China Price Index: A Long-Term Growth Strategy in Global Crop Protection Requires Focus, Innovation and Rapid Change

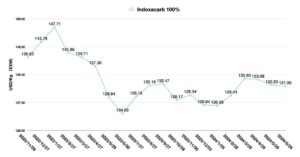

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also outlines why focus, innovation, and rapid change are more important than ever in 2024 for both Chinese pesticide companies and the multinationals.

The data released by the General Administration of Customs shows that the total value of China’s import and export of trade in goods in the first half of this year amounted to 21.17 trillion yuan, an increase of 6.1% year-over-year. Among them, exports amounted to 12.13 trillion yuan (around USD $2.98 trillion), up 6.9%; imports amounted to 9.04 trillion yuan (around USD $1.27 trillion), up 5.2%. China’s exports to the U.S. in the first half of the year reached to 1.71 trillion yuan (USD $240.85 billion), an increase of 4.7%, the trade surplus with the U.S. 1.14 trillion yuan (USD $160.56 billion), expanding 8.4%. In the process of gradual recovery of global demand, China’s exports still have a certain degree of resilience.

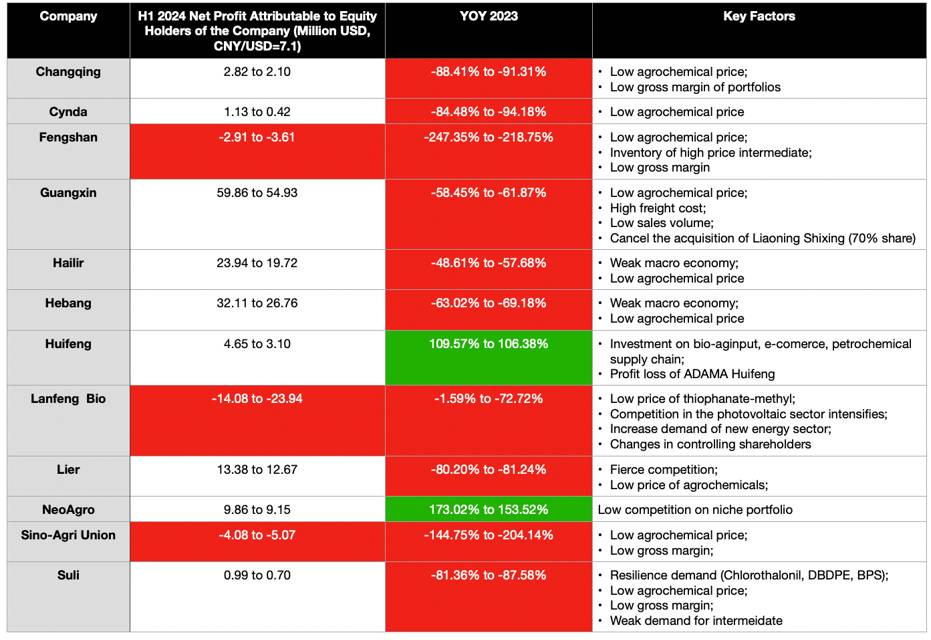

Listed Chinese pesticide companies have also recently announced their earnings forecasts. In the first quarter, China’s pesticide companies were affected by seasonal factors, exports were not as expected. However, the release of demand in the southern hemisphere after March, offset part of the decline in the performance of Chinese pesticide companies.

On July 12, the market freight rate for export from Shanghai port to the South American base ports (sea freight and sea freight surcharge) was USD 8,760/TEU, an increase of 110.93% compared with April freight rate. The increase in freight rates represents to some extent a strong recovery in South American demand. Since July, the South American demand season has been winding down. The supply market has returned to its usual silence. Reduced production rate or even production stoppage has become the norm for Chinese pesticide enterprises, especially small and medium-sized pesticide enterprises.

Among these export-oriented pesticide AI producers, resource advantage and scale advantage remain key to ensuring profitability. Guangxin, thanks to its phosgene resources, can still post a sizable net profit in absolute terms, although net profit declined in 1H2024 compared to the same period in 2023. Hebang can ensure a certain level of net profit while actively investing in production capacity, mainly due to the company’s investment in the upstream industry chain and infrastructure which gives it both a cost advantage and a scale advantage. Moreover, the return of overseas demand in Q2 2024 has brought some support to the Hebang’s performance.

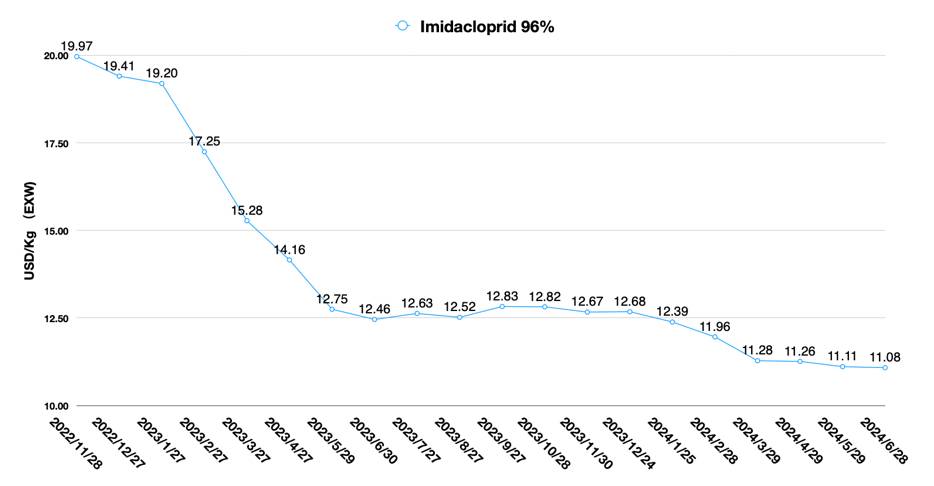

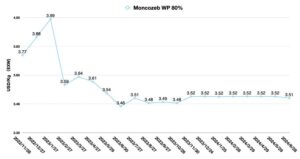

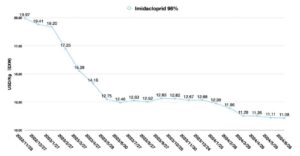

Hailir’s net profit is still impressive, and prothioconazole is still the key pillar of the company’s performance. Lanfeng is in a period of corporate transformation, so they need time to reorganize their product lines. Sino-Agri Union’s performance is mainly limited by the lack of demand for neonicotinoid insecticides. Fengshan’s relatively old portfolio, slow development of new products, and lack of growth potential are key issues for the company.

Under performance pressure, some underperforming Chinese pesticide companies are likely to shift their strategies and make management changes.

First, the strategic shift of Chinese pesticide enterprises has been obvious. In the case of major and long-term uncertainties in the main agrochemical business, many companies with resource advantages and financing capabilities have turned to business diversification. But this is a defensive strategy in a period of market volatility, never a growth strategy.

It is not wise to enter other tracks under the inherent mindset of these pesticide companies. In the agrochemical business, some companies have not adapted to changes in market demand for product category development and increased their relative competitive advantage. The same mistakes could be also made by the management teams in other tracks. Strategic mistakes will lead to eventual strategic failures in new tracks. Some listed companies will eventually have to abandon the layout of the new track, for example, some pesticides listed companies to withdraw from the new energy field of investment, is the obvious consequences of strategic mistakes.

In contrast to business diversification, some of the successes of multinational companies are worthwhile for a case study. For example, Corteva has been streamlining its business for the past three years. In addition to continued R&D in seed traits with Enlist brand at its core, Corteva has successfully introduced a biological portfolio in channel depth and acquired channel resources through the acquisition of Stoller, which has resulted in good cash flow and expansion of business growth margins. Although Corteva has not aggressively expanded its investment in new compound innovation, the company’s focus on R&D innovation and rapid change and growth in the pan-agriculture sector has enabled them to build a strong business model. Corteva’s growth strategy is clearly more resilient in the long term than the last century diversification philosophy of other crop protection companies.

Secondly, some Chinese leading pesticide companies will choose management optimization. Of course, this is done based on organizational structure optimization. The core operation of the so-called organizational structure optimization is layoffs. Streamlining teams, especially those that are not profitable, will be the main strategy. The R&D team of some companies may be the priority target of layoffs. Currently, the number of collaborative projects between Chinese pesticide companies and multinational companies is decreasing at an accelerated rate compared to the rapid growth period of pesticide industry in China (around 2006-2012). Since R&D teams are mainly project-based, if Chinese pesticide companies no longer develop business in new category markets, the matching R&D teams will no longer be relevant. This is not only happening in Chinese pesticide companies, but also in multinational companies.

We need to be clear that it is common for companies to optimize their R&D staff. But the question is, after optimizing the organizational structure, does the management of the company have a clear understanding of where the growth areas of future market demand are? And how close are they to the growth frontier? We have seen Tesla and NVIDIA quickly find new teams after organizational restructuring. The new headcounts are closely related to future market demand growth areas, such as the rapid growth in artificial intelligence. This is the core issue in front of China’s pesticide management teams.

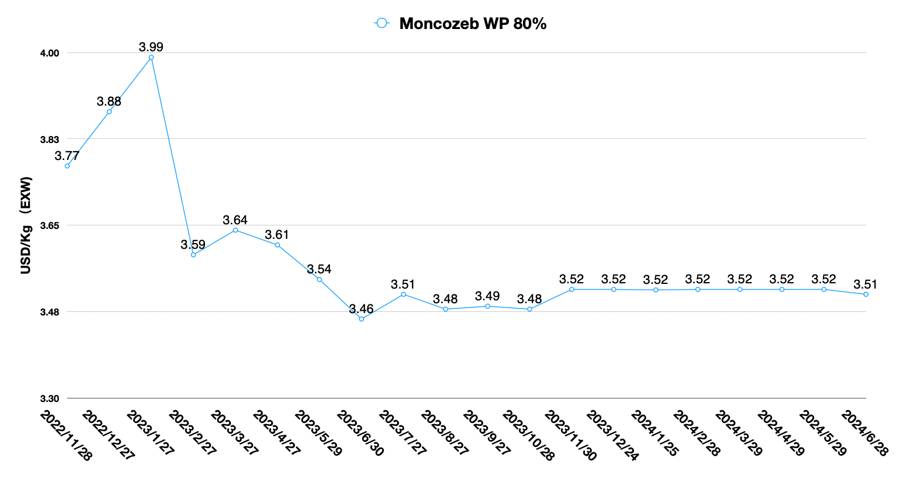

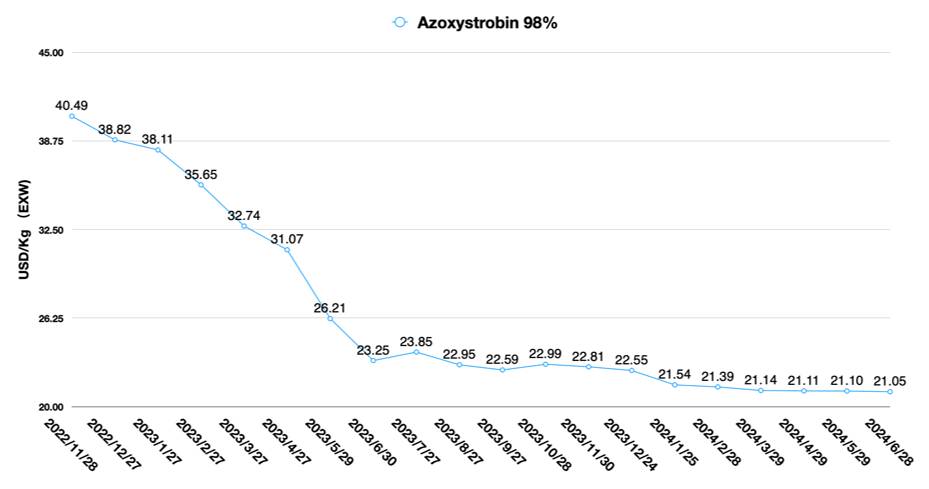

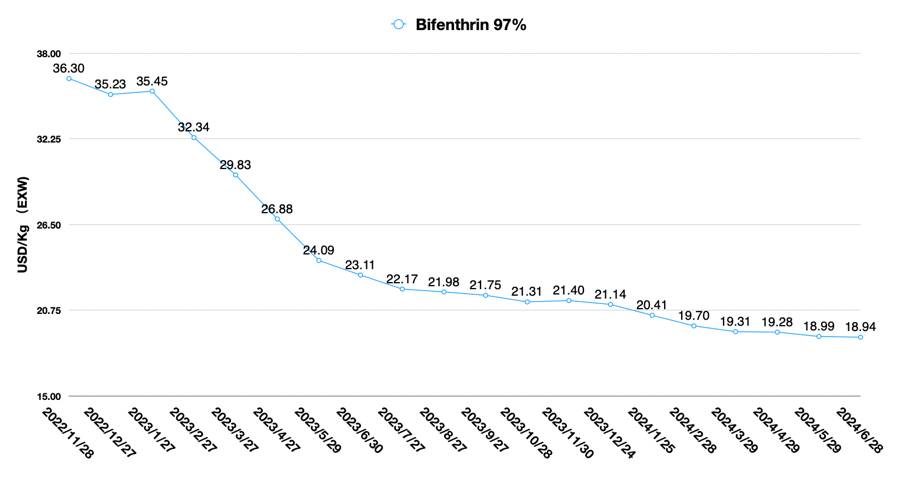

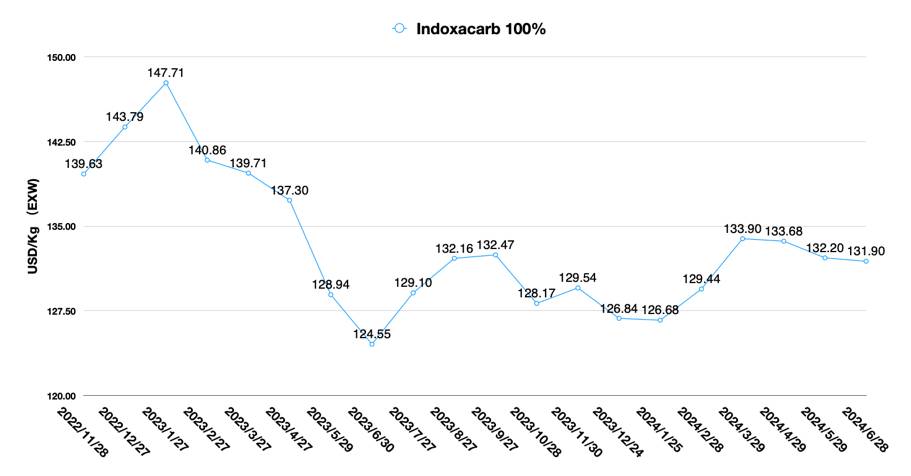

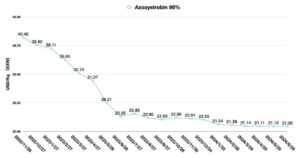

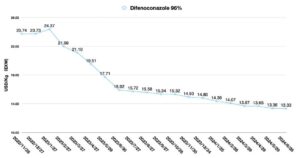

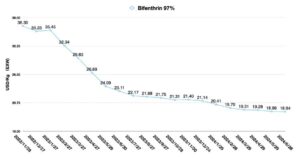

As far as the existing business of Chinese pesticide companies is concerned, we do not see the potential for long-term growth in the future. At the very least, growth is becoming more and more distant for Chinese pesticide companies at a difficult time when the prices of most key active ingredients are hovering at low levels for a long time.

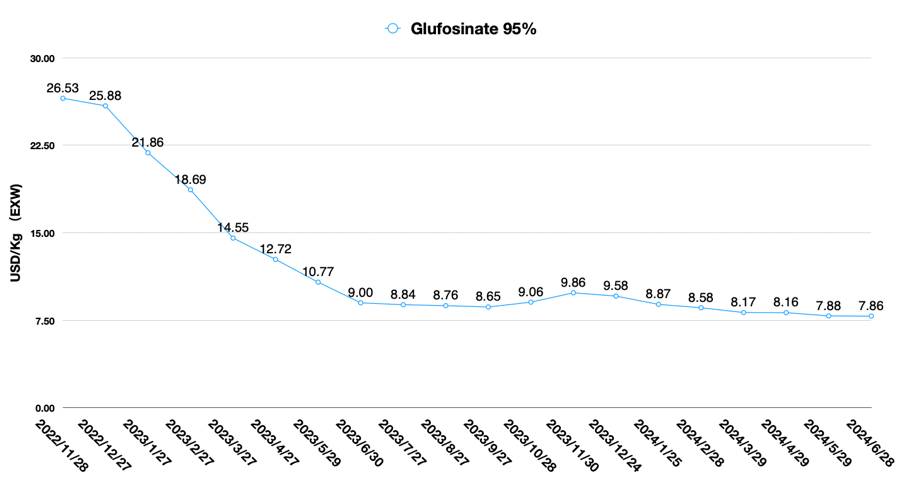

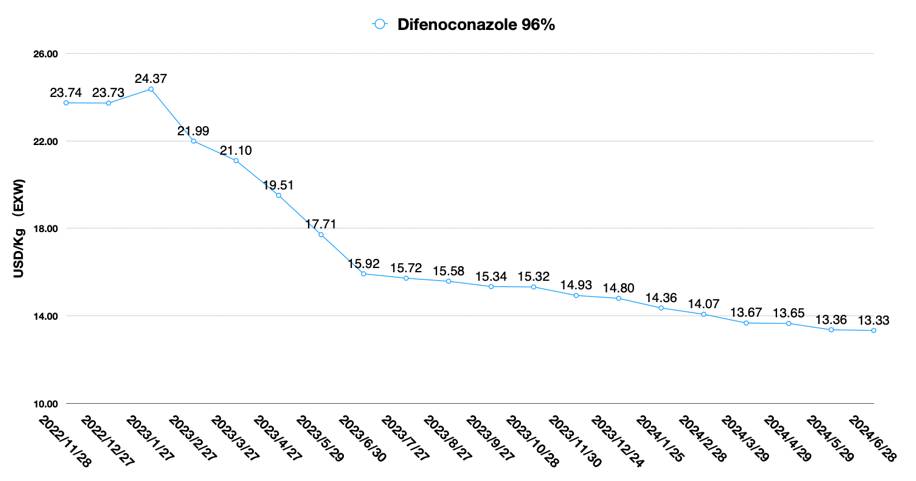

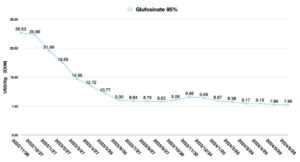

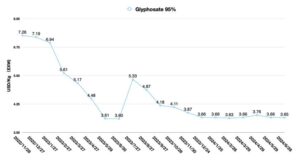

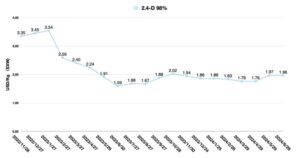

Market demand is sluggish, and supply is dominated by large enterprises. For products with serious overcapacity, such as the producers of glufosinate, prothioconazole, and difenoconazole, the SMEs’ (small and medium-sized enterprises) operation rate was further reduced, and even production shutdowns occurred. The dilemma for SMEs is to vacillate between the decision to scale up or abandon that product. For some startups, the need to tie up key customers as soon as possible is even greater in the early stages of product launching. This increases the opportunity cost for the strategic sourcing team to make decisions. The strategic sourcing team’s decision-making backwardness further constrains the certainty of growth for Chinese pesticide companies.

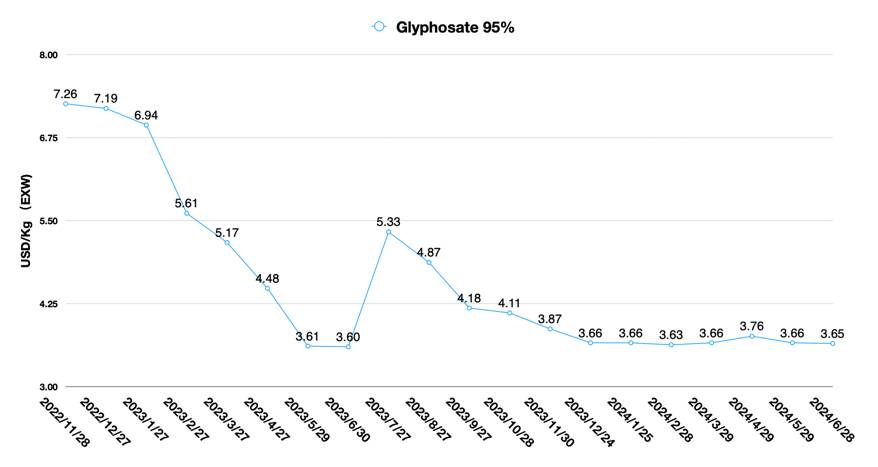

For strategic sourcing teams in multinational corporations, it is not easy to make forward-looking predictions. News of capacity investments in new AIs and intermediates is plentiful and difficult to discern. The price of AIs has long since moved away from cost accounting and toward a market-based pricing mechanism. Market trends are shifting from value determines price to sales strategy determines price, with glyphosate’s current historic lows being a clear case in point. Limited demand is causing almost all sales teams to be in a state of stress. The balance of commercial negotiations for Chinese pesticide companies has shifted.

All of this information may inspire a pessimistic feeling—but that’s not the full picture.

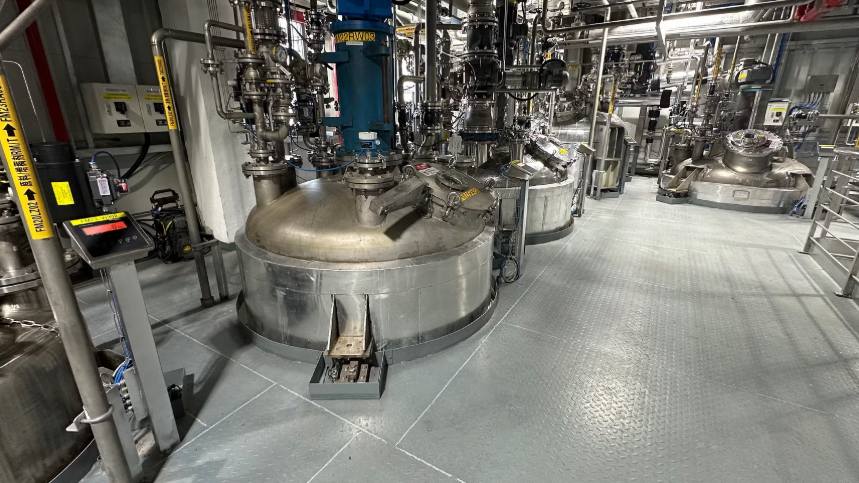

In the face of such an intricate environment, perhaps there is a breakthrough. R&D and resilience of supply chain management are always the core criteria for pesticide manufacturers. The problem-solving ability of R&D teams is the cornerstone of a stable supply.

Having chemical R&D capability is not enough to solve the problem, as I have personally experienced. Some chemistry PhDs who have returned from overseas may propose possible synthesis routes that cannot be realized in actual production, or the possible synthesis routes may be constrained by intermediates, catalysts, and other limitations that prevent them from being realized. Then the R&D team needs to work with the operation team to find tools that can be used in the Chinese supply chain to creatively solve the problem. R&D directors in multinational companies may question the level of R&D in Chinese companies. But since you haven’t grown up in the Chinese chemical supply chain, it’s hard to imagine the unique problem-solving approach of Chinese chemists.

If someone wants to analyze business relationships, then they need to track the flow of money. In the same way, to analyze the future landscape of Chinese pesticide companies, then it is necessary to pay more attention to the changes in the R&D teams of Chinese pesticide industry. In all likelihood, the most competitive pesticide supply companies in the future may have yet to emerge from the China market. Powerful teams may develop and grow in China, or they may also cooperate with multinational companies, both sides to establish a production base in overseas, creative realization of China overseas is also a possible option.

During the past two decades of rapid development of the pesticide industry in China, the lack of strategy on the part of the buyers’ strategic sourcing teams became more and more evident. In 2024, a generic company had to face huge losses due to fluctuating prices of AIs in China. The main reason for the loss was the disconnect between the Chinese sourcing strategy and company’s marketing strategy. There is no need to discuss the details of the poor decision-making. What needs to be emphasized is that the strategy teams of multinationals have not been more focused on long-term growth strategy. There have been instances where Chinese suppliers have been lobbied to temporarily expand capacity to make up for short-term supply shortfalls. But when the supply chain whip effect is realized, the lack of demand leads to idle capacity at Chinese suppliers. This is a lose-lose situation for both sides: the Chinese company loses cash and incurs opportunity costs, and even misses out on an IPO timing, while the multinational company loses reputation in China market.

Focus, innovation, and rapid change are more important than ever in 2024, when the world is changing at an accelerated pace. It’s relatively easy to draw conclusions though. But the real difficulty is how to execute. Socrates once famously said, “An unexamined life is not worth living.” Similarly, an unexamined strategy is likewise not worth executing.