Crop Protection Market in Southeast Asia

Scroll Down to Read

By Derek Oliphant

Co-Founder

AgbioInvestor

This article will outline the key crop protection markets in Southeast Asia, examining the current situation as well as the key future trends expected to influence market development in the coming years.

Market values are Agbiolnvestor’s estimates of the value of crop protection products used on the ground in the agricultural year, expressed in U.S.$ terms at the ex-manufacturer level. The agricultural year is approximately October to September, for example ‘2023’ refers to the value of products used on the ground between October 2022 and September 2023.

Introduction

The Asia Pacific region is a diverse assortment of countries located in the Asian continent and in the Pacific regions. This conglomerate region is amongst the most significant globally in terms of crop protection market value, representing more than 30% of the global total ($20.331 million out of $74.806 million global total in 2023).

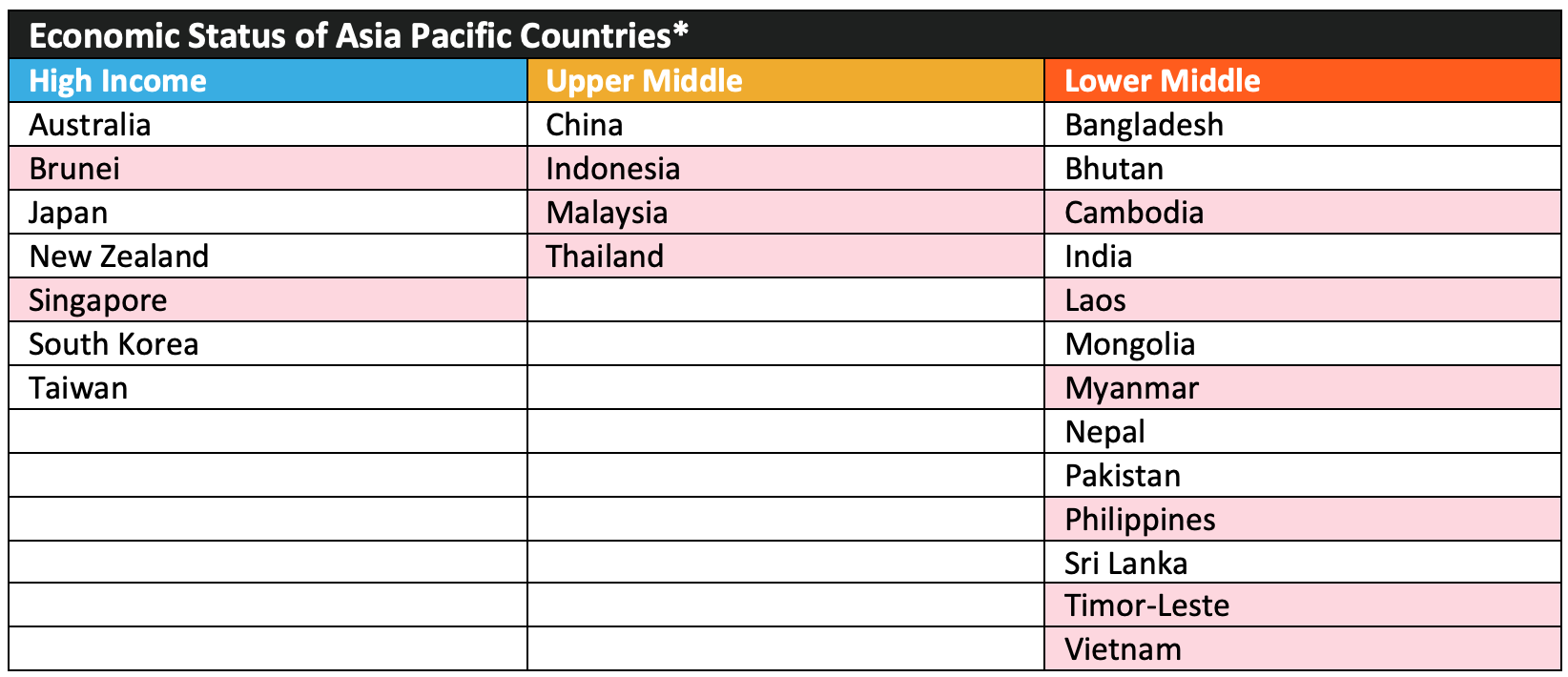

Within this, the most significant markets for agriculture and subsequently crop protection, are China, India, Japan, and Australia. The table below highlights how the most agriculturally significant Asia Pacific countries are grouped in terms of economy, according to the Food and Agriculture Organization of the United Nations (FAO): Lower Middle, Upper Middle, and High Income. For the purposes of this report, the countries categorized as part of the Southeast Asia region are highlighted.

While there are two Southeast Asian countries identified as High Income, these are very minor in terms of agriculture and subsequently crop protection. The most significant crop protection markets in Southeast Asia are represented by Indonesia (Upper Middle Income) and Vietnam (Lower Middle Income).

Southeast Asia Crop Protection Market

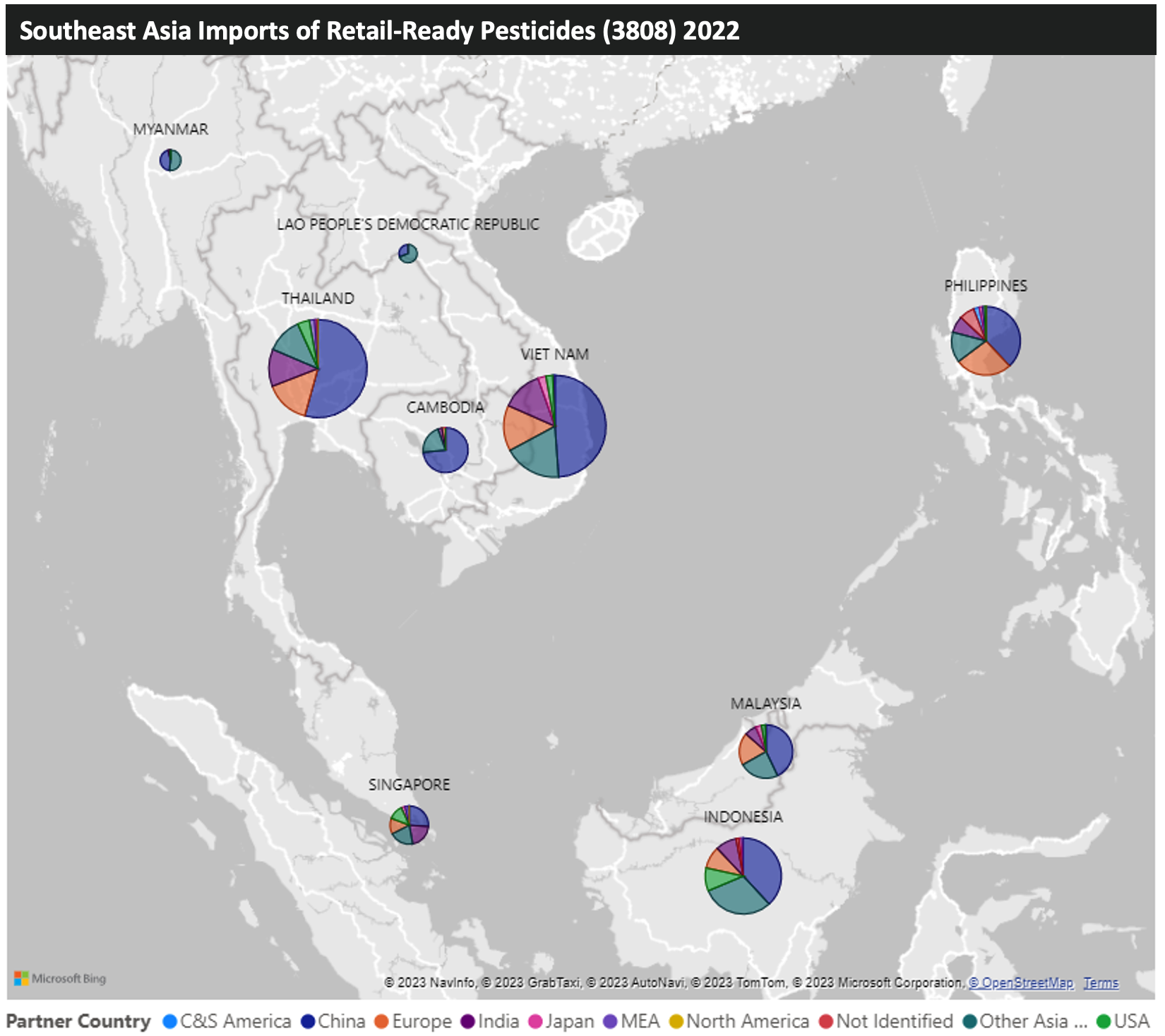

Within Southeast Asia, much of the crop protection product requirements are sourced from China. Formulated product imports are more common, although local formulation does take place in some countries, notably Indonesia, Vietnam, and Malaysia. These local formulators will often import technical material from China then export the formulated products to other countries in the region where local formulation is not possible. Product synthesis is not as common, given that China is a reliable and relatively low-cost option for this activity, although there is some limited involvement in some countries, notably Malaysia. The figure below shows the breakdown of the import of formulated products for each country, highlighting the importance of Chinese material in the region:

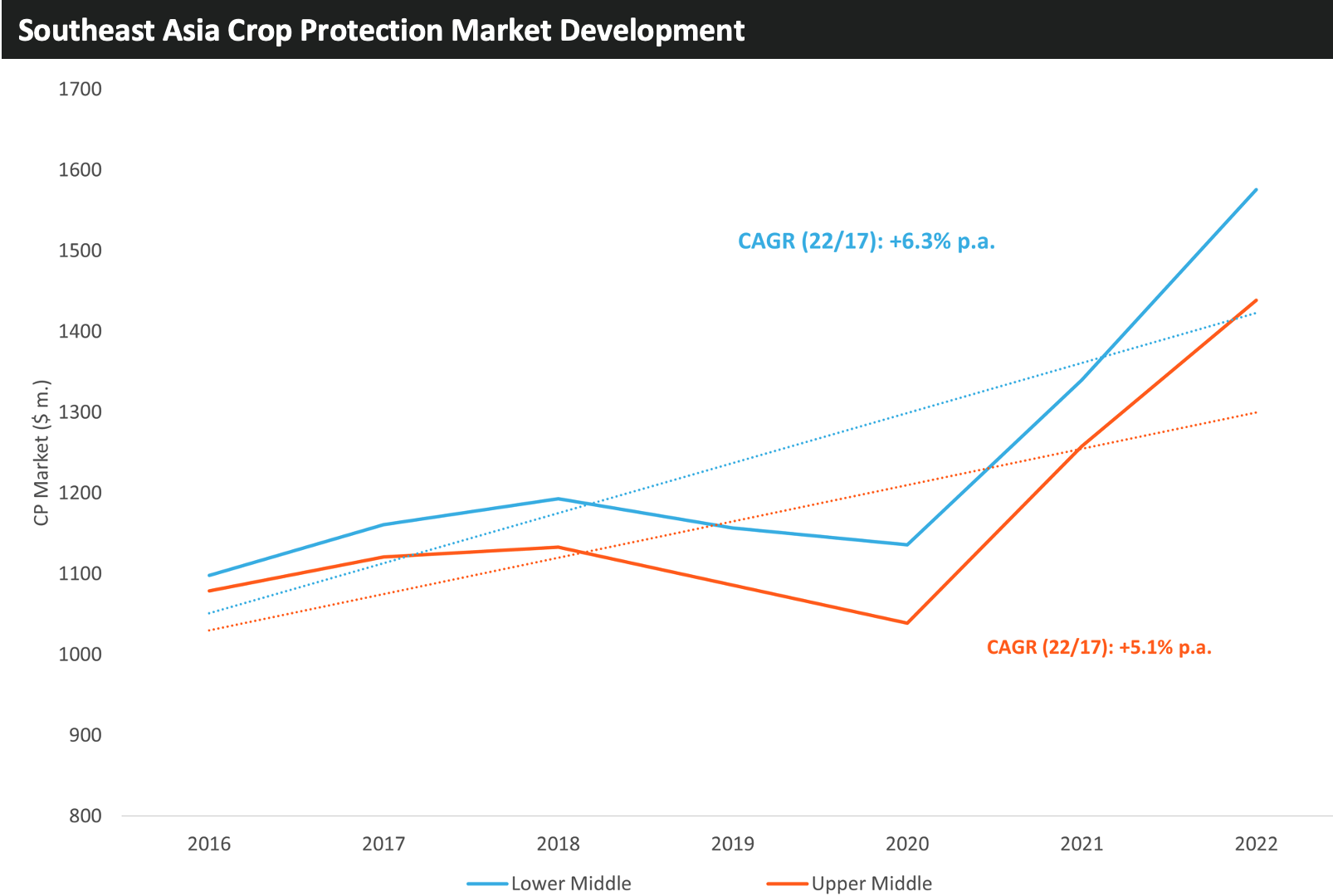

The value of the crop protection market in Southeast Asia in 2022 was just over $3 billion, with this consisting of approximately $1.6 billion from Lower Middle Income countries and approximately $1.4 billion from Upper Middle Income countries. In recent years, the value of the crop protection market in Southeast Asia has outpaced that of the overall industry, with the strongest growth coming from Lower Middle Income countries, as highlighted in the figure below:

INDONESIA

Overview

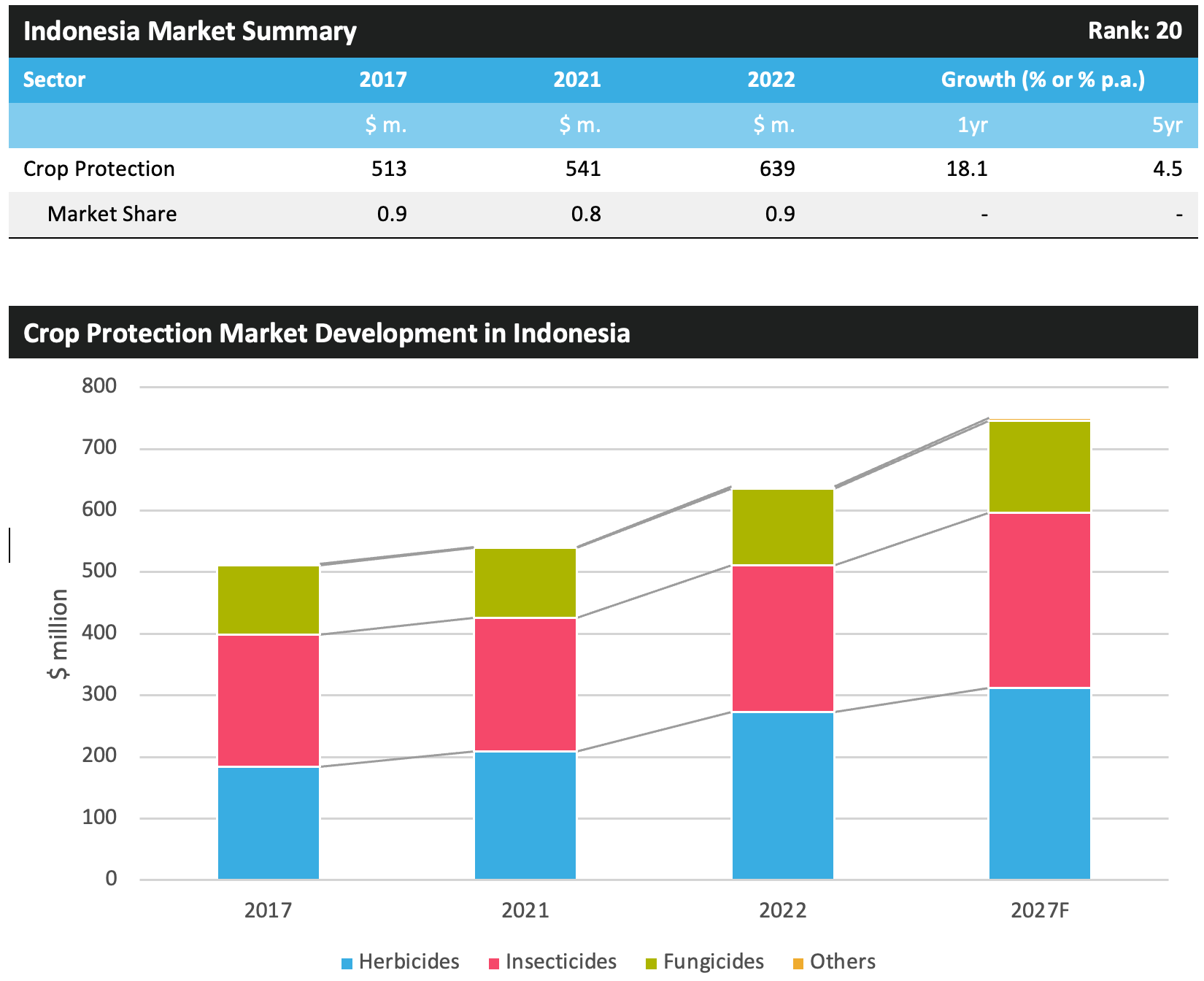

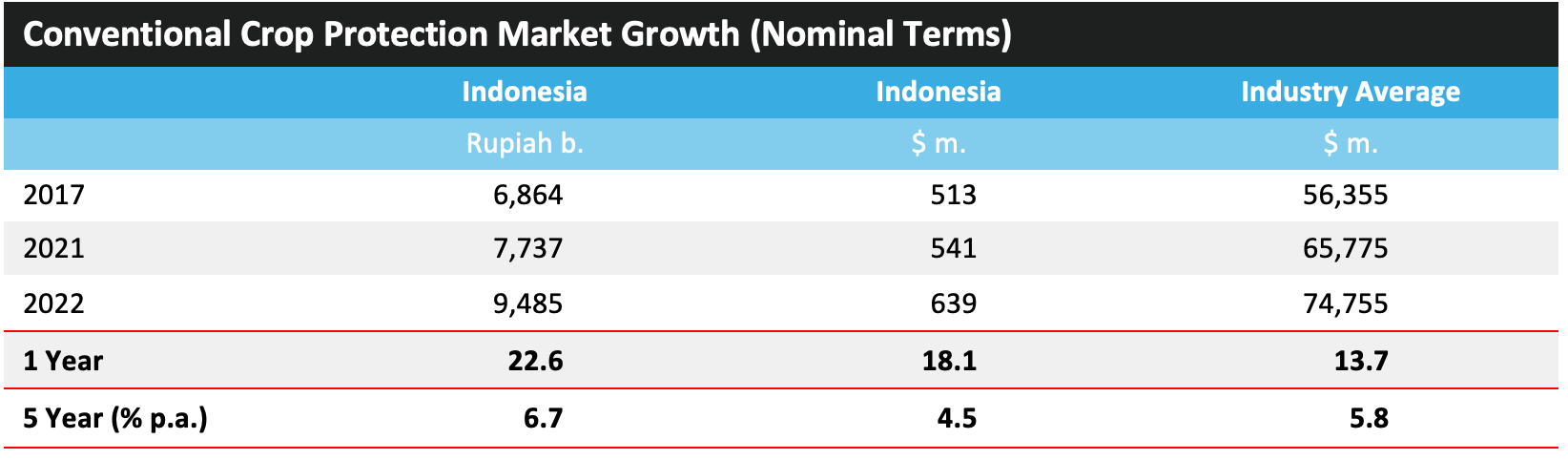

The crop protection market in Indonesia increased by 18.1% in 2022 to reach a value of $639 million, making the country the 20th largest in the global crop protection industry in terms of value. In local currency terms, the market increased by 22.6% to IDR 9.485 billion.

Indonesia is major producer of a wide range of agricultural tropical products, and although agriculture’s share of the country’s gross domestic product has declined markedly during the last five decades, it still provides income for the majority of Indonesian households. In 2022, while agriculture accounted for only 12.4% of the country’s $1.32 trillion GDP, the sector employed approximately 29% of the entire workforce. Indonesia has a relatively large and steadily growing population, which in 2022 increased by 0.6% to reach 276 million, contributing to rising demand for agricultural produce. Much of the growth in population has been in urban centers, with the Indonesian urban population now accounting for 58% of the country’s total population.

Indonesia’s mountainous terrain and position straddling the equator enables cultivation of a large variety of crops, with the most important arable crops in terms of area being rice, maize, cassava, and soybean. The country also grows a wide array of fruits and vegetables, with the most important being mangos, onions, chilies, peppers, bananas, and citrus, and the country also has an important plantation sector led by oil palm, with rubber, coconut, cocoa, coffee, and tea also important.

The planted areas of all key arable crops have been in a trend of decline. Between 2017 and 2022, the area under rice has fallen by an average of 1.2% per annum, while the areas of maize, soybean and cassava declined by an annual average of 4.7%, 16.4%, and 4.1%, respectively, between 2016 and 2021. Production has followed a similar trend, with output of all key arable crops declining in the latest five-year period.

Indonesia’s agricultural activities are generally determined by the rainy and dry seasons. The main rice crop is typically planted in the rainy season around October to February, followed by a second rice crop in March to June. This is usually followed by a third crop cycle with crops such as maize, soybeans, peanuts or sweet potato. Cassava has a longer cultivation period than other crops (usually around nine months), during which time farmers could cultivate multiple other crops, which has recently been a factor in the declining area for the crop.

Palm oil is the leading agricultural export from Indonesia, although other commercial-scale plantation crops such as coffee, tea and cocoa, as well as spices and fruit and vegetables are also important. Palm oil production capacity has increased significantly over the last decade, with use for biodiesel becoming increasingly important. Biodiesel production is organized by a state run organization for both domestic consumption and exports, and the Indonesian government has put a number of measures in place to develop the sector. In February 2023, the country increased its mandatory palm oil-based biodiesel blending mandate to 35%, up from 30%, with plans to raise this further to 40% at an unspecified time. Indonesia’s biodiesel mandate program is financed by levies placed on palm oil exports. Since 2015, the amount of levy fund utilized for the biodiesel program reached IDR 144.59 trillion ($9.2 billion). In 2022, total levies were estimated at IDR 34.59 trillion ($2.2 billion), down from IDR 71.6 trillion ($4.6 billion) in 2021.

The Indonesian crop protection market increased by 22.6% in 2022 to reach Rupiah 9,485 billion, equivalent to an increase of 18.1% in U.S. dollars to $639 million. Growth was driven by high agrochemical prices, as well as a higher planted area of rice, which increased by 1.8% to 14.8 million hectares.

As mentioned, the presence of La Niña conditions meant that much of southern Indonesia experienced wetter-than-normal weather, while northern regions were impacted by much drier conditions. Maize production is reported to have reached record levels, supported by a higher planted area and favorable growing conditions.

In U.S. dollar terms the crop protection market in Indonesia increased by an annual average of 4.5% between 2017 and 2022, only slightly behind the wider industry average. Growth in the market has benefited from increasing demand for domestically grown crops, increased government support for agriculture, and economic growth. This has resulted in an increase in intensity of product usage, with a higher number of farmers being able to afford crop inputs.

Outlook

An increasingly large and developing population means that demand for food is rising in Indonesia, and this is expected to benefit the agrochemical industry, with more area being required to meet the needs of the population and emerging middle classes. This could potentially drive growth for increased usage of crop protection products to produce high quality fruit and vegetables. A recent trend of increasing wheat imports has been evident, as people switch from rice to bread as a staple, a situation often associated with developing economies. Although this has the potential to have a depressive impact on demand for rice, and subsequently the rice agrochemical market, the increasingly large population is expected to maintain demand for rice. Self-sufficiency driven policies from central government are expected to help drive growth with planted areas expected to increase for crops such as rice, maize and soybeans. Fungicide use has been rising in the country, and with the current maize fungicide market being extremely limited, there remains strong potential for growth in this sector.

Another factor which is expected to benefit the market for crop protection products in the country is the increasing cost of labor. This is leading to many growers to switch away from manual tasks such as hand weeding toward increasing usage of crop protection products. This situation can be expected to continue in the short term, with product use intensity still some way behind many other nations in the region.

In an effort to increase crop production and ensure food security, Indonesia has started to encourage the use of genetically modified (GM) crops, specifically soybeans. Since 2018, the level of soybean production within the country has dropped significantly, with imports being cheaper than domestically produced soybean. By encouraging farmers to use GM seeds, the government hopes to increase soybean yields so that dependence on imports is reduced. GM maize has also recently been approved for cultivation in the country, with initial areas of 15,000 hectares planted in 2022. In 2023, Bayer launched the maize variety DK95R, which possesses tolerance to the herbicide glyphosate. Other traits approved for cultivation in Indonesia include Bayer’s NK603 herbicide tolerance trait and Syngenta’s GA21 (glyphosate tolerance) and Bt11 (lepidopteran pest resistance) traits. Uptake of GM technologies has the potential to impact the crop protection market, although Indonesia’s current GM area is too small to have any noticeable impact on product usage and market value.

The rice crop protection market can also be expected to continue to rise in the near term, driven by increasing demand. The country is generally self-sufficient in rice and can normally meet requirements with domestic production, although imports are still utilized in order to keep internal stocks replenished. With the need to feed a rapidly expanding population, there remains the prospect that domestic production could soon not be sufficient to meet demand unless yields increase substantially.

In addition, small-holder farms dominate the rice production sector in Indonesia, with the average farm size being only 0.8 hectares. As a result, in recent years the Indonesian Chamber of Commerce in cooperation with local companies has initiated partnership programs with smallholder rice farms to increase production through the use of new technologies and financing aids. This can be expected to boost the value of the rice crop protection market moving forward.

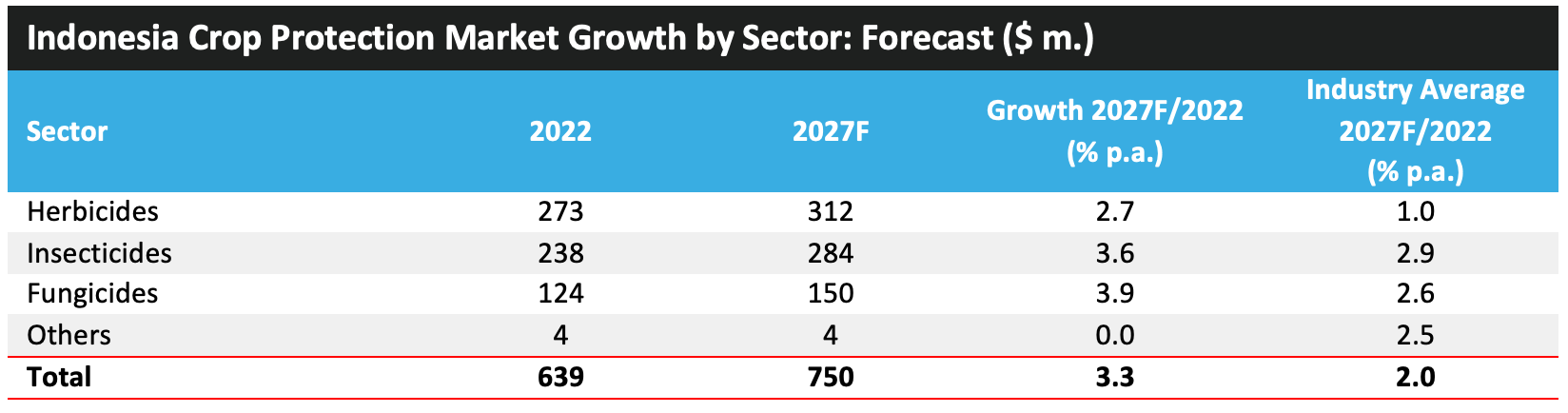

As a result of the above factors, the value of the Indonesian crop protection market is expected to grow at an average rate of 3.3% per annum between 2022 and 2027 in dollar terms to reach $750 million.

VIETNAM

Overview

As with several other Southeast Asian markets, Vietnam has been developing rapidly over recent decades, with a significant increase in GDP partly being driven by the increasing importance of industries other than agriculture, and an associated increase of the urban population as people relocate to cities for employment. Despite this, agriculture remains an important part of the Vietnamese economy, accounting for 11.9% of the country’s $408.8 billion GDP in 2022. Of the country’s 98.2 million people, approximately 61% lived in rural areas in 2022, down from over 75% at the turn of the century.

Vietnam’s agricultural sector is export-led, with the key commodities being rice, coffee, rubber, bananas, sugar and fruit and vegetables. Government-led initiatives have driven the importance of exports to the Vietnamese economy and have transformed the country from being a net rice importer to becoming one of the leading exporters of the crop. The primary agricultural areas in the country are the Mekong and Red River deltas in the South and North, respectively, however, the nation’s mountainous terrain allows for the cultivation of a wide variety of produce, with the Northern midlands and mountain areas, Northern Central area and Central coastal area and Central Highlands important for a variety of crops. Climatic conditions vary geographically, with the North experiencing defined rainy and dry seasons, and the south experiencing more tropical conditions.

By area, the most important field crop in the country is rice, followed by maize, cassava, sugarcane and peanuts. Rice cultivation is practiced throughout the country, with over half in the Mekong Delta, around 16% in the Northern Central area and Central coastal area, and 14.5% in the Red River Delta. The Northern midlands and mountain areas and Central Highlands are less important for rice production. As much of the area is planted in the Mekong delta, a significant issue for the rice crop in the country is salinization, with saltwater intrusion being a particular problem in years with limited rainfall and irrigation storage.

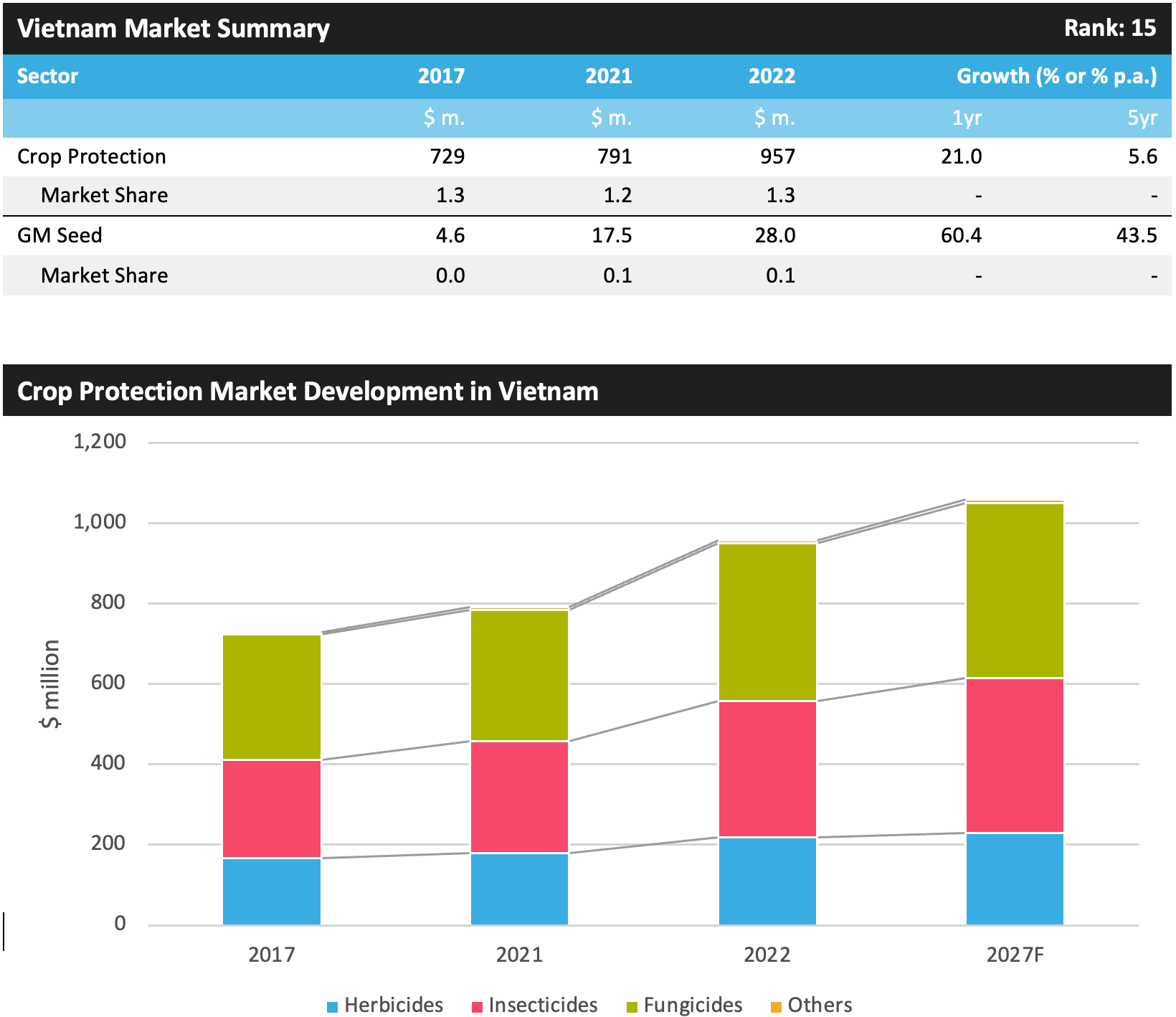

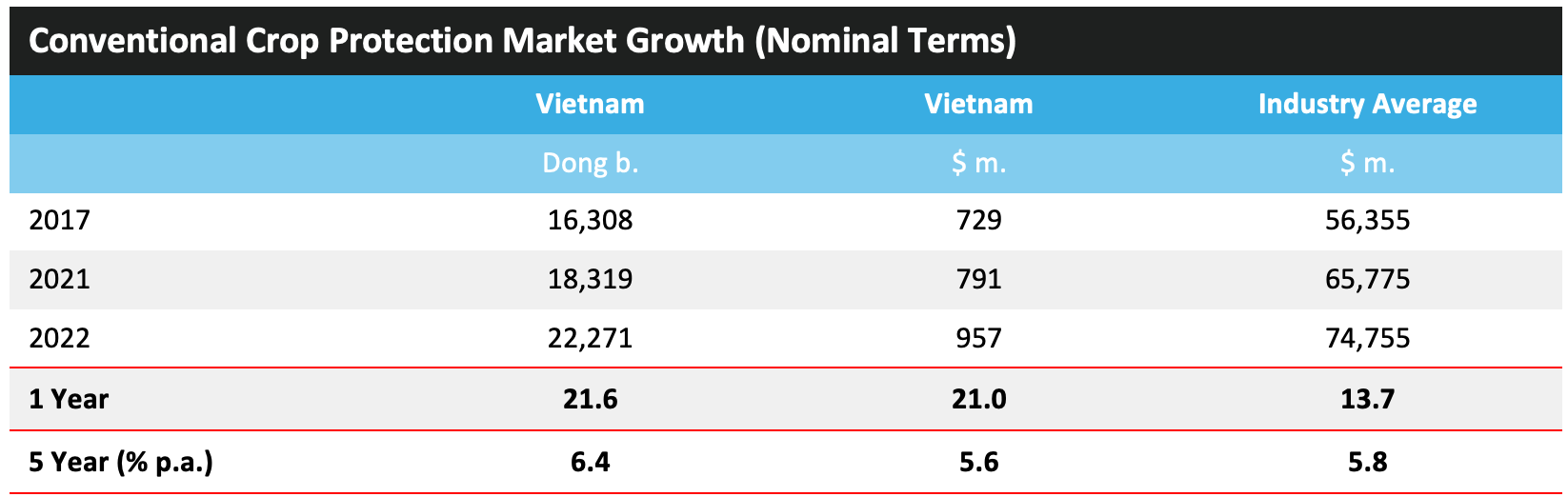

The Vietnamese crop protection market in 2022 increased by 21.6% to 22,271 billion Vietnamese dong, equivalent in U.S. dollar terms to a rise of 21.0% to $957 million. At this level of sales, Vietnam is ranked as the 15th largest country market in the global crop protection industry.

The market has performed slightly ahead of the global average in local currency terms over the five-year period, with growth less positive on conversion to U.S. dollars. Growth has been driven by strong price development in the country, a rapidly developing economy, an increasing domestic population and strong demand in export markets. In 2023, market growth benefited from high agrochemical pricing, which offset the impacts of area declines of various key crops.

Outlook

The Vietnamese government has increased its focus on market liberalization in recent years, with the country being a member of 12 free trade agreements with more than 56 countries, including TPP and the EU-Vietnam free trade agreement. This brings with it reduced tariffs and the removal of certain trade barriers, with exports from Vietnam benefiting accordingly. This continued focus on exports should benefit the crop protection market as growers aim to maximize yield and crop quality.

Vietnamese agriculture is relatively dynamic, with growers switching to more profitable crops with swings in prices and costs, and this could have an impact on product usage, particularly in crops such as sugarcane, pepper, coffee, rubber, and cocoa, which tend to compete for area.

Product choice could become an issue moving forward, as the country’s Ministry of Agriculture and Rural Development (MARD) has recently implemented bans on several significant products, including glyphosate, paraquat, and 2,4-D and the insecticides chlorpyrifos and fipronil. The country has also announced plans to gradually phase out several active ingredients throughout 2022 and 2023, including acetochlor, atrazine, benfuracarb, carbaryl, carbosulfan, chlorothalonil, mancozeb, maneb, propineb, streptomycin, thiodicarb, zineb, and ziram. With these products coming off the market, there could be an opportunity for newer technologies. In addition, MARD has announced plans to reduce the number of chemical pesticide brands registered in Vietnam by 30%, intending to replace these products with biological alternatives.

The Vietnamese Ministry of Agriculture and Rural Development has outlined its strategy for rural development through 2030, stressing the importance of public-private partnerships to stimulate investment in the sector and aims to shift focus from production-orientated to more sustainable practices.

More focus on sustainable agricultural practices opens up opportunities for higher value and lower volume products, biological products and technologies such as drones and formulation technologies to improve product use efficiency.

Continued economic development and increased intensity of product usage are expected to benefit the Vietnamese crop protection market in the coming years. Positive political incentives, increased demand for high quality produce and demand from export markets are expected to drive crop protection usage and technification, with associated benefits on the market in the country.

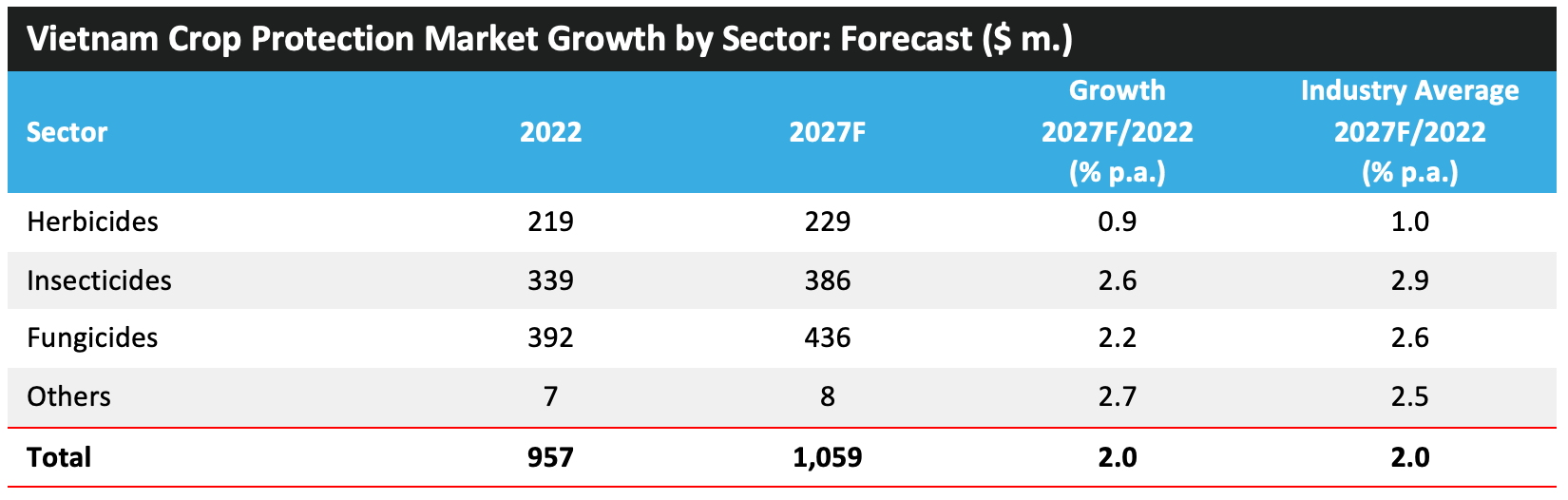

Based on the above factors, the Vietnamese crop protection market is expected to increase at an average annual rate of 2.0% per annum between 2022 and 2027 to reach $1.059 million, in line with the expected industry average over this timeframe.

Other Countries

Cambodia

The crop protection market in Cambodia is one of the fastest growing in the region, albeit from a comparatively low base. Growth has been driven by increased uptake of mechanisation, as well as crop diversification into profitable perennials such as maize, cassava, and vegetables, while export demand has also placed an increased focus on fragrant rice varieties and rubber. There has also been a high level of farm consolidation, bringing with it a greater emphasis on professional farming in favor of more traditional subsistence methods.

However, a number of barriers remain in place, notably a difficulty in accessing credit, poor infrastructure, and limited regulation. There is also a retail poor post-harvest processing industry, limiting export potential in some cases.

As mentioned, the country has one of the fastest developing crop protection markets in the region, with average annual growth of 18.9% per annum in nominal terms between 2017 and 2022.

Philippines

The crop protection market in the Philippines is relatively well developed in comparison to many other lower-middle income nations in the region, although as a result the growth rate is below many of these other countries.

The market in recent years has benefited from the government’s Rice Competitiveness Enhancement Fund, improving the financial situation for rice growers in the country. In addition, in recent years the irrigation infrastructure has been improved through investment, and access to credit is comparatively straight forward. There has also been diversification into high value rice alternatives, opening up new opportunities to export markets.

However, despite this diversification, market development has still been held back somewhat by many growers still focusing on staple crops. The crop protection market has also been held back by the uptake of GM technology, limiting value in certain segments.

The crop protection market in the country has increased at an annual average of 6.2% between 2017 and 2022.

Malaysia

The crop protection market in Malaysia is relatively well developed, with the key crops being plantation crops and rice, with a strong focus on export markets. While the market has benefited from the loss of several older low-cost products in recent years, notably paraquat, chlorpyrifos, and carbofuran, there does remain an issue over illicit products being imported into the country and offered mainly through e-retail platforms.

The key crops and the high level of investment has seen a number of products being introduced for drone application, and in recent years there has been a drive to boost yields from key plantation crops, primarily palm oil, partly in order to reduce deforestation rates which has seen palm oil come under increasing scrutiny in several markets, notably in Europe.

While here remains a strong focus on plantation crops, in recent years there has been a high level of diversification to high value crops for export, such as exports.

Growth has been held back in recent years by labor availability and affordability, as well as poor farm economics and high levels of competitiveness. In addition, there has bene a relatively limited switch over to mechanization, although the aforementioned labor issues may accelerate this in the coming years.

Between 2017 and 2022, the crop protection market in the country increased by an average of 6.0% per annum in nominal terms.

Thailand

The Thai crop protection market is one of the most significant in value terms in the region, behind only Indonesia and Vietnam. However, the market has been severely impacted by weather effects in recent years.

Despite this, growth has been maintained in recent years, benefiting from increased mechanization, higher levels of diversification as growers switch away from rice monocultures, higher intensity of production (increased use of crop protection chemical per hectare), and strong export demand for key crops, notably jasmine rice.

However, as with many other of the more economically developed nations in the region, agriculture is continuing to be impacted by rising labor costs. Similar to other Asia markets, Thailand has also been affected by an aging farm population, with urbanization accelerating in recent years. There is also limited levels of land ownership and access to irrigation.

The crop protection market in the country increased by an average of 5.5% per annum between 2017 and 2022. •

Derek Oliphant – AgbioInvestor