teams and their keen sense of the market allow them to remain competitive in terms of process and production innovation.

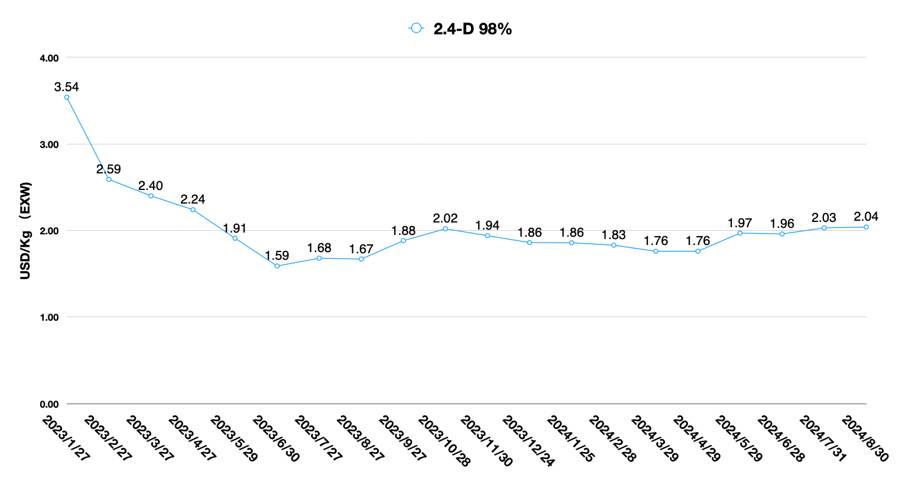

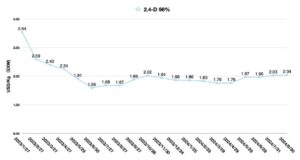

Unlike Hebang, which insists on investing in glyphosate and upstream raw material capacity, Xingfa has the ability to integrate horizontally. Horizontal integration is evident in the company’s strategic intent, which shows the advanced strategic investment thinking of Xingfa’s management team. Xingfa is currently laying out 2,4-D, L-glufosinate, and is involved in the production of nicosulfuron with Zibo NAB. In addition, Xingfa has recently entered a strategic cooperation with Wanhua Chemical to gradually enter into the new energy business development and capacity layout. Xingfa’s supply chain management is more concerned about how to utilize external resources to match with its own horizontal integration strategy. In short, horizontal integration is the core of enterprise management wisdom and sustainable growth potential.

How will Chinese listed pesticide companies adjust their strategies at the tail end of 2024? Decision makers in the industry seem to keep repeating historical blunders. Only, the track has changed, the people making the decisions have changed, and history has merely changed to a new theater, but the script remains the same.

Horizontal integration may become a strategy for many companies in the next decade. But we must remember that horizontal integration is linked to the continuous exploration of market growth frontiers and the matching of target customer development strategies. At the end of the comments, it’s still about corporate leadership’s judgment and response to the current situation. The CEO’s leadership is being sorely tested in these downward economic times.